Market Briefing For Monday, Nov. 14

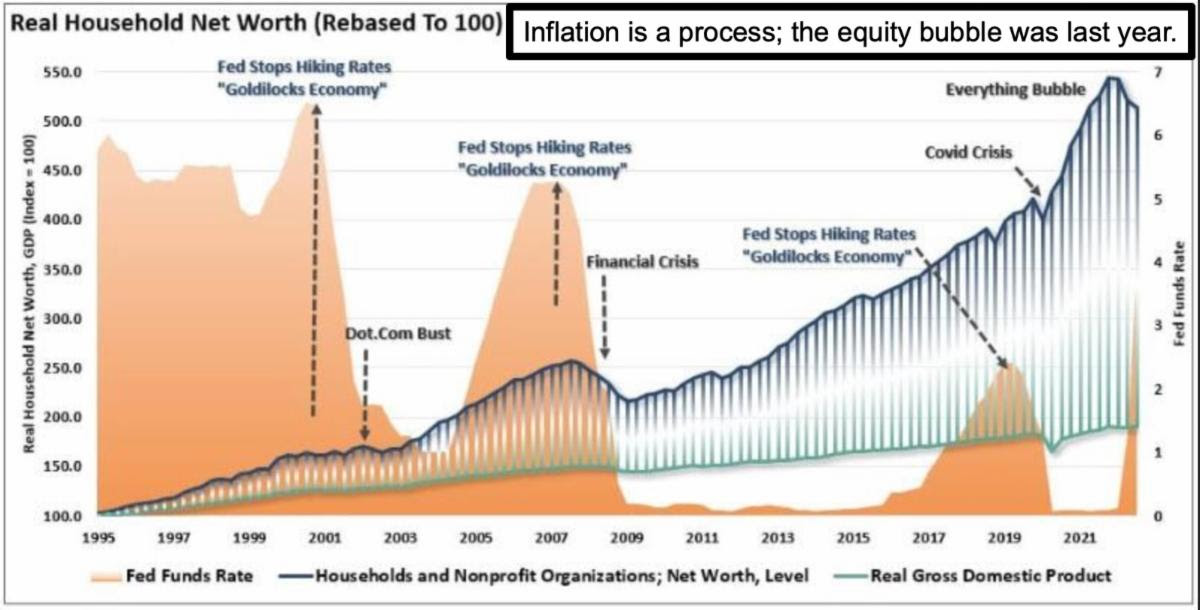

The 'game-plan' evolves. Discarded stocks that weren't junk rebounded; at least some in fairly dramatic or substantial ways; or at least have shown signs of life. Also firmer mega-cap stocks, against the admonition to sell the CPI by most major firms, rebounded too, before settling back a bit. Bonds closed for Veteran's Day; so the heart of the action was really short-squeezes. Maybe it will be that the Labor Picture is worse than perceived (new layoffs in tech as well); but if that blows wide open the Fed will have another reason to pivot. In recent months I emphasized the Fed is over-impressed with their inflation role.

Most large stocks are still expensive relative to earnings multiples in a coming or double-dip recession - if a recession or double-dip really does extend or unfold next year. I'm open-minded to avoiding that; and if that's the case, once again the major trading firms will have missed a low; by selling into the move.

I realize many technicians stayed bearish; are still bearish; and even view the Dollar weakness as bearish. Sigh. The Dollar's desired declining pattern from almost two months ago (we called the spike unsustainable and the end of the move; and thus a drop would be good for the S&P). Four percent lower this week for the Dollar Index doesn't mean inflation's over; but does mean stabilization on a global scale may be more probable. We did connect a weaker Dollar with better stock prospects; even though much hinges on the Fed .. or on 'peace'.

A number of commodities are lower than their peaks; and Chairman Powell is not going to intentionally 'crush demand', even though he actually said that as you know; but he is going to fight unless we get peace and maybe something with China. Whether we've had the bottom for the cycle or not is debatable at the same time, as you don't get a complex bottom like I identified without some meaningful upward action; and you're seeing that. If 'demand is crushed' and more companies lay off people (like Disney did today); well, it tames the Fed.

I can't answer nor speculate too much of what 'might be'; but I did recognize a lopsided crowded short-side of the ledger, almost across the board. That's the core of my view of 'short-sellers' often doing better research; but when they're all doing the same thing, they become vulnerable to getting caught. Trapped.

With the wounded survivors of the small-cap carnage that have decent odds of remaining solvent, their longs need patience because the shares can't go below zero, while the shorts have unlimited risk and can lose over 100% of all risked money 'in theory' in a rally. Hence shorts should be and are more jittery.

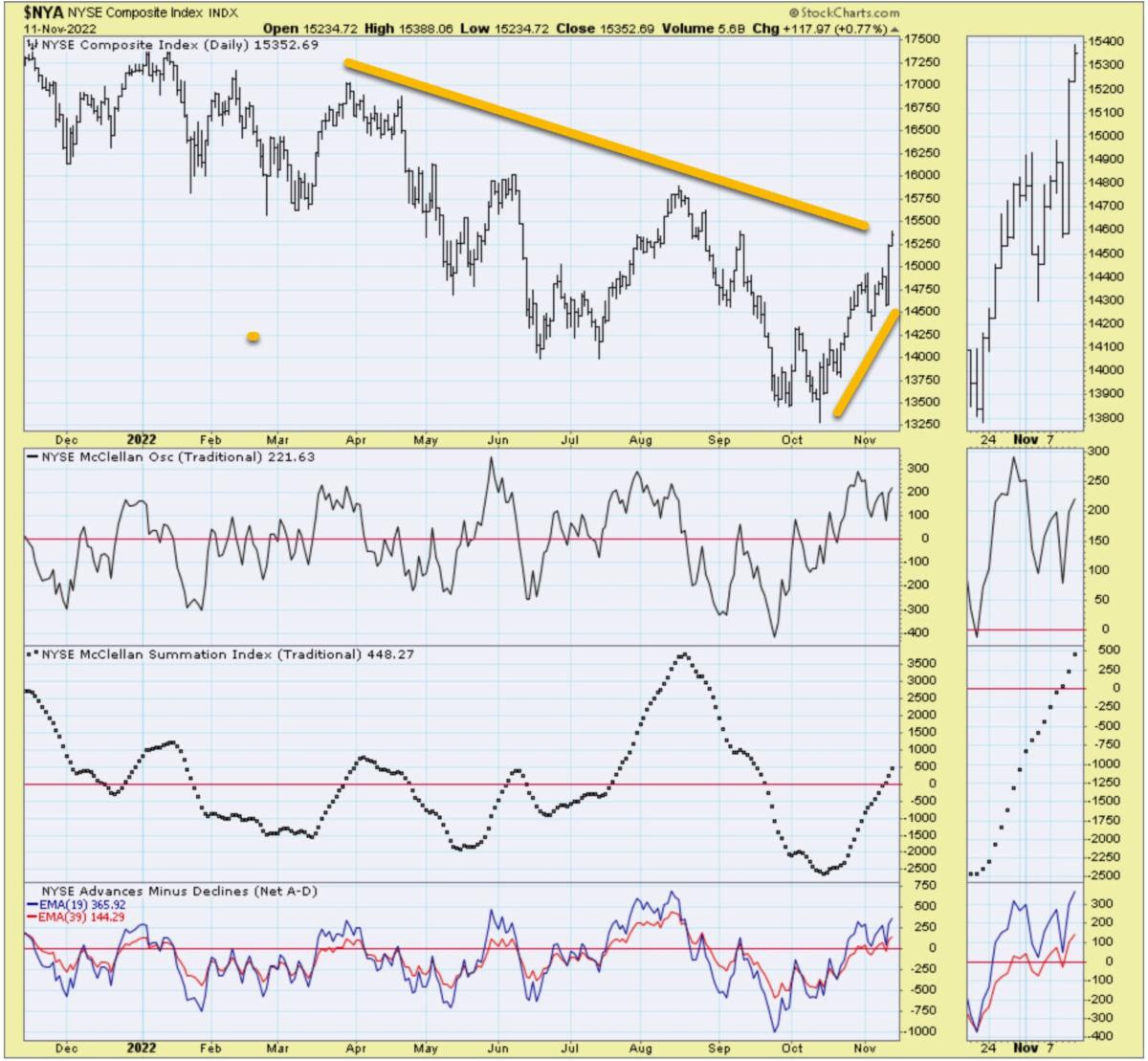

The market players are 'fighting the tape' and denying the significance of what has been the best short-term rally since coming off 'The Inger Bottom' all the way back in late March of 2020. That doesn't mean we'll not pause; but odds of it being a stairstep rally to higher levels persists, as I outlined technically for the last couple weeks (pointing to an 'A-B-C rally, not decline', emerging).

In sum: aside embedded chart comments I'll limit reporting; it's been a long busy week; and I believe we've addressed all the main issues as well as monitored a handful of 'conference calls' and nuanced factors influencing stocks; politics and the economy. Not to mention the chance of 'peace breaking out' soon.

Speaking of; if you get peace negotiations; a ceasefire; and China patching at least some things up with the US next week; well, how about S&P over 4000 ... oh we're basically there right now. OK ... be glad to see a further extension.

Hard to declare the inflation craze is over; except that the craze is. By time a slew of major firms gets with the pattern, it will be near a short-term top, as for the most part traders should know that the majority of the move occurs during the early phases with the most skepticism.

So sure; if besides 'peace' and better 'trade', you happen to get a lesser hike by the Fed next month; well by then the majority of the intermediate gains will be behind. That's why I implored recently to recognize the erratic bottoming or complex trough formation; and was critical of pundits focusing on 'what to sell in technology' (which was the idea last year); instead of 'what to buy' as part of constructing a preliminary plan for 2023; not fighting the previous war.

By the way, there is economic risk 'if' weaker economies are ahead. However, the softer Dollar is a plus for the market, not a negative, though it can become that 'if' business really slides; and we dispute the idea that the current Dollar's weakness is bearish. No. The Greenback's peak we nailed was coincident as a matter of fact with the unfolding bottom process of the S&P last month.

As to crypto; it attracted greed or bigger money than made sense for any sort of informed investor delving into hyped assets that aren't even regulated yet. I think the greatest forecast we've made is simply avoiding the entire sector; at the same time I call a few moves in Bitcoin (almost entirely correctly too; but of course that's not the point as I was never eager to venture into that realm).

I don't care if people become less tribal and get more studious about crypto. It is not ready for prime time; and amazing to hear analysts even now defend it. Back to the Fed (real world) I think it would be naive to say the Fed has made the last hike; although the pace of hikes can soften; and more so if we get the 'peace talks' or better. Of course we might not get a cessation of hostilities; so for sure I can't foretell how that goes. Fingers crossed: talks are forthcoming.

This week was news-filled; in line with most of what we'd thought likely; and it is all pretty acceptable, and not catastrophic in any way. Describing the finale of the week, on top of two-weeks-old S&P bottoming formations; and you've got a frenetic short-squeeze going on in some issues; making it tricky to sort out virtual improvements (and investor interest) versus actual upside interest.

I'm sort of glad that there is so little conviction among most about what could go 'right' in this market; because that means money managers will be Grinch until closer to Christmas, and then possibly pivot to the upside closer to then.

As one wag put it: the Fed is no longer the enemy of the market ... as much.

Bottom line: there is a tactical battle now around S&P 4000; while bears still talk about 3000 or (hah!) 2000; and major trading desks implore investors to sell not buy. Makes no sense unless one considers it means 'they missed it'!

You continue with the repositioning out of the ballyhooed 'hiding places' into a slew of smaller (but often disruptive and innovative) new stocks. Impossible to say all make it; hence the 'sprinkling' approach. You have China coming back into the fold (opening up a bit; but rising Covid cases in some cities, so ... ) and if that happens (we won't expect companies to heartily embrace China) it's the part of global stabilization that's needed; irrespective of continued on-shoring.

Some Semiconductors are doing well (including AMD emerging which, though we didn't add back to it since money was allocated mostly elsewhere); that's fine for our remaining holdings. Speaking of the new additions; did anyone use the periods of weakness over recent weeks to 'add' not subtract from holdings in the more speculative stocks? Probably some of us did just that. Why not. Buy when there's despair; and sell euphoria. Hence glad to see such skepticism.

Dare I say S&P 4100-4200 'or more' is where we're going for now, allowing for a couple consolidation periods along the way.

More By This Author:

Market Briefing For Thursday, Nov. 10

Market Briefing For Wednesday, Nov. 9

Market Briefing For Tuesday, Nov. 8

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.