Market Briefing For Thursday, August 22

The FOMC Minutes focused more on the economy as 'mid-cycle adjustments'.

While that really shouldn't particularly comfort the uber-doves pressing the Fed for even-lower rates (you know my views about how that can become more or less counterproductive, and even contribute to the building bond bubble)... despite that the market held-onto gains as best able (going into the final hour).

Anxiety is mounting while the S&P persists swinging within the relatively high level trading range I've indicated as 'healthy' because it's shy of really surprising folks by moving to all-time highs 'if' things fall-in-line just right; at the same time there is trading space (maneuvering room) between a bullish breakout and a bearish breakdown; identified basically as the August lows.

Now this is not just a broken record repetitive series of sessions. It's what I have described as a purposeful poising of the S&P above the triple lows of two prior weeks, as well as in-proximity for a thrust higher should favorable events justify. That's the kind of roller-coaster that is pending resolution; but mostly impacts the FAANG+ stocks that are the heaviest Index influencers, given that so much of the broader market is either neutral or corrected.

As I mentioned before the week began, it would get choppier, and that's not to say we can't have more significant intervening volatility as soon as later in this week for that matter (depending on the FOMC Minutes tomorrow); and then G7 and so on. Thereafter the market focuses on the China telephone call to see 'if' the sides decide to then have another negotiating session, this time in Washington DC.

Meanwhile the President reflects anxiety too; suggesting to reporters late on Tuesday, that we're nowhere a recession; then listing a number of ways his Administration could move to basically reinforce the economic conditions; if necessary it sounded like. He referred to 'mulling over' payroll tax cuts again (a comment heard then denied a day earlier); and Indexing as well as a few other approaches that he believes can help the Nation avoid a recession.

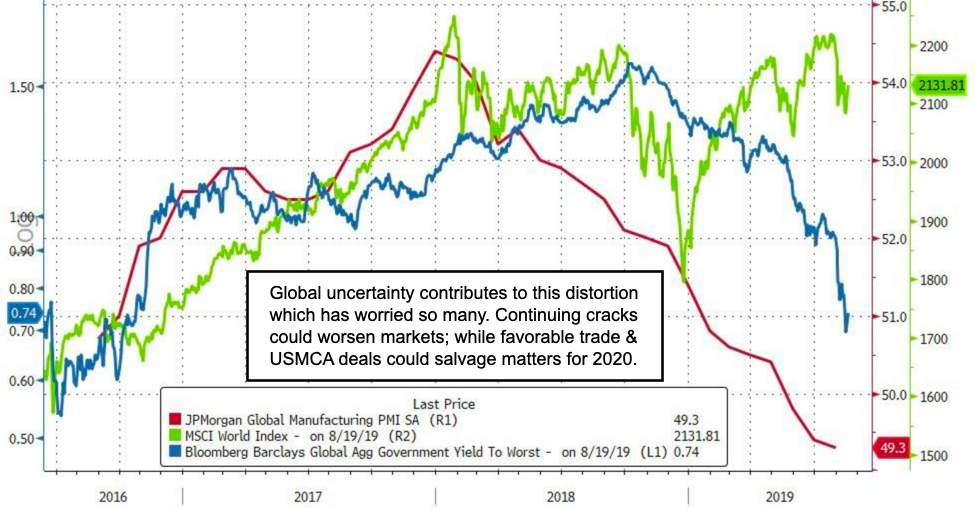

I should add that my own view remains the same: the nuances appeared oh about a year and a half ago; the economy has been sluggish but stable for a long time, and absorbed a longer-than-idea trade standoff with China more or less pretty decently. However ultimately it's negative; and solutions would of course buoy a lot of industries. (Passing and implementing USMCA may even help more incidentally.) As to China; the President said 'somebody had to take them on' and 'even if it takes a couple Quarters of recession', with regards to making things workout (with China presumably); it's worth it.

He repeated that 'someone had to take them on', and as you know I entirely agree with the premise, if not necessarily the delicacy (or lack sometimes) in regards to how it was handled in terms of 'face saving'; although the basics of what needs to be addressed are appropriate, whether some find Navarro abusive or not (maybe it takes a tough cookie to work this out with them).

So sure; there are plenty of influences that can rock the market either way; in multiple swings. That's why it was so important that traders behaved just well enough to defend the recent lows; and gave themselves maneuvering room without defining the bigger picture in the process, as we've outlined.

In sum: the trepidation ahead of potentially significant news continues; and I urge investors not get overly bearish nor make much out of any swing to higher levels; until or unless the underlying influences are truly significant (at this point even a 'blockade' of Venezuela -actually being considered we hear- wouldn't be a huge market mover, unless it depressed Oil prices with thoughts of Venezuelan crude back on market.

Mostly this market ponders the impact lower rates would have. Realizing of course, that if the market perceives officially lower rates are helpful; the real world interest rates will start to firm, not decline; as (or if) the credit markets anticipate stimulus to induce more robust growth and business activity.

good thoughts. caution is warranted. sitting on my hands for now.