Lowering Your Risk In Tesla

Time To Take Some Risk Off

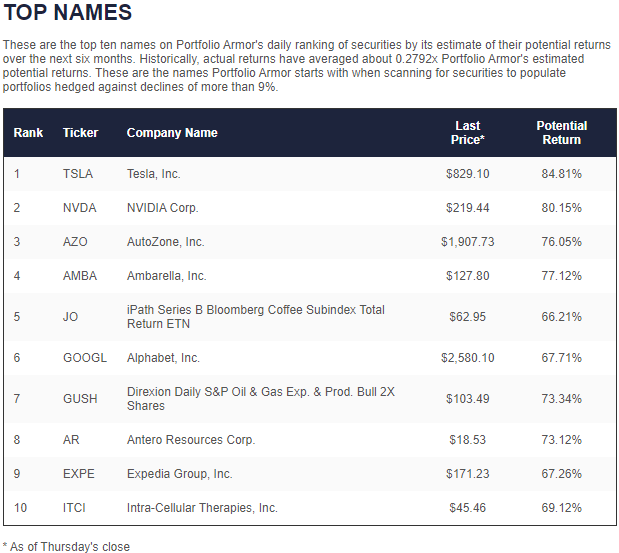

As regular readers know, each day the market is open, our system gauges stock and options market sentiment to select the names it estimates are likely to have the highest returns over the next six months. Tesla (TSLA) has been a frequent top ten name in that daily ranking, including in this top names cohort from two months ago.

(Click on image to enlarge)

Screen capture via Portfolio Armor on 1/27/2022.

Since then, it's up more than 32% on not much significant news, beyond its recently announced plans for another stock split.

Critics Continue To Highlight Its Valuation

Trevor Scott of Tidefall Capital is one of the latest observers to contrast Tesla's market cap to that of the rest of the auto industry.

$TSLA market cap is equal to the rest of the top 20 auto makers combined. pic.twitter.com/cY7jsTAcbm

— Trevor Scott 🇺🇦 (@TidefallCapital) March 28, 2022

But this isn't a new phenomenon, and as Rajesh Sawhney noted a couple of years ago when making a similar comparison, bulls can attribute it to Tesla's execution.

Tesla’s market cap is more than the combined market cap all these iconic car makers.

— Rajesh Sawhney (@rajeshsawhney) November 24, 2020

And the gap is widening!!

Change is difficult for the incumbents indeed! All these car makers have EV platforms, but none has the urgency and focus of Tesla. pic.twitter.com/isDPLZvJTr

Tesla Bull Takes Some Off The Top

Cathie Wood of Ark Invest has been a vocal Tesla bull, but on Tuesday two of her company's funds, her flagship Ark Innovation ETF (ARKK) and Ark Next Generation Internet ETF (ARKW) sold some Tesla shares.

Another Way Tesla Longs Can Lower Their Risk

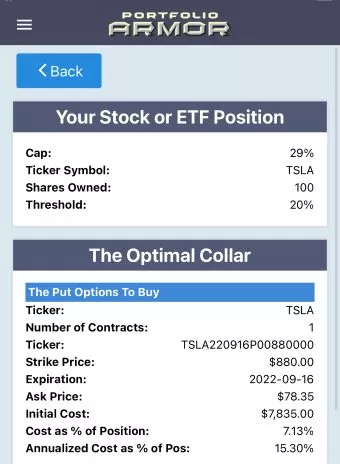

If you don't want to sell some shares here, another way Tesla longs can reduce their risk is by hedging. Here's one example. Let's say you have 100 shares of Tesla and are willing to risk a 20% drawdown over the next several months, but not one larger than that. If you were willing to cap your possible upside at 29% over the same time frame, this was the optimal collar hedge to give you that level of downside protection.

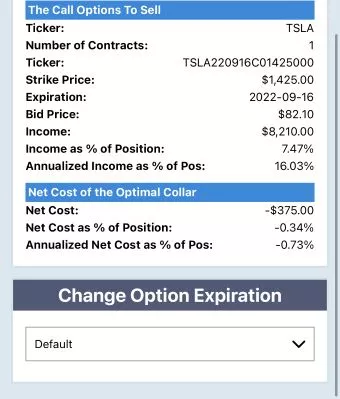

Screen captures via the Portfolio Armor iPhone app.

Here, the net cost was negative, so you would have collected a net credit of $375 when opening this hedge, assuming, to be conservative, that you bought the puts at the ask and sold the calls at the bid. Since you can often buy and sell options within the spread, you likely would have received a larger net credit when opening this hedge on Tuesday.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more