Macro Briefing - Friday, March 21

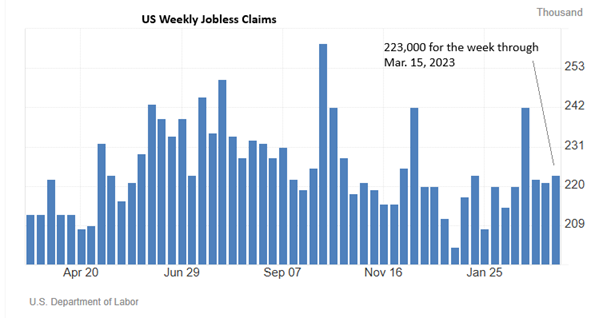

US jobless claims rose modestly last week, but remain low, suggesting the near-term outlook for the labor market remains positive. Claims rose 2,000 to a seasonally adjusted level of 223,000, a middling level relative to recent history.

The US Leading Economic Index fell for a third month in February. This benchmark of the business cycle “fell again in February and continues to point to headwinds ahead,” said an analyst at The Conference Board. “Consumers’ expectations of future business conditions turned more pessimistic. That was the component that weighed down most heavily on the Index in February.

US existing home sales increased in February, surprising forecasters. Rising supply attracgted buyers. “Home buyers are slowly entering the market,” said NAR Chief Economist Lawrence Yun. “Mortgage rates have not changed much, but more inventory and choices are releasing pent-up housing demand.”

The Philly Fed Manufacturing Index eased for a second month in March, but continues to indicate growth. The regional benchmark shows that manufacturing activity expanded overall but was less widespread this month compared with the first two months of the year.

The US stock market’s implied nowcast of recession reflects a low risk that a downturn has started, according to analysis by TMC Research, a unit of The Milwaukee Company, a wealth manager. A model based on the rolling 1-year change in the S&P 500 Index currently estimates the probability of an NBER-defined downturn at just 5%.

More By This Author:

Macro Briefing - Thursday, March 20

U.S. Stocks Remain 2025’s Only Loser For The Major Asset Classes

Macro Briefing - Wednesday, March 19

Disclosure: None.