Market Briefing For Monday, Dec. 14

Bubble levels exist - but they are concentrated in super-cap stocks, IPO frenzy stocks that 'pretended' to soar (as we discussed) and often sold-off; though some tanked and others didn't.

Bubbles in the credit market exist and have for months; and the same doom-and-gloom crowd around all year focuses on that. They are not wrong about the eventual price to be paid (in life and markets; including a real estate drop in more areas); but all of that as I've contended is down-the-road.

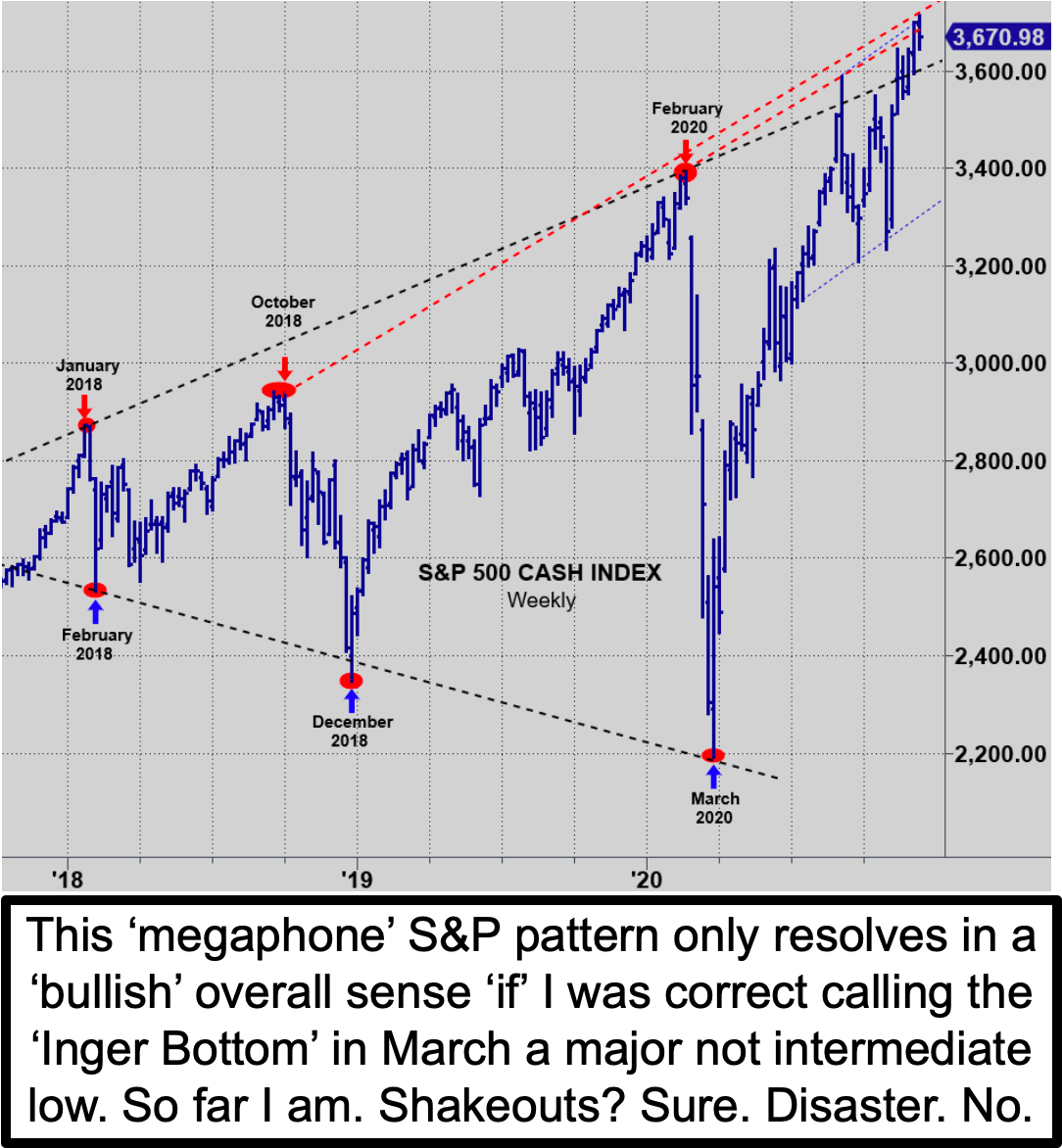

That's still the case; and worries about tax policies depending on the Senate is probably the single most crucial issue facing the market 'corporate wise'. At the same time the disparity in society can't really be tied to stocks recovering; as they had crashed just as we forewarned back in January / early February; and then turned very bullish on March 23rd; amidst max-fear. We are not so bullish now (with the game-stage for some areas) because that was time for entering and more recently time for harvesting some gains; but holding cores of stocks for which we remain optimistic.

Yes, the SPAC craze got hot; and might even be hot in good parts of 2021. In our case we did suggest (for speculators willing) the best of the bunch, which was Luminar (a private Lidar company we followed for several years); via the purchase of the SPAC if you had faith in the deal. Once it was done, media of course soared it unrealistically so we suggesting taking profits (a double/triple in 2-3 days you have too); but perhaps keeping portions.

Same for Velodyne Lidar as far as nailing down some gains on the pop (not a recent SPAC); and properly warning 'not' to get crazy. After all, it has military backing too (Lockheed) and or trucks (Ford); doing more than autonomous of course (proximity lidar can relate to guided missiles too you know). Also we have to keep in mind smaller firms like Innoviz, that have lower-priced goods that the likes of BMW are working with, which might limit the profit for others.

Long ago I criticized Tesla for going with optical only; and not lidar/infrared as you know; and I suspect they will change their strategy going forward (newer as well as safer technology than strictly camera-based systems). Stay tuned.

Below I retain comparisons of Pfizer and Moderna; and you can see several times more fatigue and myalgia (and more) with Moderna's version. However there aren't enough details; like age groups and other demographics. Or for instance; which participants did or did not have either the Annual Flu Shot, or the one-time Merck Pneumovox shot. There is some curiosity if having those, while not preventing Covid infection, might mitigate against severe cases.)

Friday the FDA approved Pfizer's; saying 'benefits outweigh the risks' but they did not emphasize the risks. Apparently the UK was more specific about that.

Executive Summary:

- Quadruple Expiration coming up; often is smoothed a bit by the time you get to Friday; so much is often completed just the day before;

- In stark terms, the Supreme Court repudiated already dubious odds of the Texas lawsuit against other states; and described other issues as moot;

- None of the Trump appointees to the SCOTUS dissented; so this should clear the way to proceed, despite grumbling about secession by a couple Texas politicians (so far not accused of advocating sedition);

- President Trump's team considering 'alternate measures' post-SCOTUS;

- Efforts to de-legitimize the Biden presidency, or of elections generally, will reverberate; although tightening future mail-in voting seems reasonable;

- Perhaps all states should do like Florida (no mass mailings; only requests efficiently tracked with proper citizen / tax-roll / ID or denial in-response);

- President Trump Saturday, angry with SCOTUS, responded by launching several fresh broadsides against AG Barr before the Army/Navy game;

- Next, the Electoral College meets Monday, and with the 'rule of law' now having prevailed (agree or not, it's how our system works), from a market perspective, odds of last minute disruptive zingers are reduced;

- Sadly, presumed disputes of the finality of SCOTUS decision; intimidation and threats to officials and lawmakers still feed fears about violence even now, although hopefully civil disobedience de-escalates into the fatiguing ritual of agenda-driven media tirades we all know so well;

- Our shameless Congress needs to finalize a 'relief' bill lest the markets will reinforce the general view of how shabby politicians have behaved;

- An upward extension would likely encounter resistance or short lifespan; even if temporarily overcome should we get a solid (quick) Relief Bill;

- There is also an FOMC Meeting; although no policy chances anticipated;

- Given 'carbon taxes' and other impediments (teasing intended); there's no prospect of 'lumps of coal' being in Christmas stockings; even if the stock market dips; and as to Hanukah gifts; they keep on giving for now;

- Although you got (of course) the Pfizer FDA approval (and a bigger deal with them too); note a few vaccine stocks were again on the defensive;

- Distribution is starting basically 'today'; and in 'some' quarters concern like the Brits expressed about side-effects or reactions, persists;

- This is the vaccine 'some' will get starting now; and then more; and give it a few months and I'm optimistic about a 2nd generation vaccine;

- Better yet; we'll get 'low-dose monoclonal antibodies' able to prevent AND treat disease; after all vaccine does nothing for anyone already positive or sick; whereas a shot or nasal spray (tests starting) will offer quick action;

- S&P and DJIA have slowed-down as numerous firms are warning of new hits; and of course we've been on the lookout for shakeouts anytime now that we're in the 3700-3800 S&P area; and all these shuffles are part of it;

- Market really could get a boost with a 'relief' bill; otherwise fairly tired.

In sum - the premise of this market has been less politics and more vaccines. It's reasonably resilient; with a loss of energy we spoke about allowing worries about shakeout to expand fairly broadly.

Ironically the skepticism is good; as moderated expectations ahead of what is going to be a Quadruple Quarterly Expiration week, could actually be a plus.

The majority of 'super-cap' stocks have indeed discounted much of recovery, in the wake of Covid; while others really have not, or may even be repressed during tax-selling.

We can bounce if we get a 'relief' bill; otherwise things meander or shakeout.