Market Briefing For Friday, Apr. 30

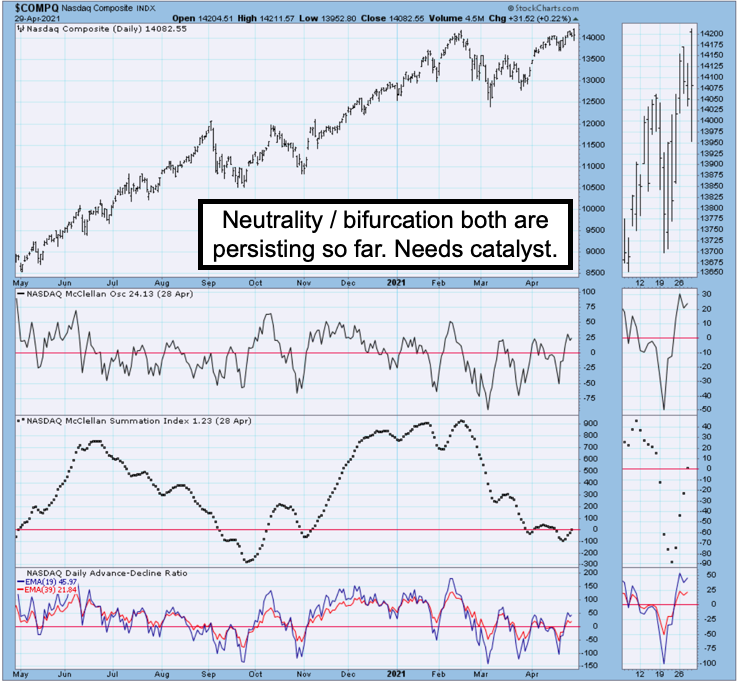

Positioning for decline seems to be the increasing bias of most managers. At the same time, some indicators continue to suggest risk is to the upside not to the downside. It's hard to embrace that perspective; while at the same time for sure this market doesn't accommodate those expecting an S&P thrashing.

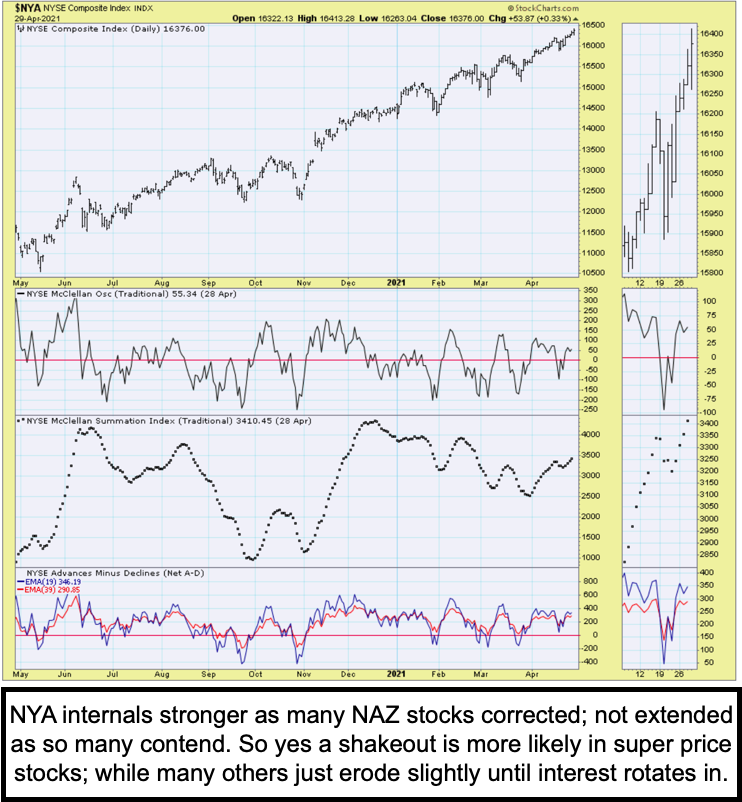

I mention this as the essence remains a market that 'already' corrected within primarily the smaller-cap sectors, but widely for stocks outside of the handful of leaders, as we have often noted. The point is that while a cursory glance at the S&P clearly says 'this should be done'; a more in-depth look at sectors or individual stocks suggests it's more ambivalent than taking a tough stand.

So I tend to call this a 'Summer Market'. Some are up and some are down. It's actually fairly balanced and while S&P shakeout risk persists of course; there is not a set-up for an all-encompassing plunge like some have in mind. Surely, of course, there's always risk of some exogenous event becoming a catalyst, that indeed breaks the market dramatically; but aside that this remains totally dependent on liquidity, the continuity of Fed policy (expected for now; though I wouldn't be surprised if they touch on a 'tapering topic' at the next FOMC); as well as the promise (insanely expensive as it is) of further fiscal stimulus.

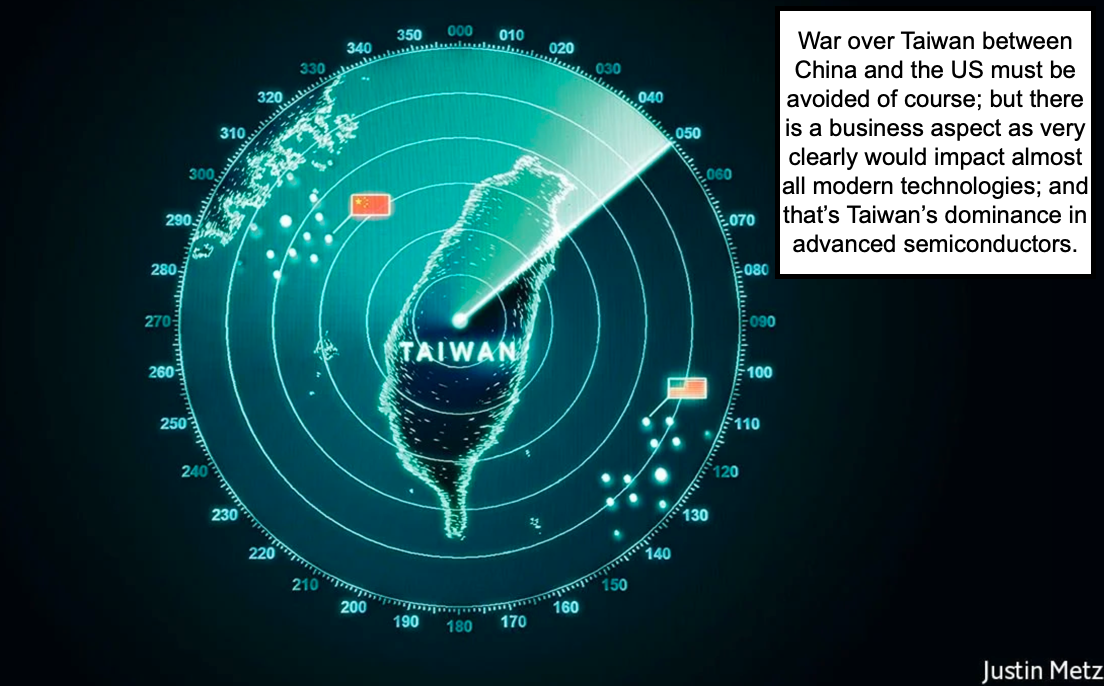

As to disruptive catalysts, few if any stand out like China's threat against what is the democratic island (the 'other' China if one really looks at history) Taiwan or even the threat against the smaller islands within artillery range for China.

Besides the obvious debacle of an actual war; Taiwan is something else (I've been there once, not just Taipei but also Kaohsiung, the shipbuilding center, as well as the free trade zone). Taiwan is the 'world's heart' for sophisticated semiconductor manufacture; since so much has been contracted to TSMC or others; from everyone ranging from ARMS, to Apple to others. Even the Ford comment about how a shortage interfered with manufacturing and thus sales, in the preceding and present Quarters, denotes how important Taiwan is.

The ambiguity of how the United States treats the 'One China' policy has sort of run its course. Beijing seems hell-bent on wanting to seize Taiwan one way or the other. While most tacticians believe China is about 5 years from having sufficient naval forces to really do it; that feigns accidents and is no assurance something doesn't fail along the way. Such as a South China Sea 'clash', or a Chinese Captain that goes rogue and fires at a US Navy warship making one of the fairly frequent 'freedom of navigation' cruises thru the Taiwan Straits.

Overall .. little has changed; and much hinges on the embrace of the platform (with more specifics) that President Biden outlined. As Senator Romney said today; the amount of spending is such that 'if it was a credit card and I was in my school years, Dad would be taking my credit card away' (or close to that).

Clearly this market is running on liquidity; on masking distribution that's been ongoing in a number of stocks; by concentrating active interest in just enough to hold-up the Senior Indexes, which are capitalization (not price) weighted.

Years ago I used the term 'distribution under-cover of a strong S&P umbrella', and I think that applied this year. It doesn't deny correction, while mitigates at least somewhat, against a horrendous decline (although we know that once a decline gets going, the mood can shift swiftly, with after-the-fact panic... but of course we don't know that will occur, only that lots of folks are fearful of it).

In sum: a market opens up post-Biden; and pulled back a bit; as expected. It's not a rout by any definition; and breadth remains nearly dead-even. That's about as bifurcated as markets can be; supporting my definition of this action.

Earnings results are somewhat mixed when it comes to regulatory risk (labor issue about classifying digital workers as 'employees' with benefits); Federal rules on employment can be changed; but probably requires Congress with it so that's not so easy. I suppose Uber is an example one can debate whether independent contractors or employees. Others from Amazon to Apple; have a lot of remote workers; but most are considered employees (even part time). A number of semiconductor and cloud stocks were generally defensive.

Several of the FANG-type leaders have had sharp moves higher pre-earnings reports; which limits how much one can expect after a favorable report (and of course the opposite if they miss). Some are getting hit a bit. Earlier Thursday,Comcast admitted they lost nearly half a million customers, mostly from their switching to streaming services (of which there are almost too many; few with adequate news and financial channels incidentally). Twitter missed numbers, while Amazon made theirs (no surprise); the shares rose another 120 in what might be an incredible freaking by short-sellers (I keep warning about shorts).

Friday will most likely start strong; pushed by Amazon and Google initially. However that's more based on evidence than aspirational; as we have had in mind renewed risks during this seasonal time. But as usual (in fact wisely I guess) we are not fighting the Fed, nor fighting the trend as far as the S&P is concerned. Is it ludicrous to keep holding up; sure. But most large managers and funds won't risk losing position; until or unless compelled to.