Major Market Technical Review

The major market technical review is something we will produce regularly on alternating weeks along with a sector review and portfolio stock review. Each report will contain a chartbook of either major financial markets, market sectors, or individual equities to review the underlying technical conditions for potential opportunities and risk management. This helps refine not only decision making about what to own and when, but what to overweight or underweight to achieve better performance.

How to read the charts

There are five primary components to each chart if you want to recreate them yourself in the CHARTING application under the RESEARCH tab.

- The top chart is the Williams %R set at 14-days

- The candlestick price chart is bounded by two Bollinger Band studies set at a 50-dma with 2- and 3-standard deviations.

- Below the price chart is a Stochastic indicator set at 14 %K periods, 3 %K smoothing, and 3 %D periods.

- The MACD chart at the bottom is the primary buy/sell signal set at 12/26/9 days.

- Some charts will also compare to the S&P 500 index itself as a measure of over/underperformance.

When the indicators are at the TOP of their respective charts, there is typically more risk and less reward available. In other words, the best time to BUY is when the majority of the indicators are at the BOTTOM of their respective channels.

With this basic tutorial let’s get to the sector analysis.

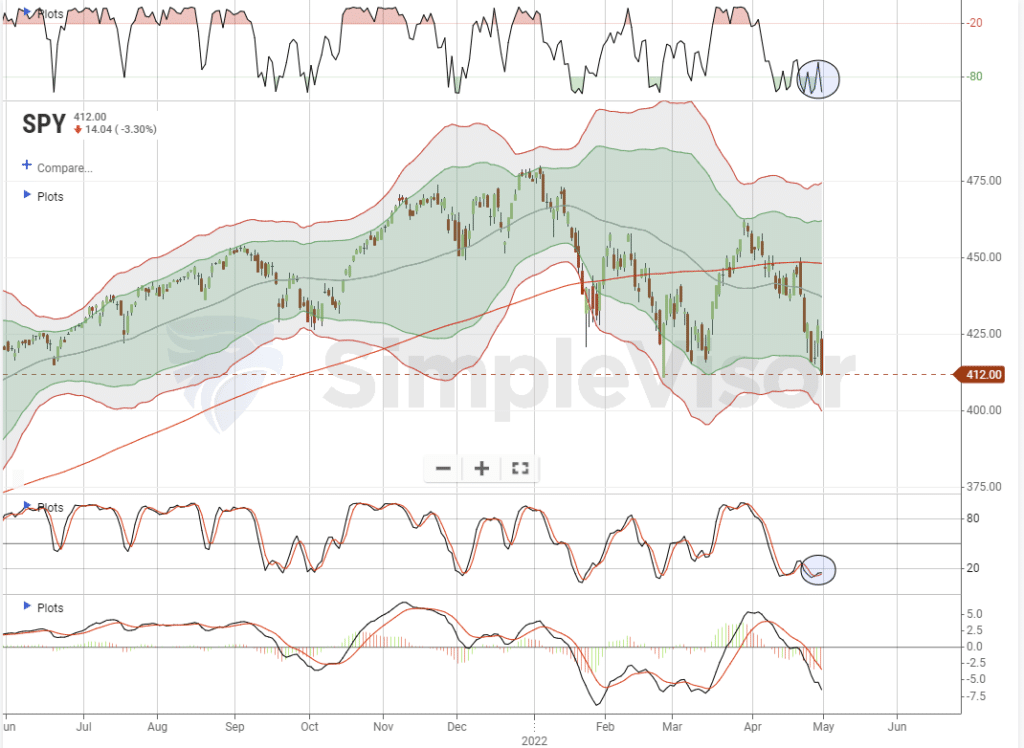

S&P 500 Index

- 50-dma has negatively crossed below the 200-dma increasing overall market risk.

- Currently, the market is on a very deep sell signal (bottom panel)

- The market is also oversold (top panel)

- Short-Term Positioning: Sellable Rally To Reduce Risk

- Buy with a target of $430

- Stop-loss is currently $400

- Long-Term Positioning: Neutral / Bearish

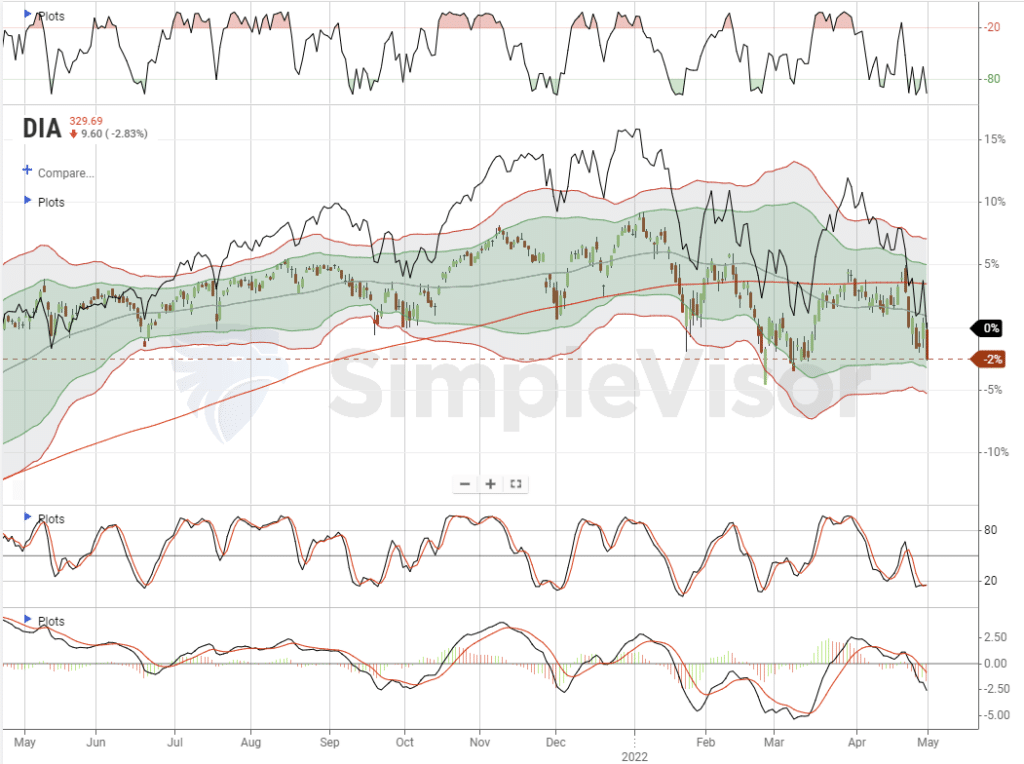

Dow Jones Industrial Average

- The Dow is currently holding support at March lows.

- Moving average crossover is bearish and is currently underperforming the S&P 500.

- MACD sell signal has more work to do, but the market is oversold and close to a buy signal.

- Short-Term Positioning: Sellable Rally To Reduce Risk

- Buy with a target of $333

- Stop-loss is currently $320

- Long-Term Positioning: Neutral / Bearish

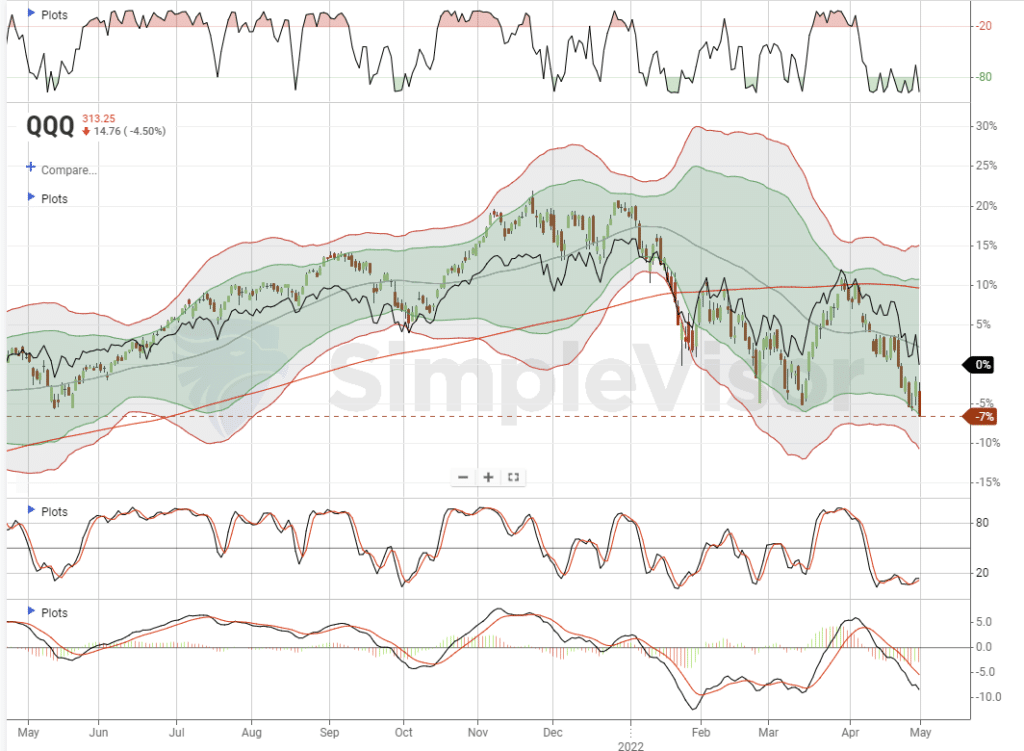

Nasdaq

- Nasdaq has continued to underperform the S&P 500 significantly this year.

- Moving average crossover is negative and puts downward pressure on the index.

- Currently, the Nasdaq is deeply oversold and close to a short-term buy signal.

- Short-Term Positioning: Sellable Rally To Reduce Risk

- Buy with a target of $340

- Stop-loss is currently $300

- Long-Term Positioning: Bearish

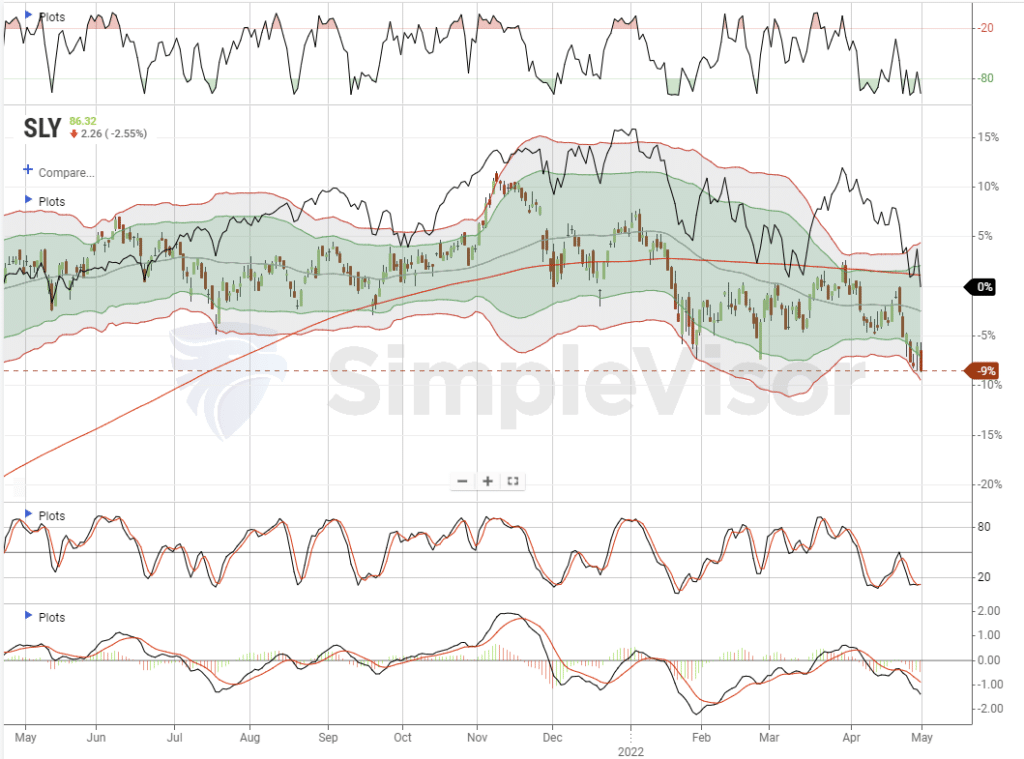

Small Caps

- Small caps have been a long-term consistent underperformer relative to large caps.

- Previous support lows are broken but the index is deeply oversold.

- While the MACD (lower panel) has more work to do, the index is due for a rally from current levels.

- Short-Term Positioning: Bearish / Reflex Rally To Reduce Risk

- Buy with a target of $92

- Stop-loss is currently $85

- Long-Term Positioning: Bearish

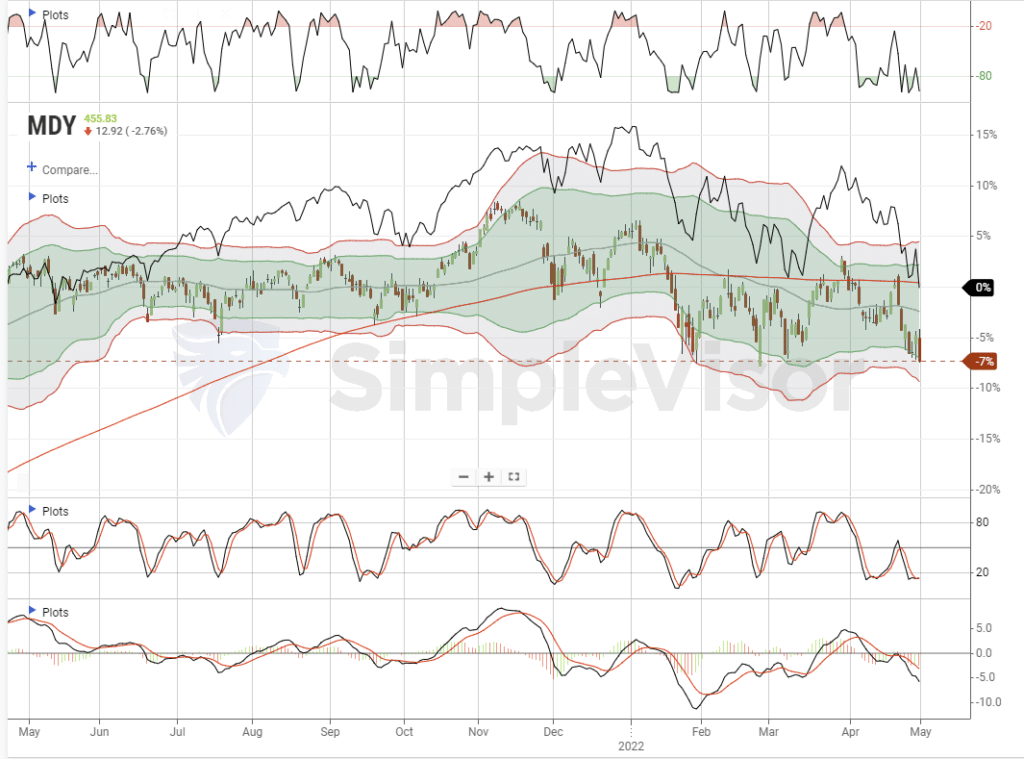

Mid-Caps

- Like small-cap stocks, mid-caps have performed equally as poorly relative to the S&P 500 index.

- The index is very oversold short-term and due for a rally.

- The MACD (lower panel) has more work to do to get to a deep oversold.

- A negative moving average crossover applies downward pressure to the index.

- Short-Term Positioning: Bearish

- Buy with a target of $475

- Stop-loss is currently $445

- Long-Term Positioning: Bearish

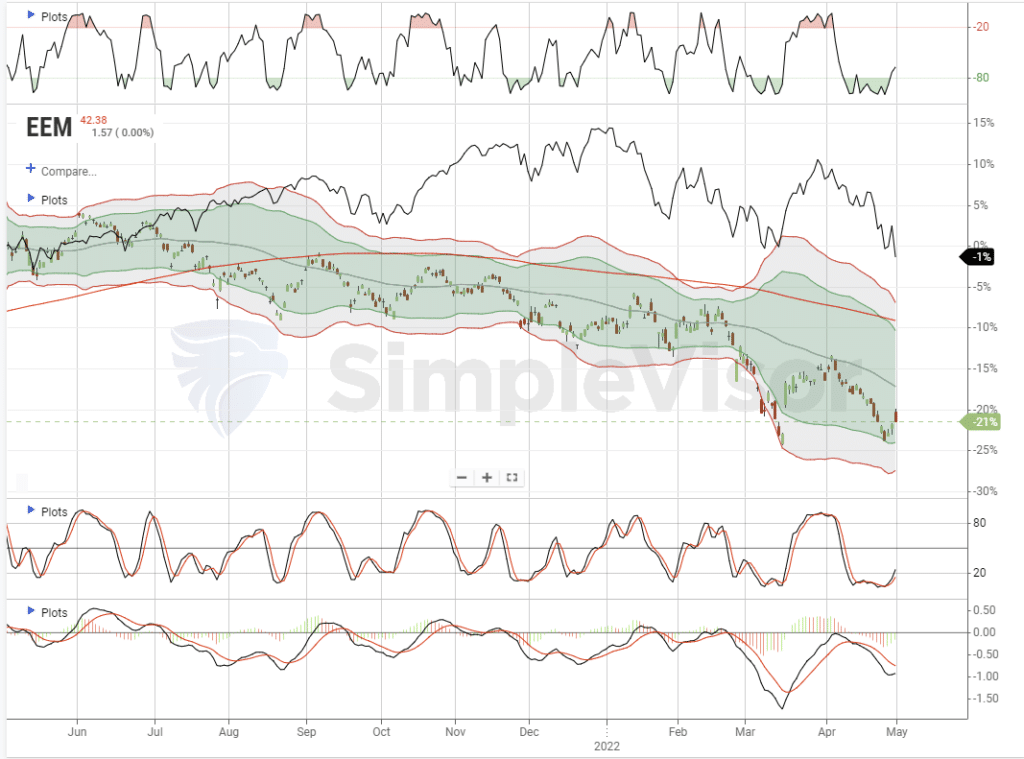

Emerging Markets

- Emerging markets have consistently underperformed large-cap stocks to a large degree. Given the global economic weakness, there is no reason to add these holdings to portfolios currently.

- MACD (lower panel) has more work to do to get to a deep buyable bottom.

- Long-term negative crossover keeps downward pressure on the index.

- The recent pick-up from the eep oversold condition is likely fleeting. Use the rally to reduce positions.

- Short-Term Positioning: Bearish / Sellable Rally

- Buy with a target of $45

- Stop-loss is currently $40

- Long-Term Positioning: Bearish

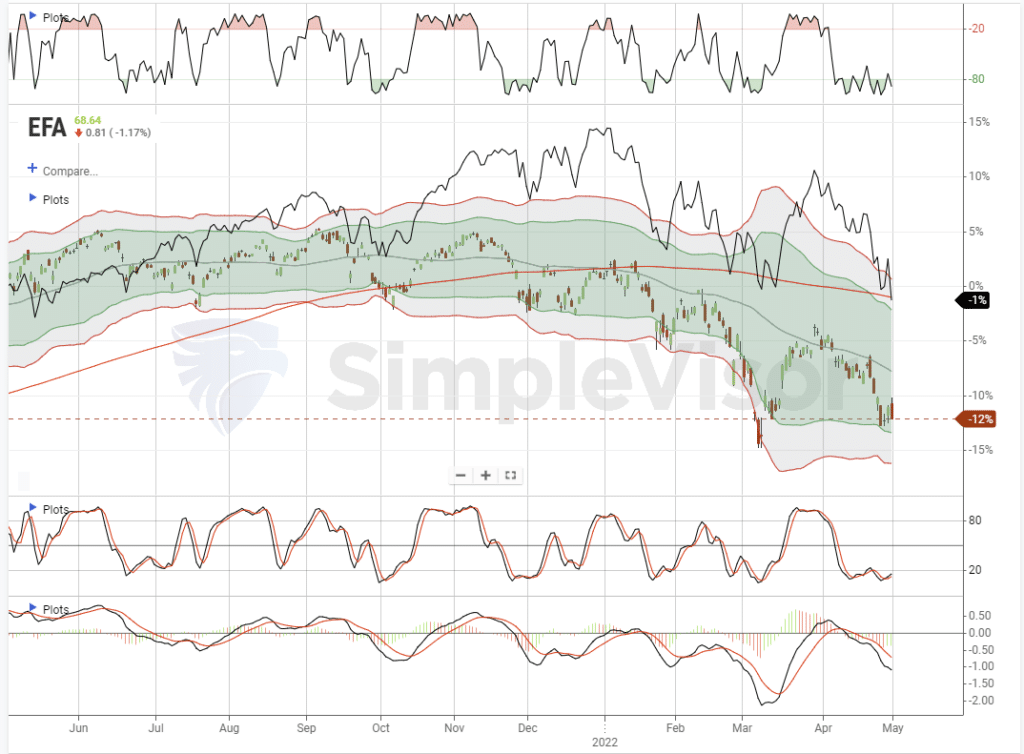

International

- International markets, like emerging, have consistently underperformed large-cap stocks to a large degree. Given the global economic weakness, there is no reason to add these holdings to portfolios currently.

- MACD (lower panel) has more work to do to get to a deep buyable bottom.

- Long-term negative crossover keeps downward pressure on the index.

- The recent support is likely to be fleeting.

- Short-Term Positioning: Bearish / Sellable Rally

- Buy with a target of $70

- Stop-loss is currently $66

- Long-Term Positioning: Bearish

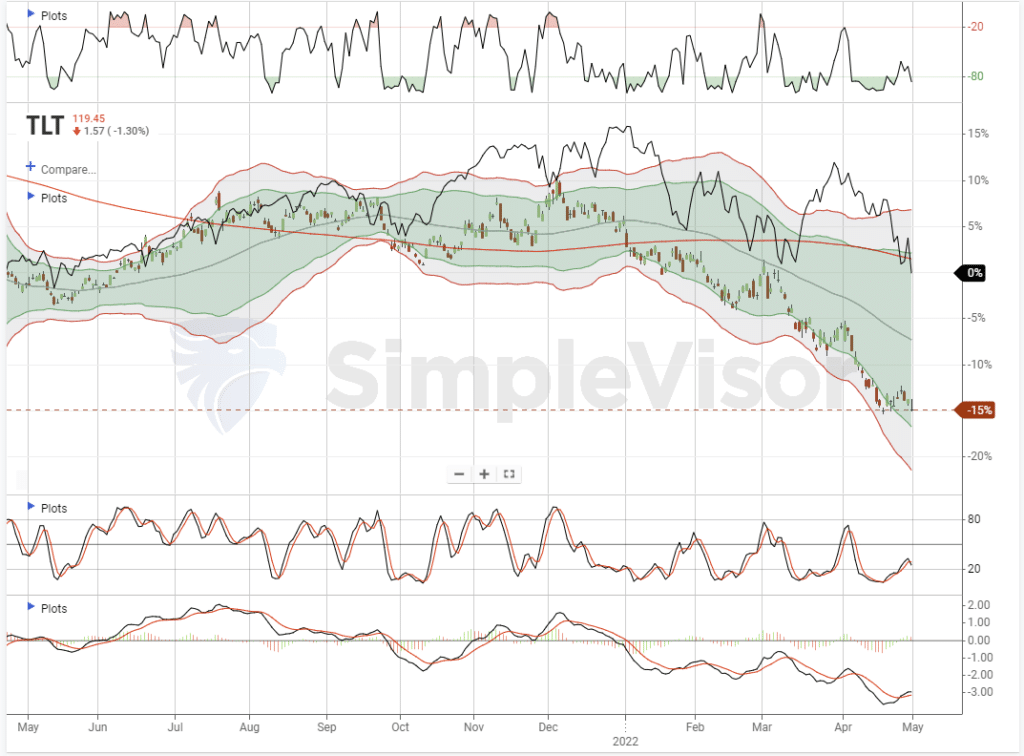

U.S. Treasuries

- As opposed to stocks, bonds are already in a deep bear market.

- The trend is negative currently, with a negative moving average crossover.

- Currently on an early buy signal (bottom panel) which is coming from a very deep oversold level.

- Currently oversold (top panel).

- The current setup is still negative, but the longer-term dynamics are becoming more bullish.

- Short-Term Positioning: Bearish

- Buy with a target of $130

- Stop-loss is currently $115 for trading positions.

- Long-Term Positioning: Neutral To Bullish

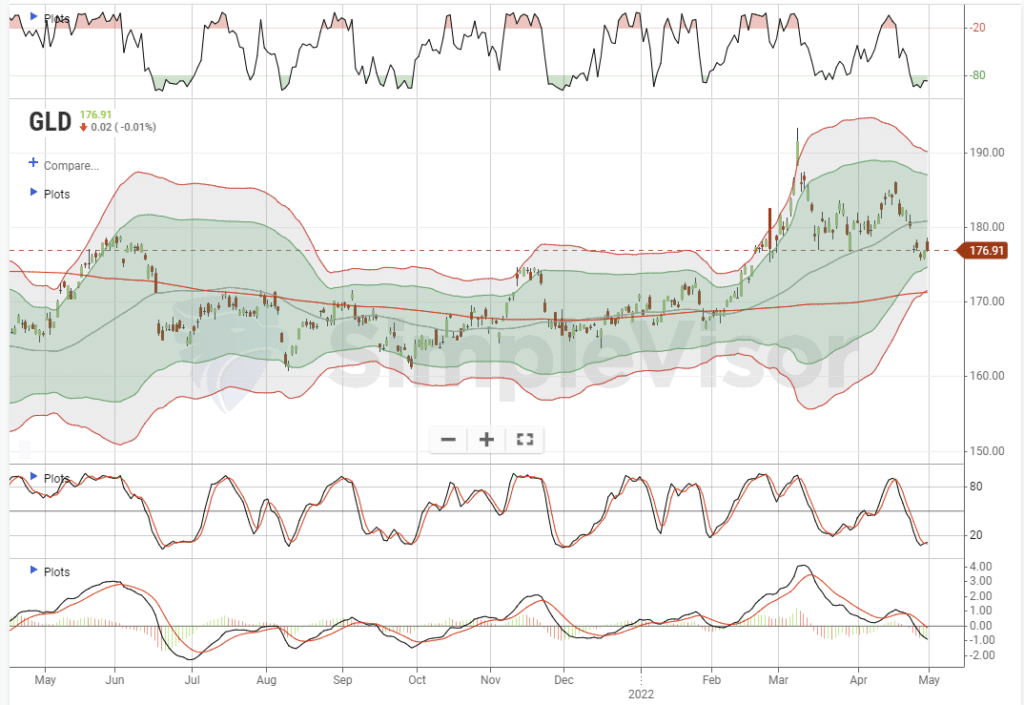

Gold

- Gold has not been the inflation hedge everyone expected this year. Instead, gold remains in a broad trading range over the last year despite nearly 9% inflation.

- The moving average crossover is positive giving support for higher gold prices with the 200-dma sitting below the current price.

- Gold is currently decently oversold on multiple levels and should be able to have a decent rally from current levels back to its recent peak.

- Short-Term Positioning: Bullish

- Buy with a target of $185

- Stop-loss is currently $170

- Long-Term Positioning: Neutral To Bullish

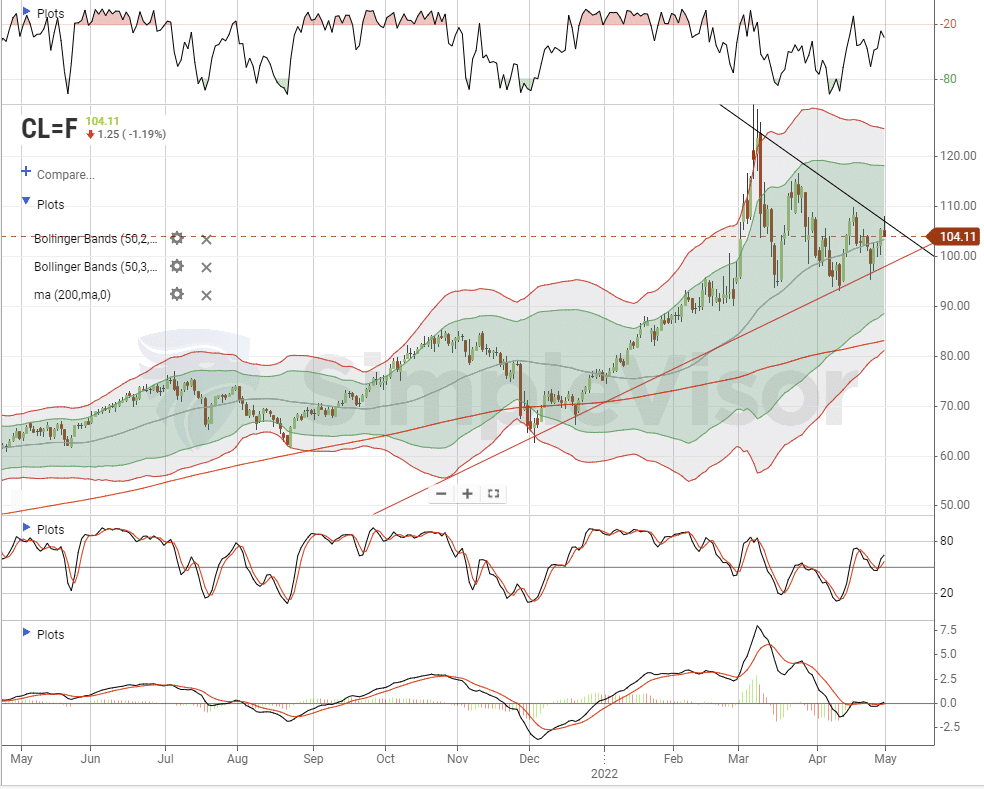

West Texas Intermediate Crude

- The bullish trend line remains intact from the 2021 lows.

- Notably, the bullish trend line remains intact and oil is consolidating in a wedge between rising bottoms and declining highs.

- A breakout above or below the consolidation will determine the next directional move.

- Oil is not in a great position at the moment to trade with indicators halfway between overbought and oversold.

- Hold current positions with a stop at $95 but don’t institute new positions currently.

- Short-Term Positioning: Bullish

- Hold at current levels

- Stop-loss is currently $95

- Long-Term Positioning: Neutral to Bullish

Disclaimer: Click here to read the full disclaimer.