Market Briefing For Thursday, Apr. 13

'Balancing Act' - seems the only way to describe the alternating perspectives of metrics that will impact the Fed's next decision, which I suspect is already known with regard to forward policy.

It's the short-term 'funds' rate everyone is so in-awe of, and actually is less relevant than their Money Supply restraint.

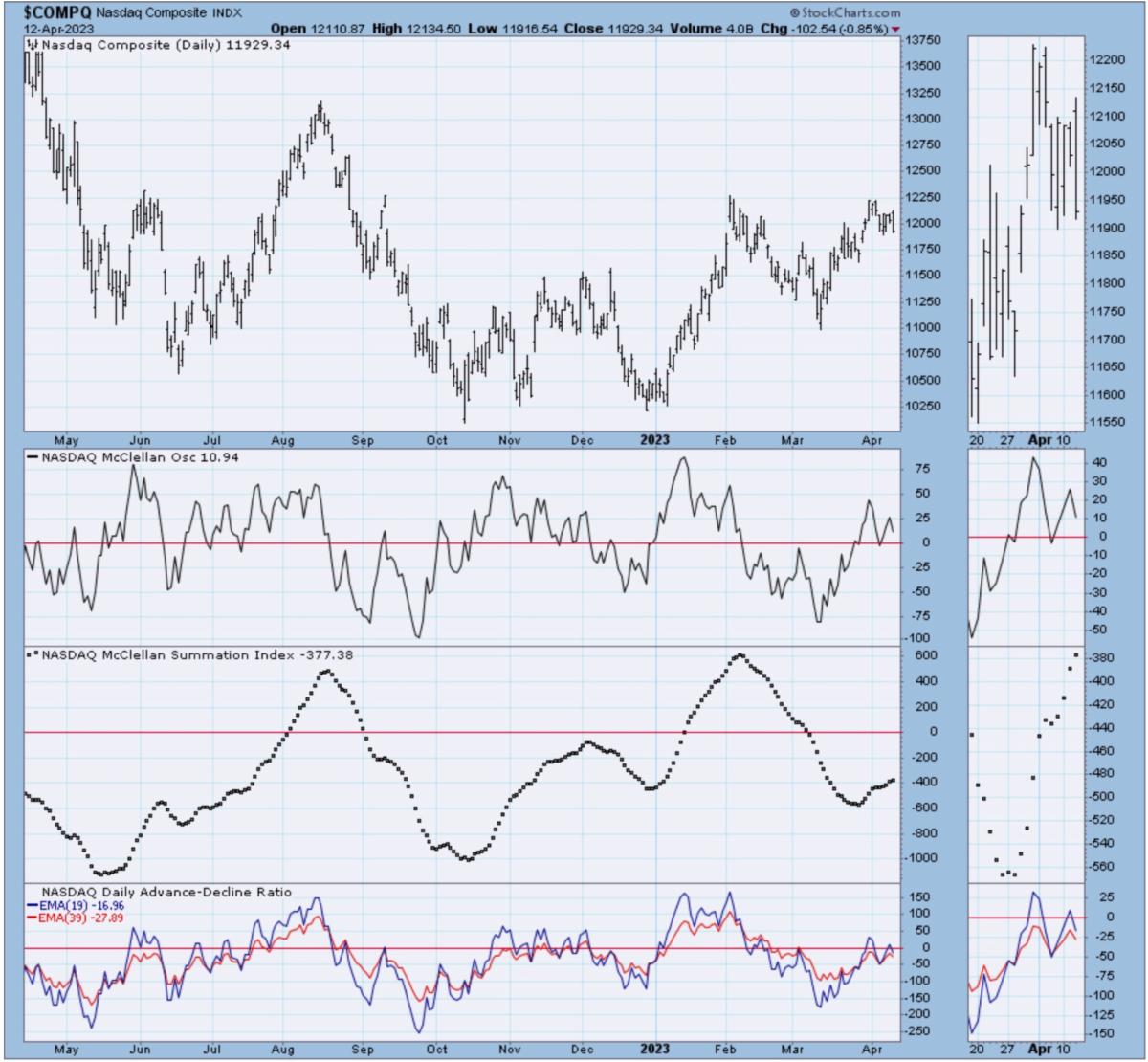

It's that restraint in contraction, that sort of supports the idea the economy is showing signs of 'gently' slowing without much overt action on the Fed's part. The Fed has 'victory in their hands' as far as a 'softish landing' and while they will say they'll make their decision based on data, they should declare victory and stop. The S&P would like that, as it did the CPI, and then briefly retreats.

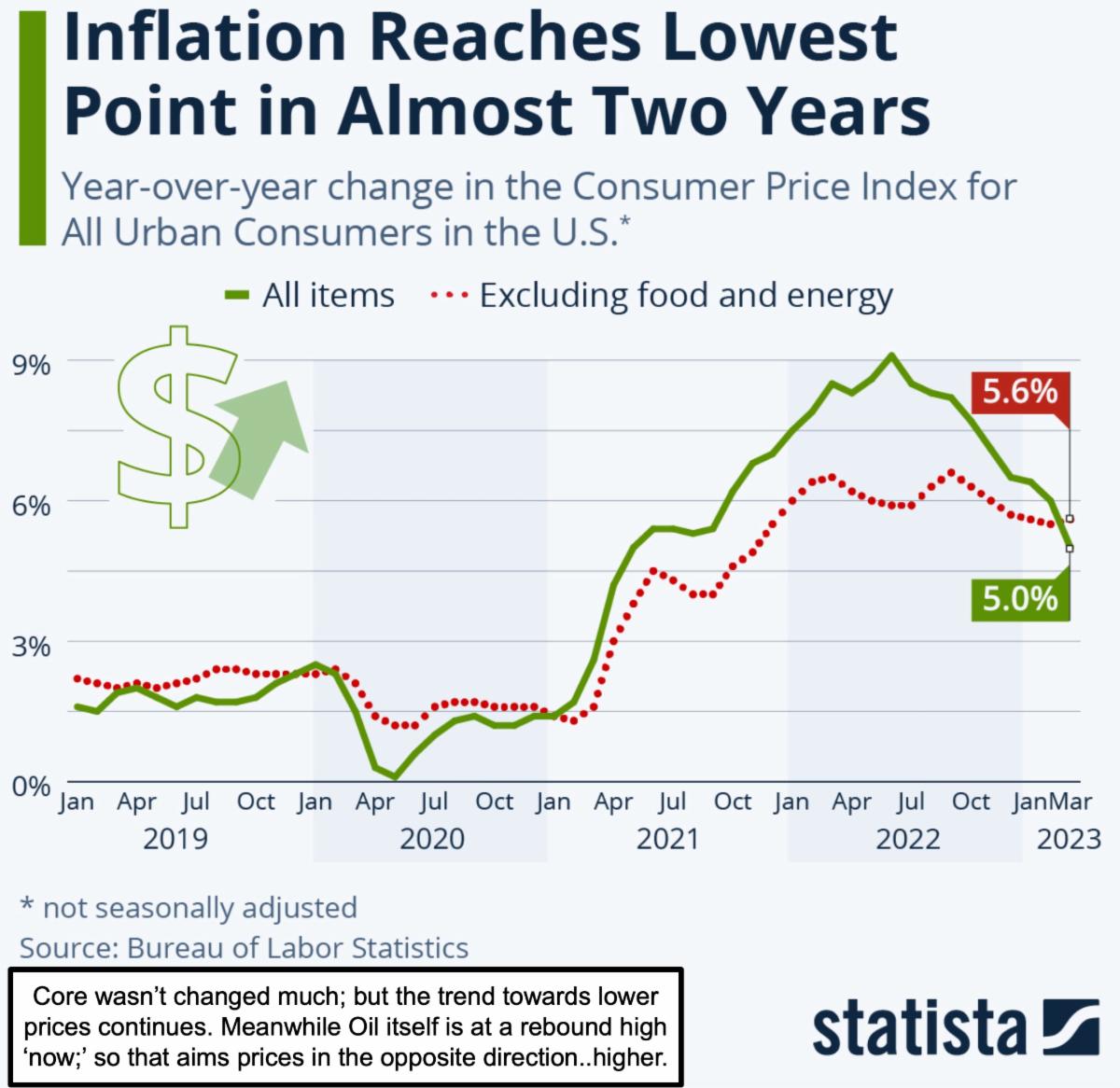

The core story (not the nominal shifts in CPI nor the mixed Fed-head remarks that dutifully followed with interpretations) remains a general slowing ongoing, not particularly impressive, but given the backdrop Defense and infrastructure spending, it seems about right, and isn't needed to assume if the Fed 'gets it'.

I suspect they do, but won't say it. Meaning they know they were too low for a long (too long) time, and now had a too fast-paced move to normal levels that we are at (based on historical precedent not based on where stocks got from a benefit that developed due to too much cheap money going into big-caps as well as allowing buybacks and so on, mostly however over the prior 2 years).

We have a couple weeks of data to go before the next FOMC, with early hints portending a sluggish economic backdrop (such as the reduction in lending), squeezing liquidity that should get the Fed's attention, and thus they 'freeze'.

In-sum:

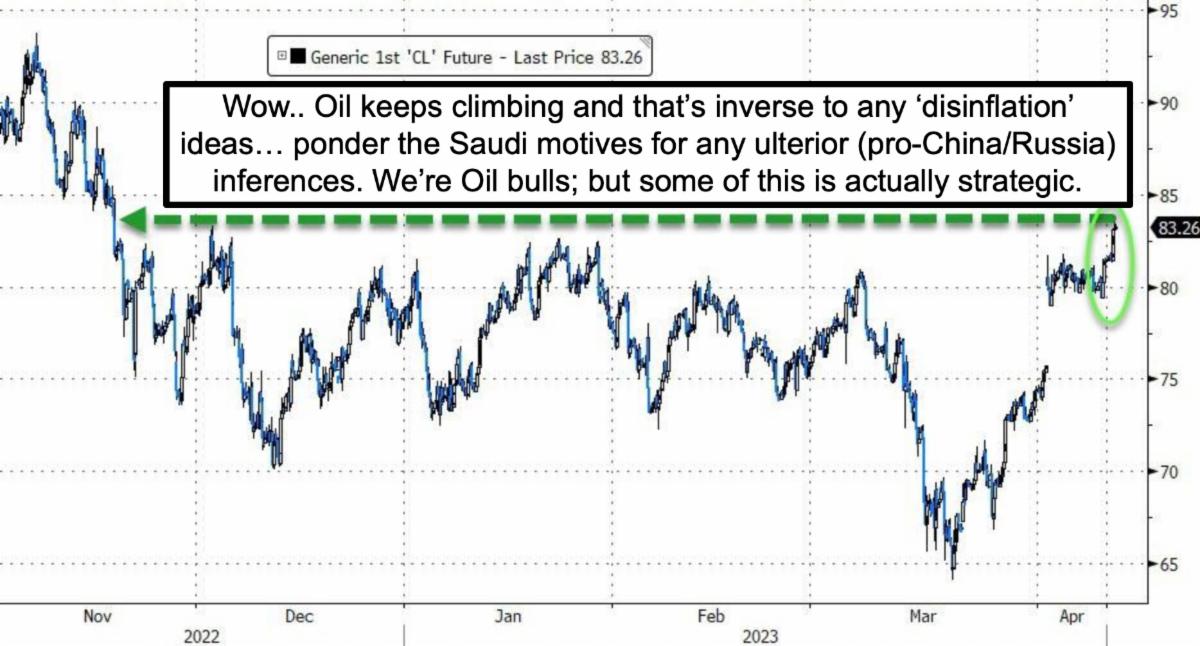

We might get a recession whether or not the Fed chills now, we think they should but it's a bit of a balancing act between the voting members. My primary concern is still 'stagflation'.. higher Oil prices and sagging economy.

In the meantime the Senior Indexes are sort of ragged (still neutral really) with periodically better breadth in a wider variety of sectors. Fed Minutes didn't do much for the pattern, perhaps the comments did as well as a story (discussed in video 2) about French President Macron talking of European autonomy vs. following the U.S. .. on his way back from China. Reminiscences of (Charles) De Gaulle's solo strategic approach, but possibly there's another reason: fear of more than riots & protests 'if' France has a problem funding pensions, while any sort of international conflagration would sure throw that off-balance too. It must be something like pension funding, otherwise it's a diplomatic 'blunder'.

Anyway we're still in a neutral view towards the market, and it's still 'ranging'. The Fed Minutes basically reflect 'in theory' that they would tolerate high rates given what seems like more concern about inflation, than economic impacts.

Even the most optimistic 'bulls' have tempered their expectations. Yes, risks of problems persist, but everyone knows this. Core inflation tamed (well its pace) and big-cap valuations still too high as they're based on multiple expansion, not contraction, and we see all that (plus war concerns, with Moscow sort of admitting Putin personally ordered the arrest of the Wall St. Journal reporter), and also recognize that the short-side of the ledger is again crowded. So that doesn't mean better days ahead for the next few months, but should be for at least innovative disruptive stocks, or possibly into next week's S&P Expiration.

Reflecting on that FOMC (Fed) Minutes release: and summarizing by saying it views the 'outcome of bank failures as uncertain'. Some of them would have hiked 50BP if not for banking stresses, as they view bank problems as limited.

Many of the participants thought we 'need' a mild Recession, and that's really candor considering the Fed 'supposedly' doesn't want to fight our citizens for the benefit of breaking inflation 'at any cost'. This sort of exposes their reality. And given that there was 'debate' with some wanting to 'stop hiking', that's a clue that they are less likely to do so at the upcoming May FOMC meeting.

The contracting Money Supply against an inflationary continuation is muddled for sure. They don't know that a recession (double-dip) would be mild, and I'm neutral on the Money Supply issue, since they have been trying to have this in a two-way street in some aspects. Anyway 'turmoil' likely results in tight credit.

There is a 'dovish wing' to the FOMC, as comments 'now' rather than the last meeting, have implied. 'No news is good news' was the Chicago trading view from the pits, and that's sort of encouraging. Given the bearish dominance as well as monthly Expiration next week, we could get some precautionary early closes (covering) of excessive short positions many hedgers established.

Oil is very strong, and that’s got to make folks think about inflation not coming down much in the face of strong Oil prices (almost a war if you will, declared by Saudi Arabia on the world with their production cut). Oil may be the most serious impediment to a bullish case for the Fed easing the inflation fight, that is rather prominent just now (with Oil ~83/bbl, disinflation's hard to argue.

Bottom-line:

I suspect the Fed will end-up cutting rates this year, especially if we get more of an economic slowdown, which upcoming data should suggest. In the short-term they caused the problem with duration risk, the turmoils isn't necessarily finished, and the bank stress tests were problematic. Maybe bank 'risk managers' (SVB didn't have one) weren't alert enough to handle duration risk, but some of the tension is eased with rates off the spike-high levels.

However, if 'higher for longer' and waning earnings prevail, that affirms more risk for S&P near-term, even if we manage to hold in a relatively narrow range (or firm into next week's Expiration). It's a mixed bag in neutral, can't help it.

More By This Author:

Market Briefing For Monday, Apr. 10Market Briefing For Tuesday, Apr. 4

Market Briefing For Monday, Apr. 3