Market Breadth Wavering Under The Threat Of Government Shutdown

Image Source: Pixabay

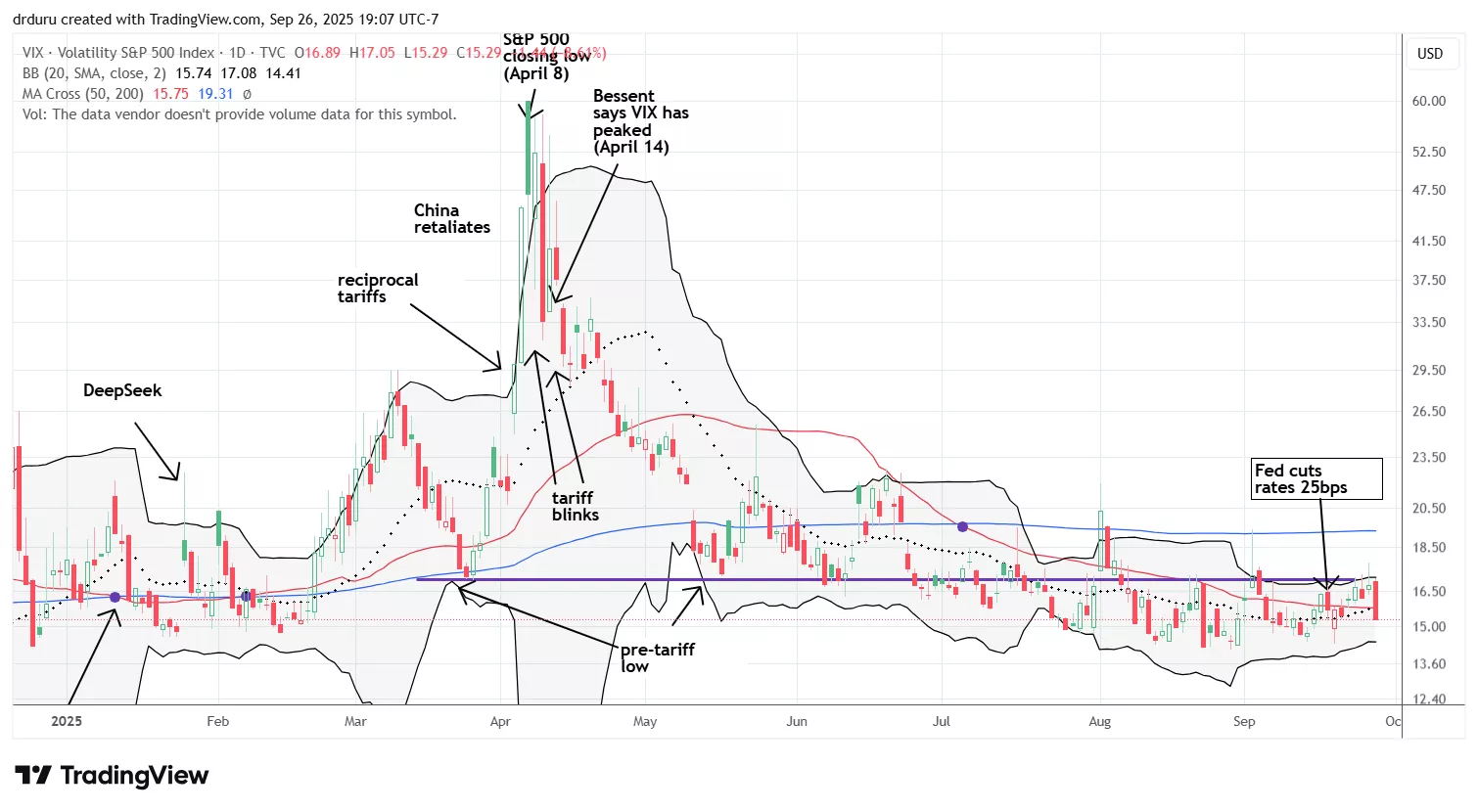

While the stock market ignores risks from a potential government shutdown, wavering market breadth tells a different story. Moreover, gold and silver continue to rally as the lonely parts of the market that care about risks. In my weekly market update (video below), I break down how the market shrugged off a looming government shutdown as the VIX fell 8.6% and major indexes bounced precisely off key DMAs.

(Click on image to enlarge)

The volatility index (VIX) continues to chop around just below its level immediately before the tariff drama, trauma, and noise in March and April. Thus the price for protecting against risk remains very low.

In the video I walk through my favorite technical indicator and measure of market breadth, AT50, the percentage of stocks trading above their 50-day moving averages (DMAs) as it weakens below the overbought threshold of 70%. I explain why I am staying short-term neutral on the market and biasing toward adding protection. I cover the standard diet of major indices, the S&P 500 (SPY), the NASDAQ (COMPQ), and the iShares Russell 2000 ETF (IWM) as well as individual company stories that caught my interest including Apple (AAPL), Zillow (ZG), Compass (COMP), Morningstar (MORN), First Solar (FSLR), MongoDB (MDB), Ali Baba (BABA), Ebay (EBAY), Carmax (KMX), Intel (INTC), International Business Machines (IBM), IonQ (IONQ), Marvell Technology (MRVL), and Nike (NKE), plus thoughts on silver and gold as signals when the market refuses to price in risk.

Video Length: 00:33:37

Be careful out there!

More By This Author:

Financing Costs Do Not Impact Calculated Inflation

August Beige Book Points Toward Higher Inflation To Come

Powell Places His First Step On The Stairs Of Hopeful Monetary Policy

Disclosure: long IWM shares and calls, long GLD call spread, long FSLR

Follow Dr. Duru’s commentary on financial markets via the more