Market Briefing For Monday, July 26

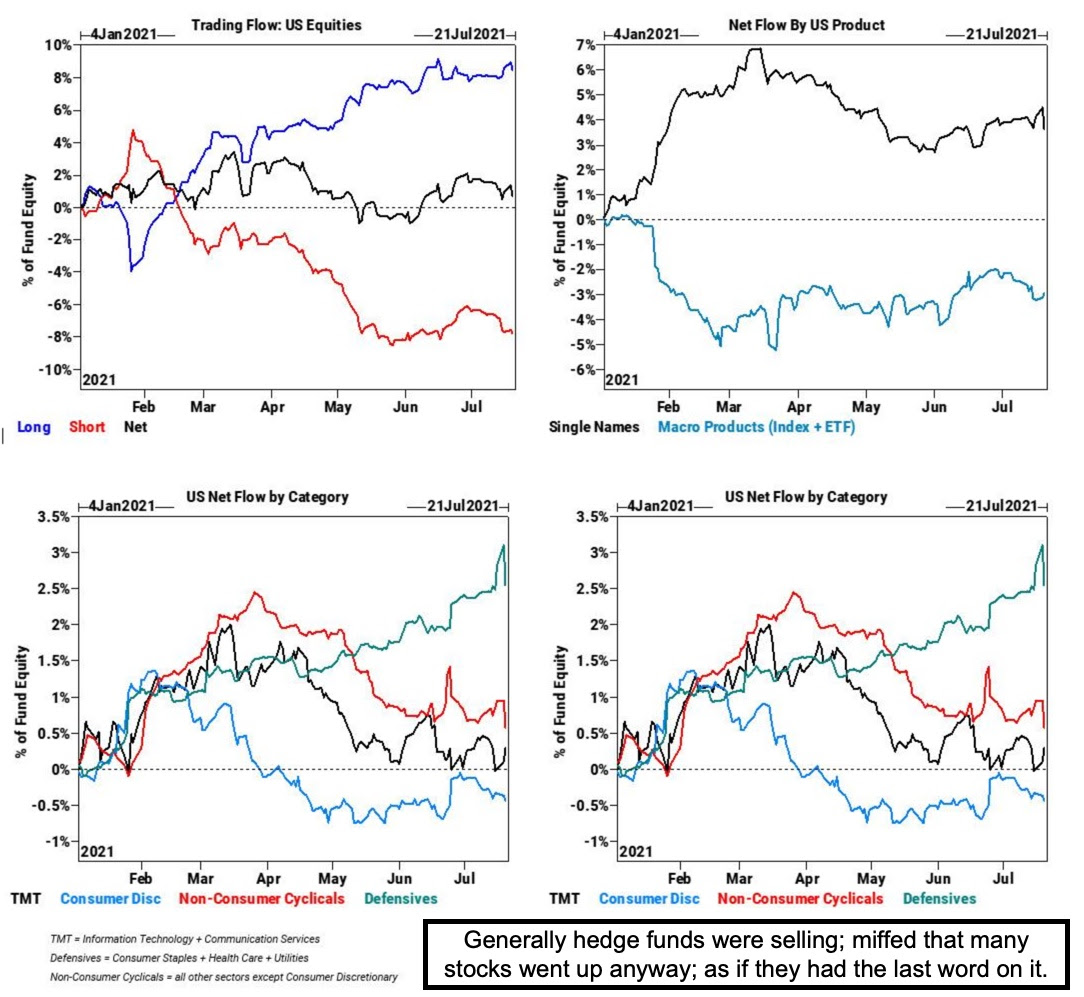

Focused Fund Flows find fulfillment hiding in big-cap techs; and only once in a while do we see the smaller stocks perk-up and participate. That's not the reflection of post-Covid optimism; because it's not post-Covid; as the Olympic frustration (not so much the players, but the hosts and even NBC) reflects.

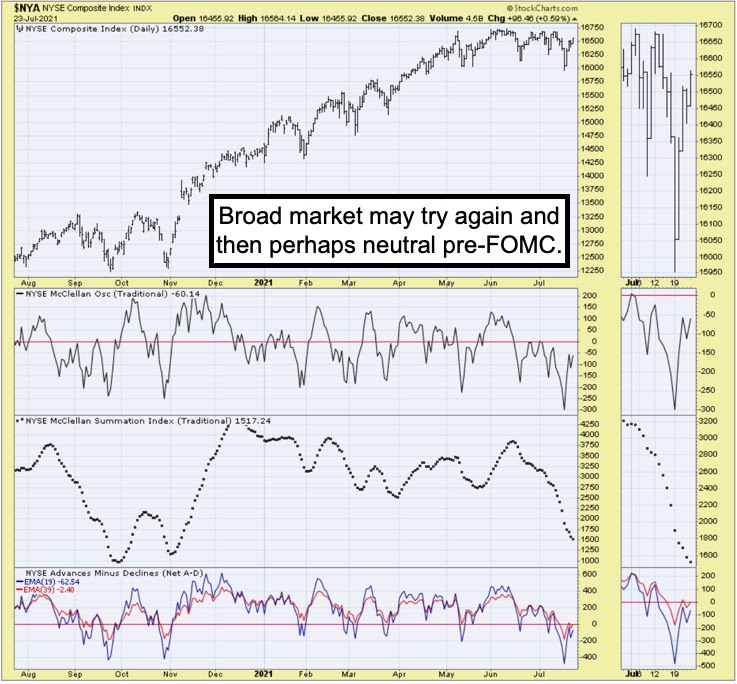

In so many ways this Summer is particularly unique. I'd try to point that out as a reason why you could get only moderate shakeouts it seems so far at least, and not any kind of catastrophic breakdown in the Index (S&P); while the broad market would better reflect 'mass' underlying realities.

Hence it's fine to focus on social media platform advances or competition; but none of them are particularly attractively priced these days; and while always interesting to speculate or learn about technological progress; most of it won't impact their share prices that are already so high. That's even increasingly the case for big-pharma companies; less so for speculative biotechs 'when or if' a key new drug is not just revealed, but shown to have efficacy (for-instance).

Executive summary:

- S&P has poked-out to a new record; which we've speculated as probable;

- Other Indexes are either also at records or not far behind; again proving the point about limitations of downside swoons;

- Some broadening-out of participation occurs; but generally the leadership hasn't changed; and is also helped when Oils or even Banks perk-up;

- China seems to be leading the United States leaning on digital business; and while they are autocratic; there is some understanding of helping the small companies foster growth;

- This has been simmering for years; naturally those 'in the biz' don't want to see the advantages they had in the early 'daze' of the Internet, when it was in the Nation's interest to let Silicon Valley be the digital 'Wild West';

- This is not the early days and some of these became behemoths that, in the opposite role of 30 years ago, are suppressing competitive creativity, or just buying them up before new concepts get much chance to flourish;

- So we shouldn't be surprised those firms resist; but politicians persist, in an on-again / off-again pursuit of antitrust or other 'equitable' actions (of course actual breakup's frequently enrich shareholders so not terrible);

- The week ahead has big earnings reports; but guidance is the dynamic; that's fluid (should be); Google (Alphabet), Microsoft, Apple, Facebook, Amazon... sort of wow... and most expect to exceed Q2 earnings; so will we see buy the rumor, sell the news... that's the question;

- Tesla reports (candidly or not about competitive pressures); and our (pick of the year 2019) AMD, should do well and give positive guidance; given our entry price of 17+/-, of course we're not advocating new members go chase it; however we do expect lots of hedge managers are doing that;

- All are expensive, overpriced but continue to invest big time; and among these probably Microsoft is in better position than broadly realized; due to Azure (their Cloud service); which is well-run and appreciated in industry;

Apple might talk about early orders for Qualcomm and other chips ahead of the next iPhone, due to the shortages and might mention the flood; oh and I expect the 14" (same size body) MacBook Pro ideally in September;

- By the way, General Motors only slipped modestly on news of more fires in Chevrolet Bolts. Well, customer interest bolted from Bolt, and GM has woes reminiscent of the Chevy Corvair or Ford Pinto of decades ago; so it also might help upcoming Ford F150 EV 'if' it can avoid such problems; of course that's a pickup not car; but in-general GM EV's look bad for now;

- This alone might be a considerable problem addressed by better battery protection and circuits; however the platform is intended for other models in the near future; and LG (battery partner) doesn't have a reliable fix yet; and there's no timeline commitment as to when GM & LG may have one;

- Covid-19 has helped the earnings on all particularly-noted stocks; which in-theory could mean pace of gains diminish in the post-pandemic years; but of course we're not there yet; even though we all wish that were so;

- Meanwhile Oil continues to hold well; rebounded as suspected; but also has a 'cap' on how high it can go for now; barring exogenous events;

In sum: At last I have fought my inner writer, and created a 'briefer Briefing'.

The new week may be mixed to start; have some sort of intraweek firming (I'll not say rally because a strictly big-cap momentum lift is not a broad rally); go on-hold ahead of a FOMC meeting that should be inconsequential; although it is possible Chairman Powell will touch on talking-about-talking of tapering. So if there's a notable new shakeout, it might be later in the week; but they need Oil to rebound (maybe Banks) as the leadership is priced-for-perfection.

When (if) the S&P drops again they'll say it's because Covid's Delta variant is spoiling the Summer's escape ideas. Or it already dampened optimism. They will be partially correct about 'Delta'; but it's not news that this is a real messy situation; and nobody wants to talk of the latest Israeli study suggesting only a 40% of less efficacy to the vaccines. Nobody in the know dismisses it; since it was Israel that had the best compliance and even got lower Covid levels than South Korea, Czech Republic or Taiwan; all of whom did a good job early-on in the pandemic. Israel was the first to report the 65% efficacy and now that's lowered; and interestingly isn't getting much reporting; presuming it's correct.

Keep in mind we had one side of the 'hurricane' (Covid); the 'eye' (reopening) as a pause; and the 'other side' of the storm. Eventually more Roaring 20's.

A 'light at the end of the dark tunnel' of the pandemic is not visible; even as some at the Olympics think it is. Perhaps for the 'Games' themselves; but not yet for the people of the world, sadly. Give us an antiviral pill (Merck), or very low side-effect monoclonal antibody or effective stem-cell treatment (Sorrento leading in the number of candidates); and indeed the light won't be illusory.

'Buying the dips' in big-caps is expected to be the tactics employed forward as well; however a bit of caution is warranted. Not only seasonal; not only since the next meaningful move technically should be a shakeout (not quite now but close); but because the economic slowdown resulting from 'Delta' matters.

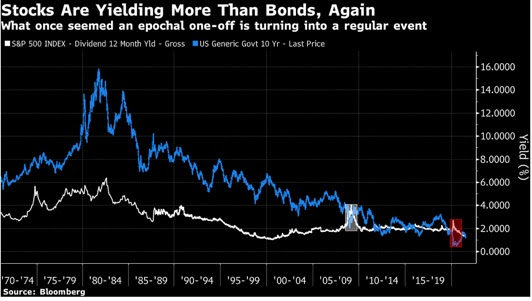

Most bullish analysts are not buying the story because they're looking at long cycle typical durations; and bonds. I don't disagree; but they underestimate at least for now the short-term concerns 'if' there's real economic retrenching. Of course there is also the seasonal and technical aspects I've pointed out.

Let's wish all the Olympians good health and success.

I sure hope Tokyo doesn't prove to be a big super-spreader breeding ground for Covid 'variants'. Go team USA!

Transitory inflation means that they did launch it, and it is moving right along, as planned, perhaps, or possibly faster than intended.

Unfortunately, again, but worse this time, many more families are not able to conveniently increase their incomes to compensate for the increases in cost. So damage is being done to the lower 80% of the population, and the feds do not care one bit.

I agree completely.. but the Fed knows the only hope is to repay debt with deprecated Dollars. Devalue purchasing power again

OK, and the giants are doing OK and what about the rest? Oh Well.

Will governments force another lock down, or possibly not? What happens if a whole lot of people die? Just really wondering what would be if a third of the population died off. Aide from the personal loss of families and friends, what would happen to their wealth? Certainly the governments would swoop in to collect a lot of it, I expect. Greed does that. The world survived the 20's and kept on surviving, but of course there was no internet to instantly spread the bad news.

Well the Social Security trust issue would be resolved. I talk about that is an embedded video but cynically as I don’t see this as genocide endnote as Covid is a ccp bioweapon..

Yes, I also see the covid virus as a military weapon that leaked out sooner than intended.And now the Delta version has been released for purposes that I do not understand, except that evidently the original goal was not reached. So certainly it will be with us for a while.And if somehow a new vaccine is created, well then another virus version would be released. That is how military battles go.

Sad.. as I had severe Covid as you may be aware.. I’m making my small effort to retaliate verbally for the ccp attacking me personally haha

Probably the wisest choice by far.

And please keep up the good articles.