Market Briefing For Monday, Aug. 26

Optimism versus pessimism - roils markets repeatedly; with markets to a degree fairly untethered from both economic and monetary realities; while at the same time an unhinged President's shoot-from-the hip reactions to quid pro quo tariff impositions have an ability to throw markets into instant chaos; and that increases potential for accidents and policy miscalcuations that for the most part would be avoidable, if handled with a bit more delicacy.

At the same time (as far as the President) Trump knows he's not dictator; he knows he moved the markets (was he short?) and all it will take (if inclined), might be an apology to both Powell and Xi for referring to them as 'enemies' to set things back on a more neutral rangebound course after this break. It's fair to say that what's 'at risk' is more than the S&P's high-level pattern; with real ramifications of things like 'ordering American companies' to bring back manufacturing to the US.

That 'order' gets 'press' but has little legally enforceable aspects, other than indirectly there are ways to punish those who ignore or tell the White House to basically stick it. Never mentioned is that the US isn't capable of handling all manufacturing internally these days. So even though for years I've called for a 'manufacturing renaissance' in the US; it's not really that simple unless we increased migration or get truly robotic to a greater extent over time.

Now, as for the lambasting of the Fed. Chairman Powell is not willing to be pushed into backsliding to an era of unanchored inflation expectations; even if the general goal is slightly higher growth and inflation. Those recalling the wild swings of the 1970's and 1980's are loathe to let this run down to 'zero' for US rates; because besides the U.S. not being in the comparable spot as much of Europe and Asia; they know it can be necessary to get 'hawkish' in a rapid fashion if need be. We saw that from Powell within the last year, as he hiked rates inappropriately (did so for balance sheet not because growth was too strong as was falsely claimed, and I noted that at the time).

Now Powell flipped dovish and can revert back to hawk on a dime really. Of course markets react even more negatively when a direction change occurs, in a way that implies a policy shift. Notice his shout-out to Paul Volcker (the once great Chairman who described Greenspan as the best clerk he had at the time).. as Volcker ended rampant inflation with high rates in the 1980's.

However, we think it's pretty clear central banks don't have as much impact on matters as essentially all the markets presume; and that's proved by the persistent monetary expansionism in Europe, Japan or even China ... mostly falling on deaf ears even if markets there generally responded favorably to their moves; albeit only temporarily. And that takes us to the dilemma that pits Trump against the Fed, believing them responsible (in this instance) for more than they can really impact, given already low rates. That he referred to 'both' Xi and Powell as 'enemies' infers he knows the truth is distributed in a great sense between them; and we'd say 'uncertainty' (a bane of markets) is absolutely more related to trade issues than to interest rate fluctuations at this already-low level that doesn't impeded business in any serious way.

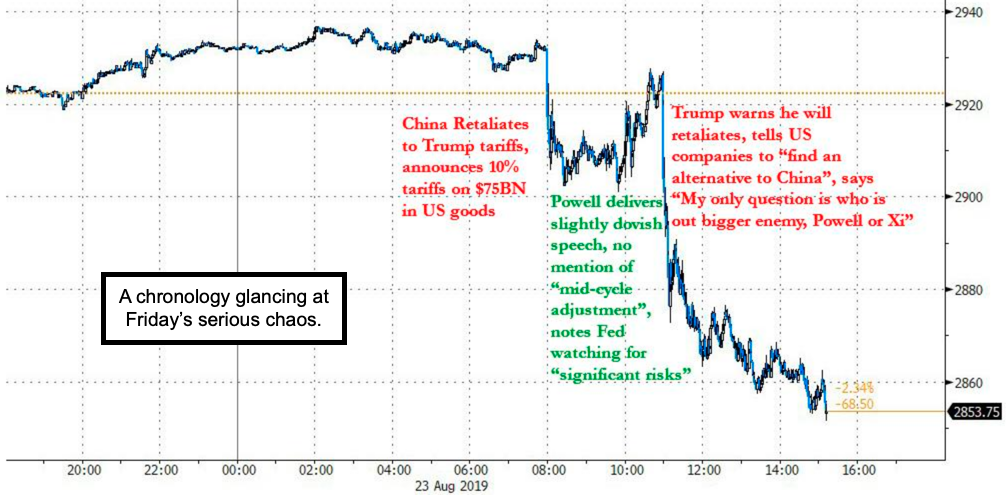

Overall we are with all this jittery focus on Chairman Powell's Jackson Hole address, while failing to realize that no matter what he said, markets would find the impact comparatively narrow; as they tried just until Trump tweeted chaotically. In fact, in my text comments to intraday members right after that happened I was curious why the S&P wasn't responding more dramatically; of course a couple minutes later it sure did.

All this matters, especially when it comes to what I think is a more important emphasis that would impact growth on a global basis, and that would be a 'trade deal with China and full ratification of the USMCA Agreement'. Unless this is a wild double-down of Trump's negotiating tactics (it may well be); it is otherwise not terribly constructive, as market response obviously affirms. I'd forewarned of corrections from early-mid July forward; with a varying degree of rolling severity; and we're in the time of year for all this. Drama evolves.

Even with a deal, there's irony in whether citizens would become irate with our (do nothing or as little as possible?) Congress; should we get a deal; then anything requiring approval might not pass the House, straight-away, with an Election pending. Would they begrudge better prosperity for politics? Let's hope not; but behavior suggests they might impede addressing getting things codified into Law, if it comes to that. These dynamics are very fluid.

However, motivating the House, if enough pressure from citizens back home intercedes, might matter. We'll see; but of course we don't have any sort of ideal; much less specifics articulated; and you have a President increasingly seeming hostile (or frustrated; hard to distinguish at times). Despite China implementing tariff moves of their own Friday, Larry Kudlow suggests we're still talking, and it will be amazing after the ensuing Trump comments, if the contemplated high level meeting in Washington during September occurs (if so it will emphasize that much of what freaks markets or media is hype).

In sum: the economy is sluggish; nuances of recession; but not terribly poor - but slowly eroding - U.S. economic performance persists; hence arguments by some Regional Fed Presidents that an additional stimulus isn't needed.

Though the Fed can always 'take cuts back' of course; as we saw last Fall; it's not so simple. Market dramatics are virtually assured to deliver greater punishment on any sort of 'take back', than even a 'stand pat'; because it often symbolizes a reversal in monetary policy 'direction', even if it's merely 'perceived'. Hence it's not so simple as giving and then taking back a cut.

The forward path of rates was eclipsed by the new China retaliatory tariffs; so you had headwinds before the Chairman's talk. The Chairman cited more evidence of global issues; Germany, Italy, Brexit and general deterioration.

He inferred that monetary policy can be adjusted to global trade issues, with the challenge being to sustain U.S. expansion to a degree independent of the trade issues. He complains about low inflation (most citizens do not; and the low inflation is a bit of a ruse in our view; as aside imported technology and garments, it's hard to really find many so-called big price drops).

Bottom line: the Chairman's mostly saying he's willing to respond to market reactions to trade matters; but sounds like not entirely preemptively. Sounds like he's hinting at rates 'possibly' headed lower; but acquiescing to views of a few FOMC members (with which I concur) that things are fairly sanguine, with regards to the Fed's current stance.

Yields dropped to their lows (so did the DJIA and S&P) initially on headlines of Powell's speech and then worked higher; pretty quickly too; then markets fell apart thanks to the President's more than two-cents input. Almost like a trench-warfare skirmish after a Fed-day decision on rates. High frequency traders having a ball swinging; with not much changed in overall markets in terms of the risk-aversion; and defensive strategies with an extra daily bite.

Conclusion: We suspected the market would be disappointed if expecting a dramatically dovish statement from Chairman Powell; and they didn't get it; so indeed you see a Fed 'giving up the ghost' on how they view handling their 'balance sheet' going forward; and that implies a lesser offload pace at the same time as it's inferring reduced upward pressure to move paper.

The Chairman sort of threaded the needle carefully by not falling-off what is an ongoing high-wire act; by flipping one way or another very dramatically. The Fed is watching development, with an emphasis on the foreign trading roles, but (thankfully) not overtly caving-in by taking-on the responsibility for a faster expansion, even when it's clear from the ECB and others, that doing it doesn't automatically have much effect. Someone tell that to Trump; while at the same time the President may be expressing frustration with China in a way he can get away with; which is slamming the Fed Chairman more (at least he gave a nod to doing so with President Xi; hinting at frustration).

The Fed doesn't want to do what isn't really necessary; and besides leaving little room in their armamentarium thereafter, would very likely not going to be able to achieve anyway; given already low prevailing rates. The US really is a little tighter than the rest of the world wants; but that also pulls money to the U.S.; after all we have a yield where many of them essentially do not. It might be helpful if some who urge too much from the Fed contemplate what could happen if funds are no longer attracted to the U.S. should rates get so low that the attractiveness vanishes. Again; optimistically willing to employ a further cutting strategy 'if needed; but staying out of 'races to the bottom' for now; as you don't want Fed policy keyed on what policy 'might be' later-on.

A data-dependent Fed should not be caving-in-to counterfactual arguments being made by those wishing to assuage blame on sluggishness to the Fed exclusively; which isn't an appropriate grasp of economics or the role trade plays in all this, which is also largely exclusive of anything the Fed did.

The Fed, like the market, is evaluating this 'new normal' (it's abnormal but in transition). Examining the Fed's toolkit is being done; so be aware that has a tendency to infer they are open to revising how they'd act in a crisis.

Truck tonnage (70% of goods transported via truck in our 70% driven consumer econ) up +7.9% YTD 7.8% in June. Not recessionary twitter.com/.../1022171195926441984?s=19