Market Briefing For Monday, Feb. 11

Running into a brick wall of resistance in early February, the S&P spent a few days probing the 200-Day Moving Average, after 'nudging-above' the target zone we establish for this market (from the forecast S&P 2300-2400 lows; to the 2600-2700 resistance area, which I termed a 'congestion zone') all the way back in Christmas week.

Throughout January I suggested that ideally the S&P (and even better for Nasdaq) would nudge higher into this area, and probe above S&P 2700; but not reach 2800, at least not on this phase.

Last year I warned investors of the dangers of buybacks (providing primarily a form of additional executive compensation for insiders who were selling at record rates); of passive investing taking investors eyes off of actual stocks; and the concentration in Index trading, ETF's and algorithmic system styles, which actually detract from an investor (or analyst) being up-to-speed on the actual workings of the economy or individual stocks.

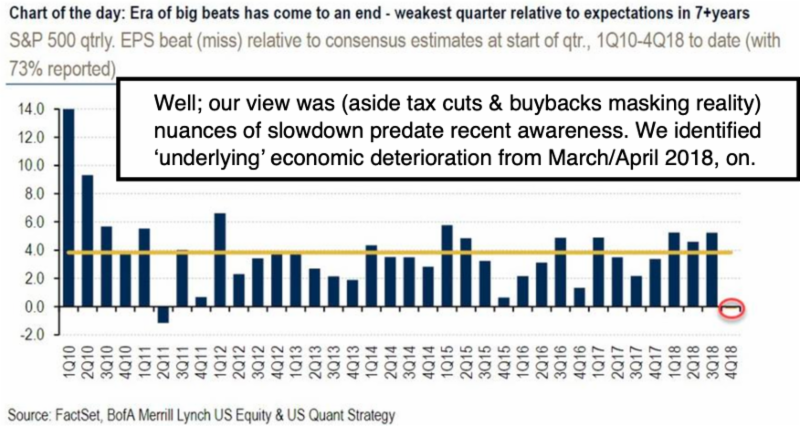

Recently there has been more understanding of impacts from approaches of this type; however it's coming 'after' the forecast drubbing during 2018 most managers suffered, for failing to use 'analytical logic' to recognize what from my view (as you know) as a blow-off cyclical top in late January of 2018.

My viewpoint was that we would have a break; and a series of alternating (a term 'rinse & repeat' was used) moves, with 'sell the rallies' being operative as a tactic for serious investors to build liquidity and prepare for better entry spots later-on. We particularly identified FANG-type stocks as overpriced.

This matters; because we indicated a 2nd 'crash alert' at September's end, and on October 2nd called for a break 'then'. Got it; and stayed bearish for the unwinding until the first 'scaling-back-in' (nibbling not noshing) into what I called an 'orthodox liquidation phase' finally appearing just ahead of what was not just Christmas Eve's low; but as stocks would start settling in 2019.

Where does this leave us now (some history summarized the past year, to give new readers a sense of how this has flowed):

- 2018 was a tremendous period of distribution; which is why I called it a 'roller-coaster' bear market of rotational selling sector-by-sector;

- Aside 'nailing' January 2018's blow-off peak (and secondary peak in the late Summer), it's important that we detected 'nuances of recession' in March-April (contrary to absurdly strong growth trumpeted by many);

- We believed stocks were anticipating this with a 'rolling bear market';

- It matters as our view was and is that the S&P low would occur about as the Street belatedly accepted that 'coordinated global growth' evolved into 'coordinated global contraction', and labeled it as such;

- Our downside idea target (all thru 2018) was S&P 2300-2400; including projections for the S&P to 'tank' in the Fall, and trough near year-end;

- 2019 had a targeted rally suspected likely to run out-of-steam into early February; primarily because of technical factors;

- The S&P's 200-Day Moving Average essentially repelled the advance, in the targeted upside zone for the six-week move-up from the lows;

- 'Calmer' central bank stances were cited even before the Fed's non-move as likely, based on PBOC and EBC restraints expressed, and our belief that the big central banks coordinated their policies to a degree;

- Slow growth in Germany in particular we saw as an influence to deter a move to faster-paced Quantitative Tightening in Europe;

- DOT approval for American Airlines to suspend flights from Chicago and Dallas to Beijing and Shanghai without losing their operating authority on the routes, supports my observations months ago about Delta's low booking (the promotional pricing they'd sent) for this Spring;

- Also note most airlines have extreme discount pricing to Europe right now (low season); but that's a winter-discount, that might not persist into Summer travel (although a few airlines show good deals then too);

- China remains as a catalyst going forward; as today's action denotes; although our suspect defensive pattern preceded Kudlow's remarks;

- The shakeout on Kudlow's comment saying the leaders are 'unlikely to meet' by March 1, doesn't automatically mean higher tariffs kick-in then, but may just mean the Meeting is delayed (he didn't address that);

- White House background infers that the US may leave tariffs at the 10% level pending progress, 'if' it perceives China negotiating sincerely;

- How these future events shape up will impact odds of a Spring rally; in either case we've believed the majority of the last move was 'in';

- Europe and Brexit both remain as harbingers of problems as noted; the withdrawal of France's Ambassador to Italy is unprecedented (response to Italy endorsing the 'Yellow Vest' movement; seen as interference);

- Italy is already in 'Recession'; which combined with German slowing I'd observed weeks ago; contributed to the 'calmer' ECB stance;

- EU growth projections were brought down to essentially zero for now; and it's not entirely related to Brexit, as Germany was already slowing;

- The European Auto sector is especially under pressure (largely slower sales in China incidentally, which has been very important);

- The Bank of England said the UK is facing slowest growth in ages; as is no surprise given the disruptions that loom given uncertainties ahead;

- It might be notable Germany has restricted Facebook data practices and Facebook is fighting, rather than cooperating, on this (so far);

- Closer to home, Secretary Pompeo (not just Southern Command's Navy Admiral) alluded to not just protecting American personnel in Venezuela but also preventing Hezbollah expansion in the region;

- Before thinking that's a 'false flag' operation threat, consider that for at least the last two years there have been reports (even CNN) indicating that Venezuela was 'selling' passports to Iranians and even Hezbollah terrorists, providing entry to Caracas, and even into EU countries;

- Plus Maduro or previously Chavez, cultivated not just Cuba and Russia but Iran; hence the U.S. may be (validly) interested not just in stabilizing the mess in Venezuela, but preventing further drug and terror inroads in South America generally;

- Monetary policy notably should remains calm, which enhances market comeback odds down-the-line;

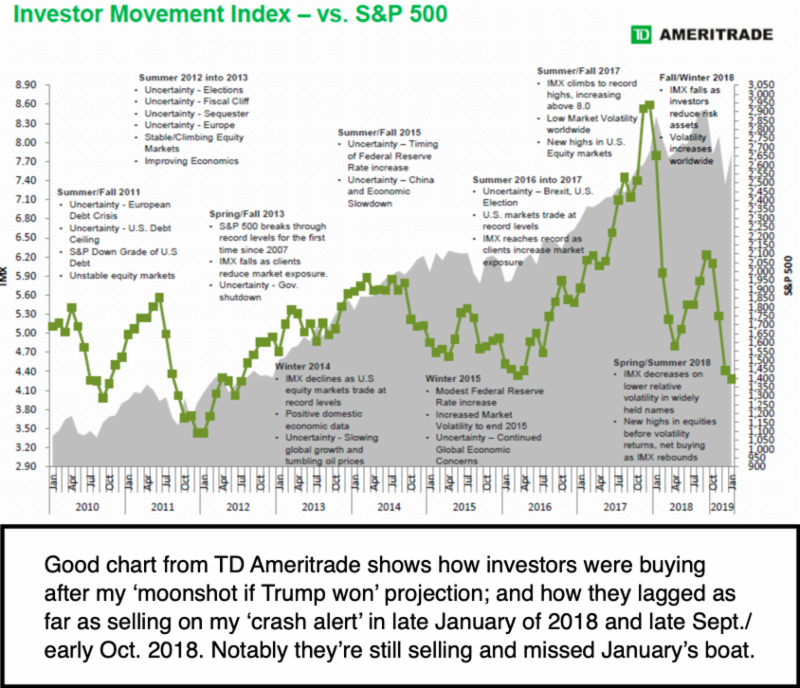

- Notably 'risk-parity' reflections have shown that investors were selling all rallies last year based on charts I shared with you;

- The important (and unusual aspect) is that they continued to sell during the projected rally of January;

- That is concerning as outlined last night; usually suggests an eventual capitulation to the upside (less likely), or perhaps a greater-than-minor setback (and here again what happens with China matters a lot).

Bottom line: we got our January rally nudging-up into February and a short term (at least) high concurrent with the early February 'nudge' slightly over the targeted upside 'congestion zone'.

Conclusion: The market indeed persistently worked higher as outlined from late December into early February. Now it has hiccups, that ideally will be in-context of better overall prospects later on into the Spring.