Macro: September CPI Stuck At 3.7% YOY

Image Source: Pixabay

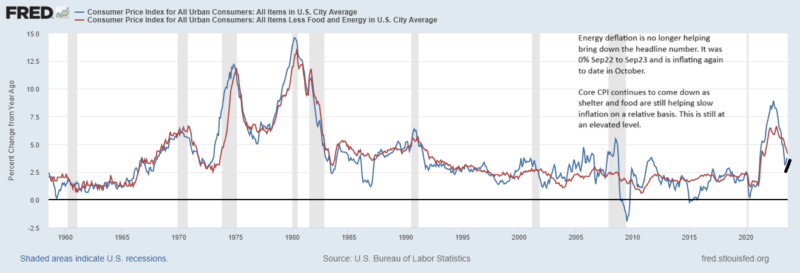

The most anticipated release of the week came in … “Unchanged” or sticky stuck from August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed be stickier for longer than we hope.

Let’s first start with energy which is about 7.5% of the basket. With the exception of the spike in oil coinciding with the Russian invasion of Ukraine, oil peaked in June'22 at around $122/bbl. So for the whole year of June'22-June'23 oil was helping bring inflation down. In June'22 energy inflation was 41.25% yoy and abated throughout the 12-month period eventually turning negative in March'23 and bottoming in June'23 at -16.5% yoy growth. This June to June time period coincides with the peak of oil in 2022 and the low for oil in 2023. For energy to have the same accumulative effect on slowing inflation, it will have to repeat the same level of incremental slowing as it did last year. Oil prices were -42.5% during this period, it's not looking like a repeat performance as oil is up around 29% since then. The Sep'22-Sep'23 change in energy prices is -0.5%. While not outright additive for the last year, a -0.5% rate growth in energy prices is higher than last month’s -3.6% change. And this increase in the change of energy prices this year relative to the decrease we had last year, will cause the headline number to go up, all else being equal. This is the sticky dynamic we’re seeing and the reason the headline number has been up since June.

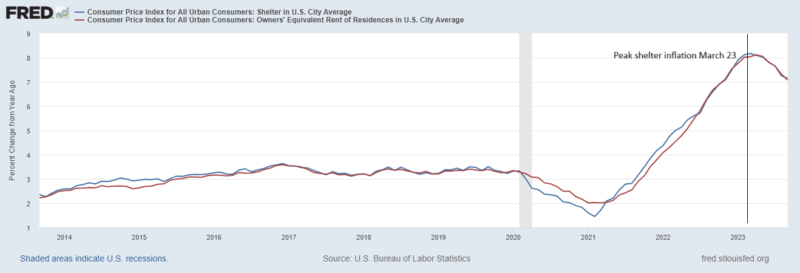

Now let’s move to the 2 biggest pieces of the consumer basket, food and shelter. Shelter is by far the largest at about 1/3 of the pie. Unfortunately, we are going to see the same sticky dynamic for food and shelter, just a bit delayed relative to the short-term price translation of energy and not as extreme as the volatile prices of energy.

Starting with food, the sticky dynamic is starting to happen now given the peak in food inflation was August 2022 (11.3%). The rate of food inflation came down inch by inch throughout the remainder of 2022 before really slowing in the first half of 2023. In the current release of Sept'23 data, food inflation is currently 3.7%yoy. Food disinflation on a relative basis is starting to have difficult comparisons and these will get more difficult in the beginning in March'24. This is hard to conceptualize, but if inflation remains at this MOM level as it has for the past 3 months, food inflation on an annual basis will decline at a slower rate from now until February 2024 and then start to actually go up in March 24. This is part of the dynamic of the persistent stickiness that we are dealing with. Just as sticky energy dynamics may abate, sticky food kicks in.

And at this same time, the difficult comparisons for shelter will begin. Luckily the shelter component is like a tortoise compared to food and energy which have been excluded from the core. But it is a big piece of the basket so will certainly have a sticky dynamic for inflation unless it starts to come down faster next spring than it did in the spring of 22. Shelter went up .35% in this same MOM period last year and it came down .1% this year, so core inflation is coming down. Energy is causing the opposite dynamic with the headline number which rose from 3.09% from June to August and is now stuck.

What’s the implication for monetary policy? We’ll have to wait and see. The consensus is that an 89% chance that rates will be held steady at the November meeting. But the Fed will see 2 more employment reports, 2 more PCE reports, and 2 more CPI reports between now and the December meeting. Consensus puts the probability of a December hike at 32%.

More By This Author:

Yes, Retirees Can Get Audited TooStudent Loans

Look What You Can Pay For With 529 Education Savings Money

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more