Market Briefing For Thursday, February 8

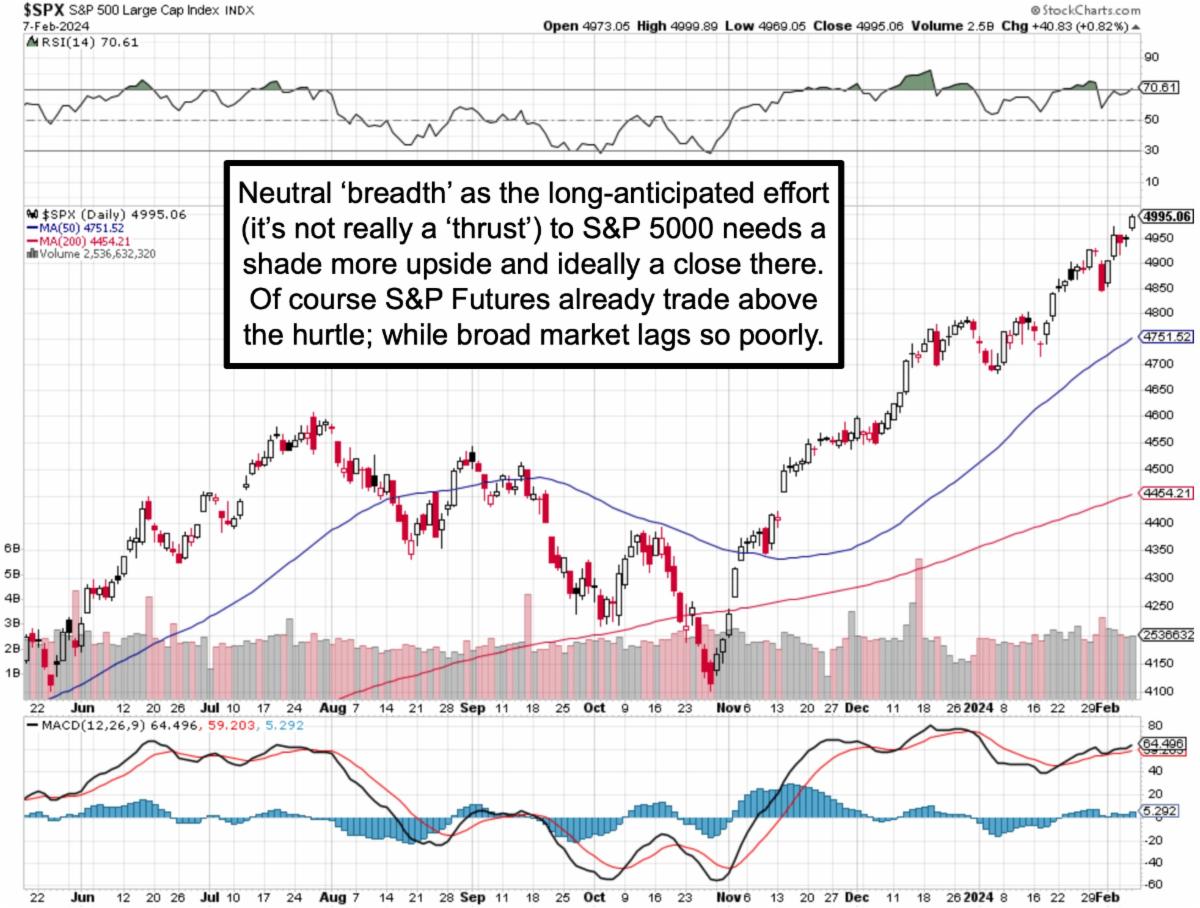

On the brink - of S&P 5000 (with Futures already above that threshold), you have a market bereft of excitement, as all available money seems hellbent on achieving that goal (we've expected would be achieved), but few participants in the romp. In fact as later charts will show, breadth narrowing as S&P rises.

Overnight little has changed in markets, aside the 10-Year Auction that notably was well-absorbed, and was history's largest Treasury fund raiser 'ever'. In a sense that was supportive, and the New York Community Bank woes weren't a factor, as they are said negotiating to sell-off their loan portfolio. However, it leaves unanswered what happens to commercial property delinquencies that have been can-kicked forward and continue to loom as a concern in many of our cities, where remote work (and general digitalization) have changed... life.

The only other major issue 'might' be fallout from a noble retaliation tonight, that being assassination of the leader(s) of the Iraq-related military group that hit our Troops at 'Tower 22' in Syria. They are Iranian-supported, but also too closely tied-into the Iraqi Army itself, as is a little detail not to be overlooked. I would anticipate awaking to violent demonstrations in Baghdad (not just Iran) and little understanding over there about the justice that was delivered with a minimum of collateral or civilian damage. Very precise, sort of like Soleimani being eliminated at nearly Baghdad Airport. The Green Zone is fairly secure.

The Saudi's are being recalcitrant on a ceasefire deal Secretary Blinken has again been trying to achieve with shuttle-diplomacy in the region. Now they're demanding declaration of a full Palestinian state before they will do a security deal with Israel. And of course Israel wants a security deal before they will do much of anything toward a ceasefire. That, and a demilitarized Gaza, matter... it seems to everyone in Israel, not just the ultra-Orthodox or team-Netanyahu. Many of these variables persist, and this is the Sec'y. of States 5th such trip.

Market X-ray:

One is certainly expecting S&P 5000 to be surmounted in the early morning, possibly some selling squall, but then an effort to extend.

I'm aware of technicians and pundits arguing whether breaching 5000 S&P is going to mean being higher months from now, based on prior achievements, as far as drawing buying in. Short-term I suspect not so much, even a retreat 'soon'. But I concur with regard to down-the-road a bit, as said all along.

Bottom-line:

Barring a 'surprise' Gaza ceasefire deal this week, you'd think we'd get a pullback after a thrust higher. But the money managers dominating this market know how they have to hold S&P up 'if they can'.

More By This Author:

Market Briefing For Wednesday, February 7Market Briefing For Monday, February 5

Market Briefing For Wednesday, January 31

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more