Market Briefing For Monday, Nov. 11

The alternating thrashing around how the 'China Shoppe' Phase 1 sorts out, or debates about pressures to forestall making a deal, surely once again dominated Friday's trading. So once again we're 'veterans', assessing a series of too-and-fro shuffles related to 'matador versus the Bulls' contest, in a sense. While this persists, as market traders or rumor-mongers make more of rampant skepticism regarding the trade progress than is warranted, little changes. Perhaps they're trading it.

It took Peter Navarro coming forth Friday morning to dispel infighting talk (regarding his purported pressures on the President 'not to deal'). Navarro said 'only Trump' can remove Tariffs and said the propaganda (whether in the Chinese press or U.S. media) is just negotiating for the White House in public; as he doubled-down on denying the trade delay reports that were out there. China and the U.S. are moving forward.

It might be notable that China's Top Trade Negotiator said "we want Trump to get re-elected", because he basically says what it is. He told audience members at Credit Suisse's China Investment Shenzhen Conference, that "we want Trump to be re-elected; we would be glad to see that happen". He's the elder statesman of China's trade diplomacy circle, so that does give a hint of Beijng's policy-making stance currently.

His remark that 'President Trump's daily Twitter posts' broadcast every impulse Trump has, both delighting and peeving his 67 million followers on Twitter, making him 'easy to read' so 'the best choice in an opponent for negotiations". I don't think that means pushover; but rather clarity in knowing what will fly and what won't. I question this a bit, knowing that Trump will hold-out for as much as possible; then compromise. That's his style, they know it too, and it's o.k... everyone can feel face-saved, and that matters especially to Chinese (and to narcissists as well). I'm not interested so much in Trump's frail personality; but in outcomes.

There are macro concerns of course; but they are not dominant at the moment, or even well-concealed temporarily by an overly-friendly Fed. Ultimately the stock market and/or asset values, combined with retiree jitters given the long-run underfunded pension fiasco and draw-downs, can't substitute for earnings from useful economic goods production in our society; and that's where you get some woe-is-us political aspects, that seem to be subliminal to the current political environment.

Asset valuations can diminish as soon as many baby-boomers (that's the old demographic argument that has been somewhat offset by easy money but not in ways that help those on fixed incomes).. try to access fund and turn them into income. Foreign buying of American assets did help address (or postpone) the impact of this as well. Nevertheless it is the real economy that needs to function better and be sustained.

That is part of what Trump has sought (it helped although inadequately as regards the needs out there); as it provoked more antipathy instead of an honest debate about how to really address the future, beyond of course the largely theatrical noise that has become the current focus. It has been literally free currency for bankers and equity buybacks that to a degree 'bought time' while the economy became sluggish or sagged over the last year and a half; contrary to some perceptions.

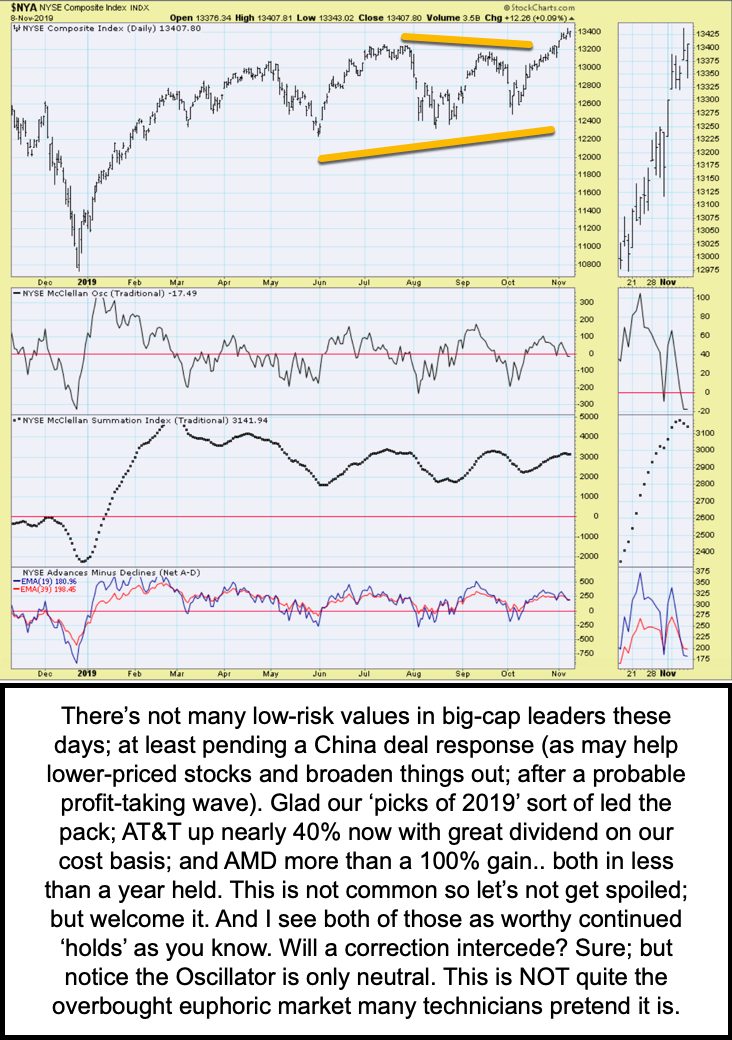

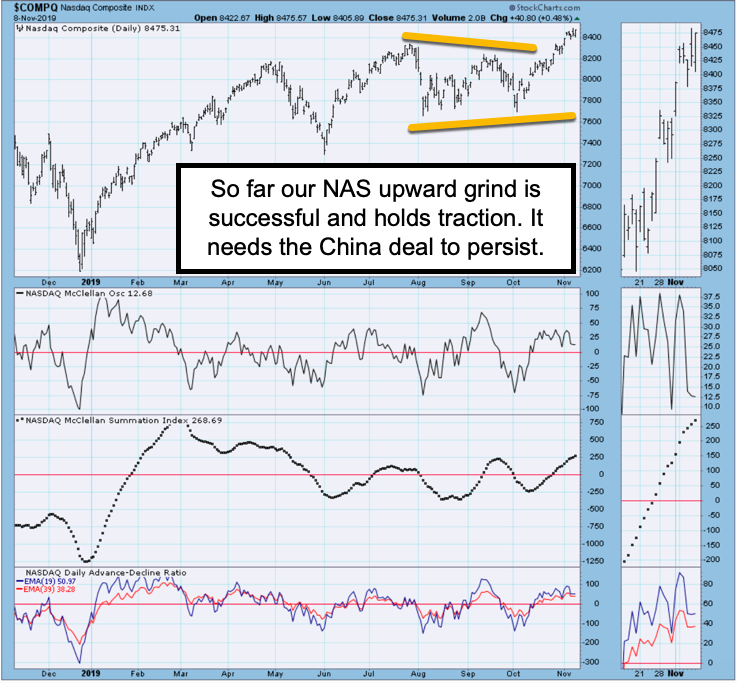

The good news is that stabilizing trade may at least give some visibility to helping the real economy (again relates to a repressed broad equity arena in contrast to the handful of leaders), which while inflating assets and aiding misapplication of capital (buybacks instead of in a business for actual growth), can improve as we get past the projected transition, especially in the technology sphere. This is part of why I've argued that there's at least a decent chance that the S&P's cycle low was the 2018 capitulation and implosion into the buy-point just ahead of Christmas. If we get the trade deal and some stabilization (with pullbacks); we may find further affirmation of that assessment.

How the future is 'perceived' depends more on determination of 'who' is running for high Office next year; than who wins it. That also means we'll know much more about market prospects to the extent that becomes clear, from of course a political view as well as progress on trade relationship fronts.

In sum: there is no change in our 'high-level' trading range view, as we move into an interesting (if not crucial) week, which I'll assess for now far from the 'big chill' sweeping into the Nation's heartland and South.

The prospects of concluding a 'China trading Phase 1' accord, as well as determination (which is irrelevant) regarding location of signing (the idea of Alaska relates to less jet-lag flying from Beijing as it seems the leadership there is tired of shuttling to the U.S.; unless it's maybe warm locations like Hawaii or Florida (if it has to be chilly; save the jet-lag by going to Alaska).

Monday is Veteran's Day, a Federal Holiday, and yet the stock market's open, while the bond market is closed. It should be a narrow session barring of course more tweets around the center of China bull-fighting ring.

Trump could compromise. But he will get little. The hardliners like Navarro and Bannon and Gaffney and Pompeo will likely feel betrayed. They all want a cold war with China, a nation that doesn't want to fight a cold war but will if necessary. The direction towards a cold war should be unsettling.