Market Briefing For Monday, May 17

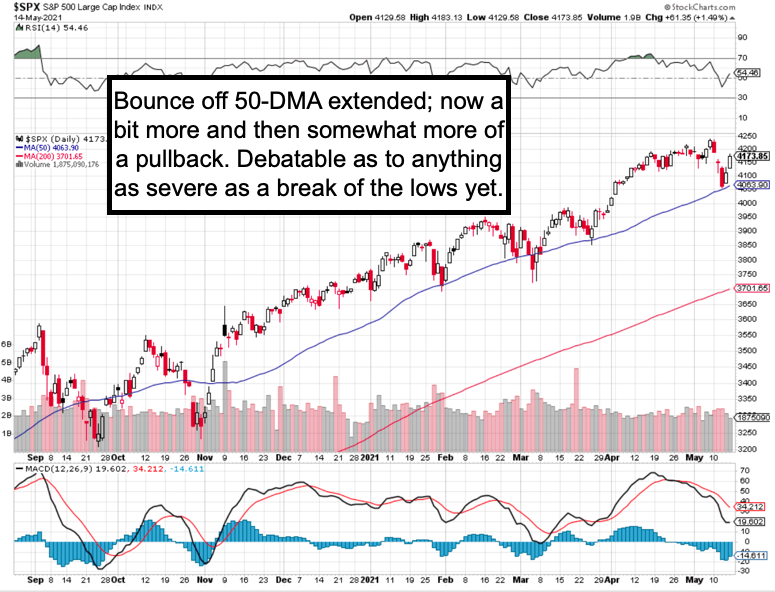

Technical analysis here - isn't like weather satellites overlooking hurricanes. It is not yet possible to ascertain if this move (impressive on the surface and a part of the reflex rebound we've looked for) is the eye of a hurricane or storms have already passed. The bias is slightly for an extension; a retracement and then higher seasonally as we've already outlined. What's impossibly for now is to ascertain odds of going below S&P's 50 DMA which we bounced off of.

While 'money and liquidity' argue that money managers have the ability to get this higher (and will for the moment); inflation data isn't going away; so now of course we get a segment of players who will argue it doesn't matter; just look at how the market roared back. Ah were it so simple; it's not and it matters.

If and as you start getting an inflationary spiral, especially as it encompasses a wider swatch of the economy, you do get relative safe havens (tech stocks less than dividend plays); the argument falls apart if the interest rate uptrend continues. It's not just 2% 'red line' on the 10 year; but the FOMC meeting as well as how policy will be perceived. Markets will watch in advance.

Sure, some tech stocks will do fairly well regardless (Apple may be one); at the same time those that rebounded today 'because' crypto rebounded'; might actually be less enthused. That affects the perception of semiconductors and the real association between crypto-mining servers and graphic chip demand.

Most important this past week of course was the CDC lifting restrictions from a moderate viewpoint. The VIX destroyed anyone that chased the decline; at the same time so far you have a successful rebound off the 50-Day Moving Average for the S&P; plus you have small-caps and even Oil participating. In the coming news-sensitive week; you almost have the last chance to exhaust the rebound and have it back-and-fill, prior to our expected seasonal rally.

Next week will be helped (not hurt) by continued stable-to-firm Oil as it's been at the epicenter of this move for a long time; since the noted lows under 40.

Commodity prices are up significantly; and booming markets (tied to these as well) really depend on emergence from pandemic; mostly a work-in-progress.

Also you have a lot of retail sector earnings reports; and that could make or of course break a few patterns. One people point to is Macy's; as a symmetrical as well as coming-off a head & shoulders bottom. So technically that argues a breakout to the upside; but 'if' they miss numbers while giving good guidance (as one of the few integrated retailers left) you could get both a shakeout and then a move higher.

So once again, bifurcation is alive and well in this market. Got our breakdown and 'automatic' rally off the 50-DMA for S&P; while many momentum stocks if one looks at overall charts, appear to have rallies in long-term downtrends. So it's tough to be too optimistic especially for companies that don't benefit from a broad reopening of the economy.

Just pointing-out one easy to view equity technical picture in for the most part a market that has lots of stocks wanting to extend higher; but at this point this remains a broader market as was indeed primed for a bounce off the 50-DMA which is an absolute minimum decline area (many former tech darlings are off a lot more than 5%; or at least were; so now they make the last couple days, sort of, vanish (just like the VIX reflected).

We're not so sure and recognize our view includes a seasonal rally from later May into early-mid June; but not so sure that a solid interim low is achieved. It may be only because money managers might have no choice; otherwise they face financial ruin in some cases; so if that's the case, they'd rather be late in a move than closing their hedge funds (both painful; one terminal as most of them are dangerously over-leveraged).

So yes our view about late May / early June continues; just a question of how we get there. Stay tuned.

No matter what some say, inflation is here and it is reducing the purchasing power of those folks on fixed incomes, which is those not part of the finance elite. So hang on folks, the excitement is just beginning to start. (NOTE that excitement is not at all the same as "fun".)