Market Briefing For Monday, Jan. 28

The political circus persists; but has not intimated the market. That's very telling in that it supports our view of prospects still favorable for extensions, to the upside, regardless of 'unfinished downside business' that may follow. For the moment: China, the Fed, and key earnings reports are all on tap. If it's a 'Superbowl of Earnings', can both teams give a mediocre showing?

This matters, because the market is suggesting it anticipated something of a positive nature, before negative pressures return; even if much of what we'd been expecting to achieve this upside, relates to short-covering or strategies that reflect too many 'assumptions' that the market must reverse, simply as a result of running higher into our targeted S&P 'congestion zone', which of course is the area of market swings preceding the December plunge we'd look to trough-out, roughly in the 2300-2400 S&P area, as it did.

As the overall conditions are essentially ongoing; let's summarize where the key concerns stand with respect to many variables being pondered by most market observers, whether or not the market seems particularly concerned:

- Earnings flow is generally mixed; with conservative guidance; and key FANG stocks have potential to roil markets somewhat in the new week;

- Markets debate whether a higher multiple will be justified 'should' we get a 'trade deal' with China, since few expect robust profitability for now;

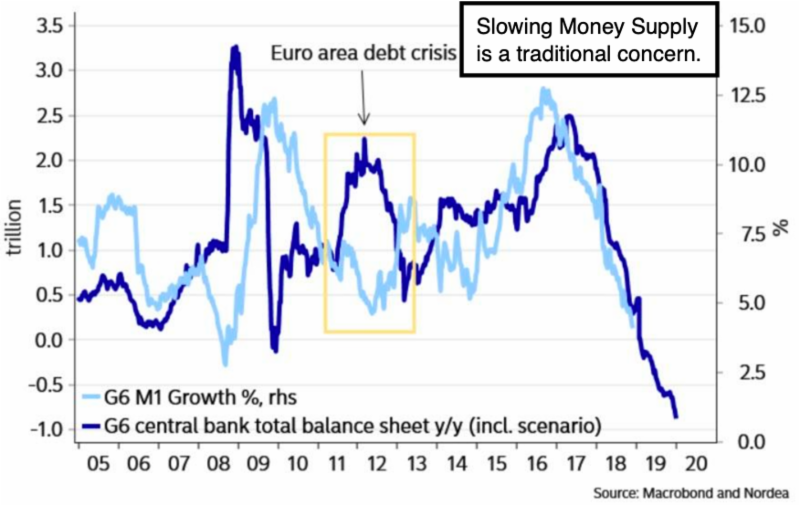

- Germany's slowing growth prompted ECB policy to be toned-down as Draghi noted, and that preceded the 'calmer' Fed 'contextual' remarks, as we had assessed it;

- Perhaps the foregoing results in a tempered pace of balance sheet roll-off, although you're not going to get QE-style help to levitate markets;

- The 'window' precluding buybacks ends soon; which may boost upside at least temporarily; although again buybacks are mostly an artificial way of imaging earnings better than reality (benefiting insiders most);

- Oil prices are fairly neutral in the $50's/bbl area; and need to stay more or less firm to be supportive of the US economy and overall growth;

- Inclusion of significant LNG & Oil sales to China in any deal reached, is very important beyond recognition; because the Dollars come to the U.S., rather than to Middle East alternative providers (to China etc.);

- The domestic 'Government Shutdown' has ended forthwith (for now);

- Potential February (not instantly) pullback remains on-tap; the extent to which we get it will depend on how many backdrop influences evolve;

- Our general view from Christmas of a 'liquidation wave' purge, to S&P 2300-2400, preceding a rebound to the prior breakdown level (where we are now generally 2600-2700) persists;

- Hence the S&P continues trading within the identified 'congestion zone'.

Bottom line: We believe many investors liquidated way-late in 2018 (rather than during the preceding 'rinse & repeat' rolling bear market distribution, as outlined thru 2018). Hence they were not properly positioned for the rally into the current levels, which is supportive of the market not breaking as of yet.

Our overall assessments persist; with the caveat that it is 'really essential'that at least some sort of interim U.S./China 'Trade Understanding', even if not a formal deal occur; so that the higher tariffs (intended for Spring absent a deal or at least a suspension for now) do not take effect.

The market is on reasonably thin ice 'as it is'; but failure to at least postpone those tariffs (however they do it) would be akin to sending an 'icebreaker' of serious potency into the market seas; perhaps without an anchor. Loosely translated: no accord of some type would carry bearish headline risk; and could impact even moderate equity performance later. Stay tuned.

So I believe that while we can correct to varying degrees even after a 'pop', in-event of a Trade Deal (even if just regarding deficits, not structural or IP); the pullback/correction would not be as severe to contend with, contrasted to a failure of the 'talks' and imposition of tariffs in March. In the interim I've indicated prospects of a fade 'within' February; but not necessarily from the start; and much of the timing may correlate to events. It matters for traders, and of course for investors in big stocks, the time was a month ago. And of course, it is 'generally' expected the Fed won't hike rates again, for now.

Just incidentally: it is exactly one year sine my first 'crash alert' warning of a big break coming, in a prolonged distribution process. I made that call while in the Caribbean on January 26. I'm not on a cruise now; so perhaps stocks won't take a 'broadside' again, yet.