Market Briefing For Monday, May 25

Executive summary:

- Herd Immunity apparently is the quasi-official goal; with the President stating if there's a 2nd wave, he won't shut the Country;

- Increasingly, the fate of our economy hinges on medical (main video addresses this particularly);

- Keeping the economy going will be a challenge if big outbreaks occur; but we understand time is running out basically (we gave it 2-3 months) not to get everyone back to work that possibly can, so here we are;

- Should this fail, as many small businesses will attempt to restart; there will be a divisive situation in commerce, without precedent of course; but also with backlash against what will be viewed as extreme corporatism;

- An early hint of this may be the 'independent' family restaurants open for this holiday weekend; while many major upscale chains, are not;

- Darden and a few others are reopen some locations (Seasons 52 is a good example opening now at least near me), but like the challenge of trying to visit an Apple Store (due to coffee spillage destroying my MacBook Pro), it's nowhere near normal, nor will it be soon;

- So we all stay on tenterhooks to see how this goes; and again the fate of markets and perhaps humanity falls largely on medical science, not a perspective of various approaches that are often too political;

- The irony, given the incredible sums thrown at 'research' now; tend to evidence that this really is (or must be) a nonpartisan issue for all.

'Herd immunity' - essentially seems to be an attempted solution (it's really not so political as what alternative is there; as you can't enforce quarantine at this point, as many are finding out, regardless of whether that would help; and we've simply bought-time for the medical establish to better prepare to deal with Covid-19; and that's really all the earlier shutdowns intended. So, much of the Country is 'opening up' (albeit slightly grudgingly in some areas) in ways that hasn't worked well in other nations that tried it, 'unless' the few who did were extremely disciplined in the process.

There's even a generational gap of behavior here, with in some cases older Americans willing to venture out, whereas younger families, understandably so, are more protective knowing what can happen if any family member is hobbled by Covid-19. That too varies regionally; as media correctly shows in this instance.

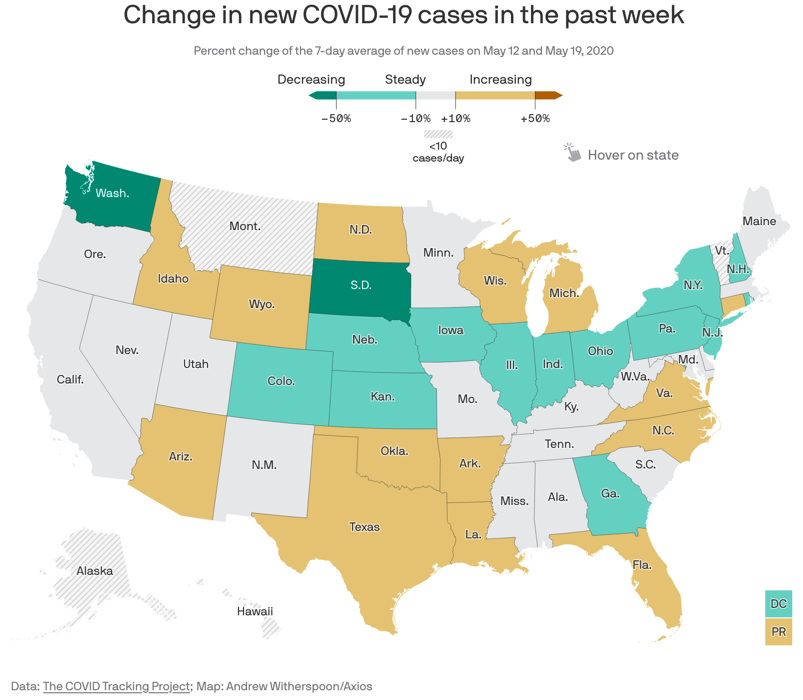

The importance of this, besides of course directly relating to immediate and urgent concerns about M&M experiences (morbidity & mortality), points out the potentially false assumptions about the Covid-19's virulence dissipating during the Summer months. I'm in Florida, the temperature is in the 90's; at the same time case levels in Greater Miami have been rising not settling; in a pattern that is not the same time as just from greater testing; which means hospitalization rates are increasing again. Before the weekend began.

Objectively that means no curves have been truly flattened; medical expert advisors have understandably been cajoled (or convinced) that re-opening is essential now (I think it is, but responsibly; and messages from Washington we'd wish were wiser at times; but they tend to be what we want to hear; not need to hear from an epidemiological standpoint; although again important; nobody is sparing funding to get drug and vaccine studies ramped faster).

In sum: this matters to everyone; and certainly to the stock market. Friday, after the close, we hear not just about Hertz filing for bankruptcy (expected for some time) but that Gilead's drug remdesivir is not so effective alone; and that oxygen and other treatments are or may have to be combined.

China is playing clever poker with its emphasis on complying with their US Trade Agreement, while terrorizing or provoking Hong Kong into improper and illegal submission to their mainland laws. Previously President Trump might have intended shifting focus a bit to China; now China transgresses enough to really justify it even more; creating a diplomatic standoff. Today (Saturday) China talked about abandoning 'central planning'. We look into that; because it has incredible implications for their society and 'realpolitik' as well as perhaps an admission of the fiasco they created with planned big cities; and compelling 'good' citizens to invest in vacant 'ghost' cities etc.

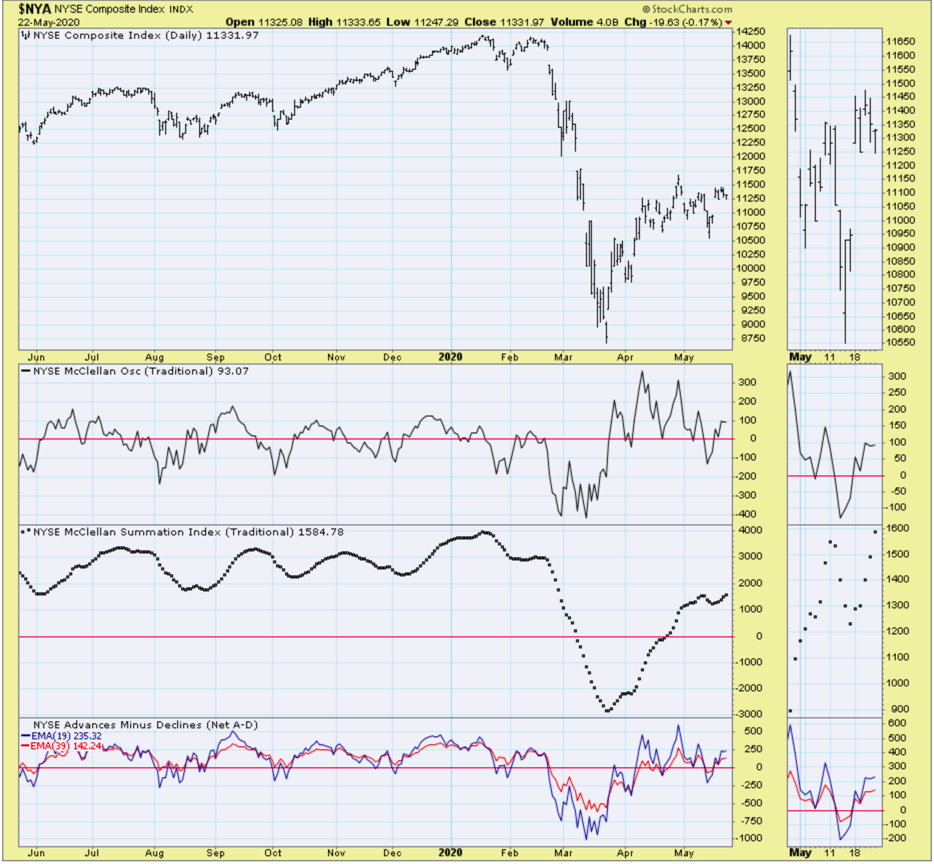

Bottom line: amidst this backdrop the market forges ahead (not surprised); with a 'Fed Put' as the driving force; and with what I call a handful of 'super-caps' at the helm; and a little better performance in so-called value sectors. As noted for weeks; so long as this persists; you do not tank the market; but you are vulnerable to corrections.

Many thanks. Well Said. James