|

Executive summary:

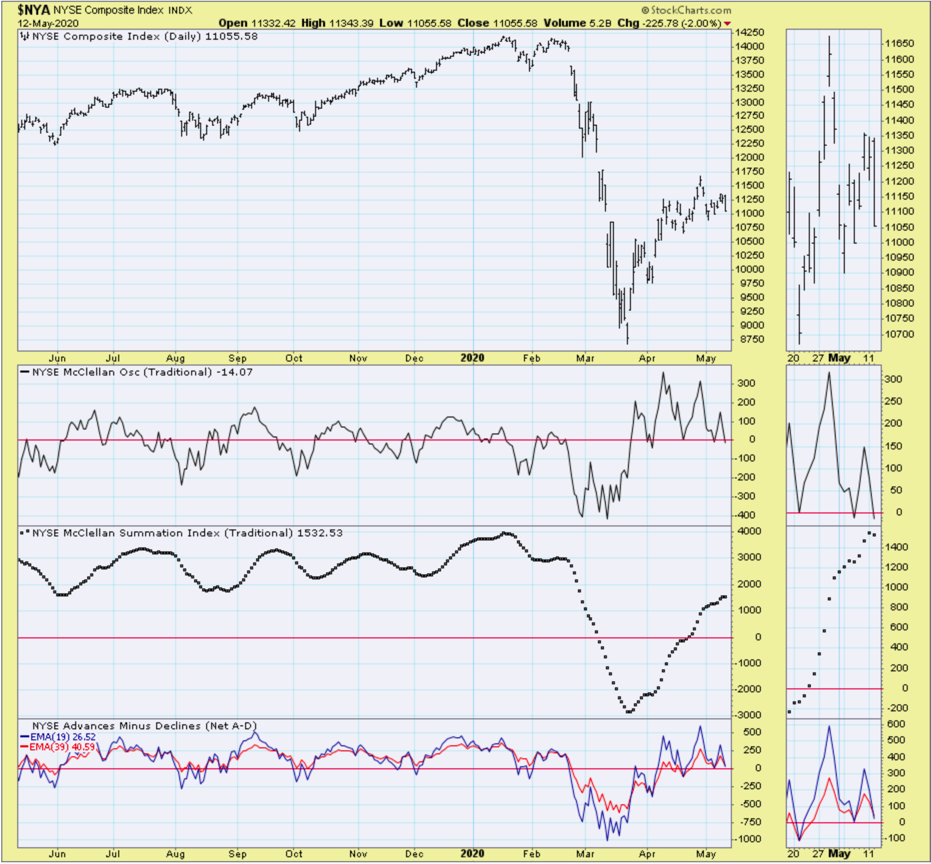

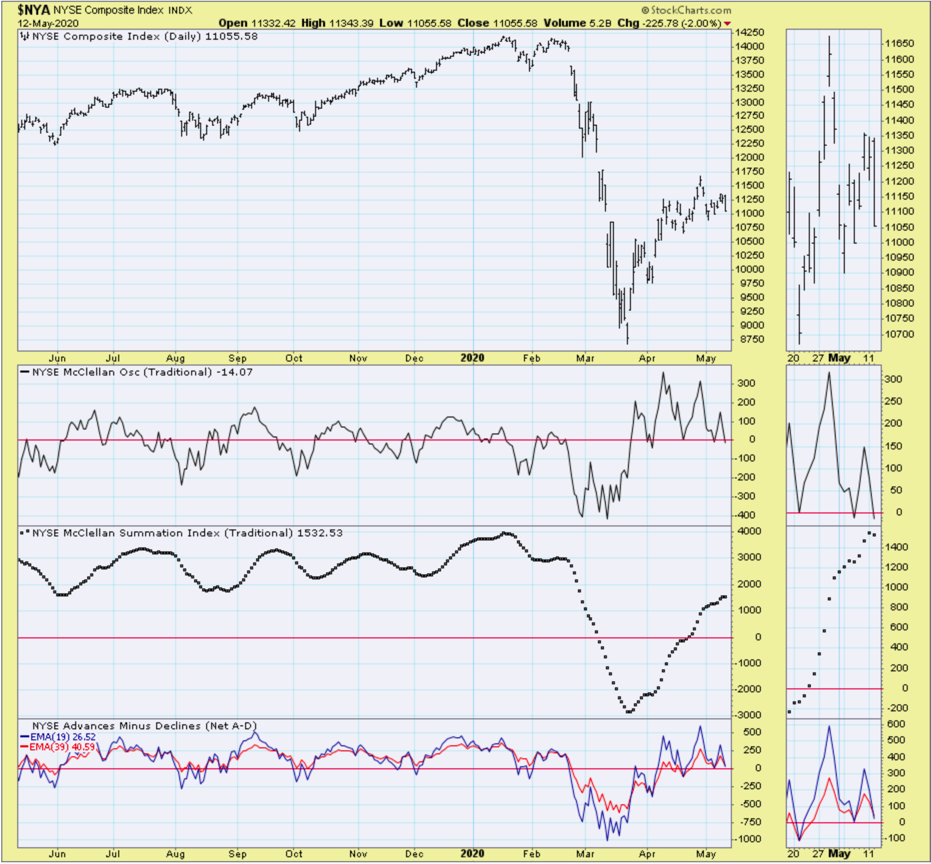

- S&P stabilization efforts continue waning, a bit more dramatically as many questions arise, while big-cap 'concentrated' leadership stocks are extended and provide downside leadership like they did upside

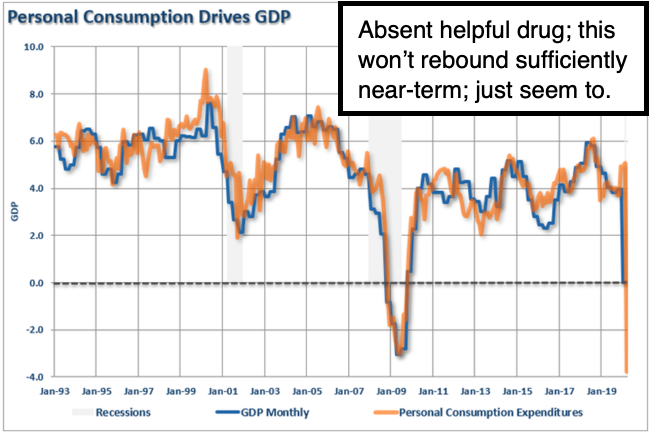

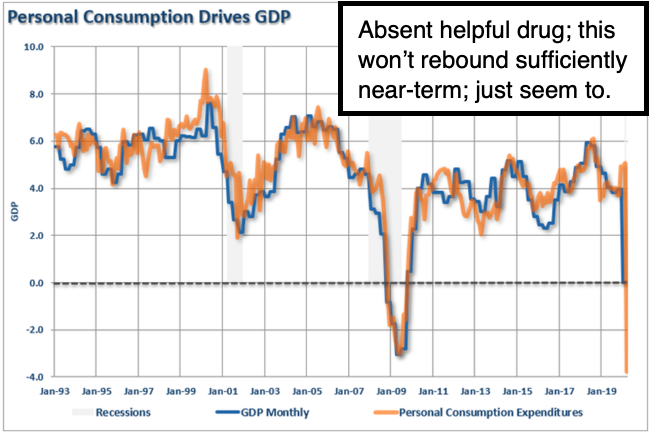

- Prospects remain that the next meaningful move, barring a striking drug breakthrough, should be to the downside, not upside, and it may be underway as of now (internals deteriorating for a few days)

- I must point out multiple vaccine candidates are identified supplies are already ordered (a bet on one of them working) and there is a visible effort to get a handle on protecting (at least partially) in time despite all the slow-go historical comparisons, so it's tough to be 'too' negative even though we expect decline in this general time-frame

- Hard to say whether downside 'gathers steam' as thought very likely in parts of May, as market sensitivity and frustration rises as people (not just investors) recognize recovery is a lengthy proposition

- I resist new 'crash alert' prospects since ideally merely correction risk, however there are known-unknown variables to all of this, either way the crisis isn't over, as S&P should work lower pending all

- Dr. Fauci sparred a bit (especially with Sen. Paul), that likely along with his warning of 'slow down or die' essentially, sobered the entire S&P in my view; more than anything else

- This behavior is aligned with our 3 weeks of warning range bound action is within the 50-200 DMA's and basically exhausting

- Brief broadening-out is colliding with sober business prospects in this health environment, and that's retarding most stocks participating

- The 'Slow Down or Die' mantra may be valid, but it doesn't help stocks or thrill Trump's efforts to see economic revival with some 'gusto'

- I've warned for months that we'd rebound but not sustain it without a drug coming along that takes 'death off the table', as we move toward treatments that are effective, but not there yet

- We are also concerned that monetary policy helps at the moment, while it has a long-term damaging impact on the financial system

- The other day I mentioned people's difficulty getting 'life insurance', it is not the pandemic directly, but more so the negative rate concerns

- Working at home and cars (vs. mass transit) will be ongoing trends in the wake of the pandemic where possible in the USA

- Twitter today said 'all employees can work from home forever', just think about it, increases headwinds trends for commercial real estate, more notable than cost savings for some firm

- Between travel & tourism and property declines, this becomes more than the country can readily recover from in an expeditious way, so yes it all goes back to following the money as it responds to 'health'

- This is problematic for big cities like New York or anyone relying on public transit anywhere, and likely enhances the idea of the epidemic impacting the poor more, but little to do about it other than 'clean', use IR monitoring, and attempt social distancing (no issue in cars)

- This is an even bigger problem in almost every big city in Europe, as the reliance on public transport has always been idealized, but now it's the opposite, so they too have to focus on sanitizing and monitoring

- So, in some areas beyond the chaos and debates about reopening, the recovery will initially look pretty good, but with a sober grasp of risks that are still there (pending an effective therapeutic drug)

- Better economic appearance will be trumpeted, and will only be seen as improvement from catastrophe, but nowhere near return to 'normal'

- By year-end, US debt-to-GDP levels could press 300%, Japan, China, most of Europe, Japan, will see worse comparisons

- By the way, yesterday's 'prohibition' for a US retirement fund to buy Chinese stocks probably contributed to an eye-opening concern about fund-flows (or similar retaliation)

- Meanwhile, nonperforming loans and corporate debt worries persist, banks remain in-trouble, noted since January, knowing there was something triggering the Fed's interventions even before Covid

- Wherever S&P is at the point of an effective 'trial' that tells Americans they can avoid hospitalization or serious disease, stocks soar, but for now the risk-reward ratio of buying after the forecast move are awful

- That single 'sigh of relief' would be a game-changer, everything so far only creates temporary 'hope', not a truly effective mitigation of active virus-triggered disease, so you know it's in the works, but short-leash on markets for now; very dangerous to try swinging in indexes

Collisions are envisioned - between the efforts to model earnings against an expected (at least partial) recovery in business within a U.S. reopening trend, that is itself disjointed, and risks, not entirely based on fundamental science, related to the opening guidelines (although the pressure and need to get economic activity going is broadly recognized).

This effort has to evolve into a marathon in stages as originally proposed (a series of phases that have been undermined by Governors, not just a very much business-focused President who nips-away at the underlying Covid concerns, which of course vary regionally, but remain omnipresent for now.

In a sense no matter what politicians, or hubris dictates Federally or locally oriented leaders as the case may be, or even from more-cavalier CEO's who fear bankruptcy or merely slack results, this all comes back to the Fed put which essentially is contributing to this overall sustenance by the market.

Traveling on a wing-and-prayer

Too many are anticipating a return to tourism and travel, and that's unlikely to satisfy many. Although there are arguments about what the high booking rates for some cruise-lines for next year imply, it's not comfort about cruise safety (and personally I'm not excited about that), but rather realization that Americans will have few (if any) opportunities to travel outside our borders anytime soon. I don't believe most people, whether for business, tourism or just self-indulgence, understand they're likely not venturing abroad soon.

The European Union is set to release new guidelines called "Europe Needs a Break" on Wednesday. So, the EU will likely recommend replacing travel bans with what they are calling "targeted restrictions" based on contagion levels and reciprocity among European and neighboring nations. Not every EU member is on-board, so we'll see what they say. The EU President, as I mentioned a week or two ago, effectively wants to 'seal' the entire EU from international arrivals that are not authorized for government or business, as (already) even media has to quarantine for the typical 14 days on arrival.

Many EU members were under draconian lock-downs backed by science, a bit more like China or South Korea, as countries like Austria or the Czech Republic successfully embraced (better than what Sweden or others did, a curiosity since everyone hears about Northern Europe, and not how well a couple countries nearest the Italian outbreak did almost instantly as Milan was hit by WuFlu (my name for Covid-19 before the name existed).

Anyway, the key to successful reopening in Europe is based entirely on risk assessment. That means anyone coming from any nation deemed risky or careless will be the first to be banned. So in a sense the only way citizens of our country can anticipate visiting Europe, until there's a drug or vaccine widely implemented, is 'if' Dr. Fauci's call for still discipline in reopening will be taken to heart broadly, which is tough given interstate travel and varied approaches delegated to Governors based on belief that federalism might require localized decision making. Realists may argue local implementation but absolutely adhering to the data-and-science-based national guidelines.

Simply put, should the relatively lax American approach to re-opening (test or no test) prevail, travelers shouldn't expect to be welcomed in Europe or perhaps anywhere without an optimal healthcare system, anytime soon. It's not that America's approach to this is the laughing stock of Europe, given a widely differentiated 'mitigation' approach within the EU, but besides people perhaps not eager to travel (is that why they'd risk a shipboard quarantine as contrasted to being stuck in a hotel overseas and unable to do anything) few countries will be welcoming any time soon.

|