Margin Debt Hits New High - What Does It Mean?

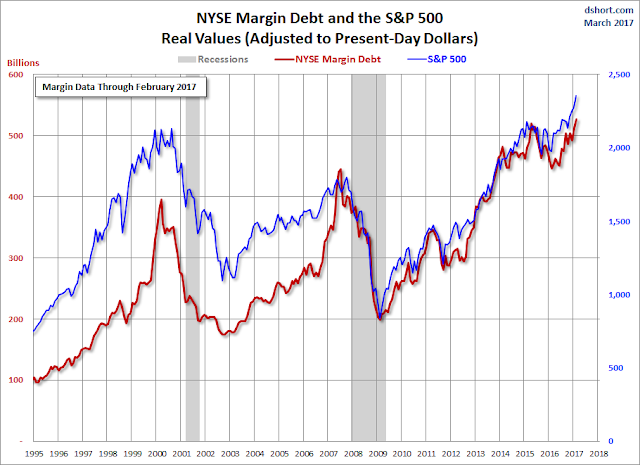

As the Wall Street Journal recently pointed out, margin debt has a history of peaking right before financial collapses. This was especially true during the previous two stock market collapses as the chart below, courtesy of Doug Short and Advisor Perspectives, clearly demonstrates.

With a margin loan, investors are able to borrow funds to be used directly for the purpose of buying of shares. According to the SEC,

"Margin" is borrowing money from your broker to buy a stock and using your investment as collateral. Investors generally use margin to increase their purchasing power so that they can own more stock without fully paying for it. But margin exposes investors to the potential for higher losses.

As I explain in detail elsewhere, increased margin lending is one of the factors that directly puts upward pressure on stock prices as the demand for stocks increases.

Additionally, as the stocks bought serves as collateral for the lender, higher stock prices facilitates yet more lending. The amount of margin loans therefore tends to increase in a positive feedback loop fashion whenever stock prices rise– increased margin lending positively affects stock market prices which again facilitates yet more lending as the value of the collateral increases and so on.

Margin debt and broader measures of the stock market therefore necessarily, almost by definition, tend to move fairly closely together as the chart above illustrates. That is the prime reason new peaks in margin lending by themselves should not be used for predictive purposes - that is, the level needs to be put in context, for example relative to the overall money supply.

However, one thing is for certain: margin lending and the stock market cannot continuously expand over time without setbacks as the bank credit cycle and with it margin lending must eventually come to an end. And this end does tend to come with a bust. In this sense, new all-time highs in margin lending is an important risk gauge investors ought to keep an eye on.

Disclosure: None.