U.S. Stocks Remain 2025’s Only Loser For The Major Asset Classes

Image Source: Pexels

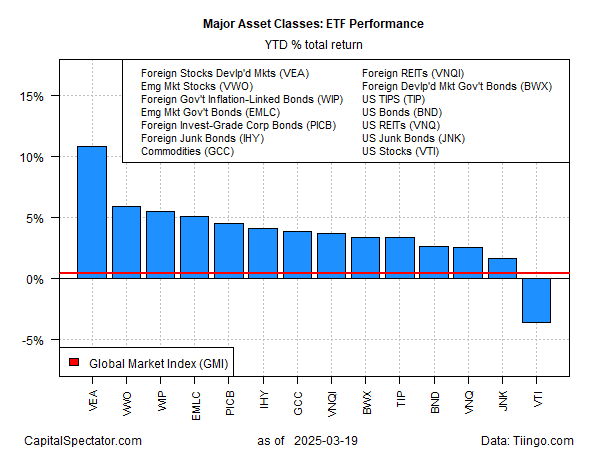

Investing in just about anything other than US stocks has been a winning strategy this year. Using a set of ETF proxies shows that American shares are still the only source of red ink among the major asset classes year to date, based on trading through Mar. 19.

The Vanguard Total US Stock Market Index ETF (VTI) is down 3.6% so far in 2025. By comparison, all the other slices of the major asset classes are posting gains, including the Global Market Index (GMI), a market-value-weighted portfolio of all the major asset classes except cash. GMI is up fractionally this year via a 0.4% total return.

The performance leader this year: foreign stocks in developed markets. Vanguard FTSE Developed Markets ETF (VEA) is up a sizzling 10.8% year to date, far exceeding the rest of the field. The second-best 2025 performer: emerging markets stocks (VWO) with a 6.0% rally.

“This is why you just can’t have all your eggs in too fewer baskets,” says Charlie Bilello, chief market strategist at Creative Planning. “You just never know when there is going to be that reversion. You shouldn’t have been chasing that hot stock.”

One positive note for the correction in US equities is a return to reasonable valuations, which in theory equates with a higher expected return for American shares. Morningstar estimates that US stocks are now trading at a 5% discount to their fair values:

“As of March 14, the Morningstar US Market Index was trading at a 5% discount to Morningstar’s assessment of its fair value, with a price/fair value ratio of 0.95. At the beginning of 2025, the market traded at a 3% premium. Stocks are down 4.5% since then.”

Is this a buying opportunity? It’s still a bit early, suggests Morningstar chief US market strategist Dave Sekera. “ “We need the market to stabilize and start to move up from here,” he says. “And if it holds those gains, I think then the market will be fine until earnings season starts up again.”

More By This Author:

Macro Briefing - Wednesday, March 19

A Fed Rate Cut May Be Near, But Not Today

Macro Briefing - Tuesday, March 18

Disclosure: None.