Lots Going On Beneath The Surface Of The Pullback

Happy Friday. Let’s talk about pullback and what to glean from it. So far here is what has occurred.

Dow Industrials -3%

S&P 500 -4%

S&P 400 -4%

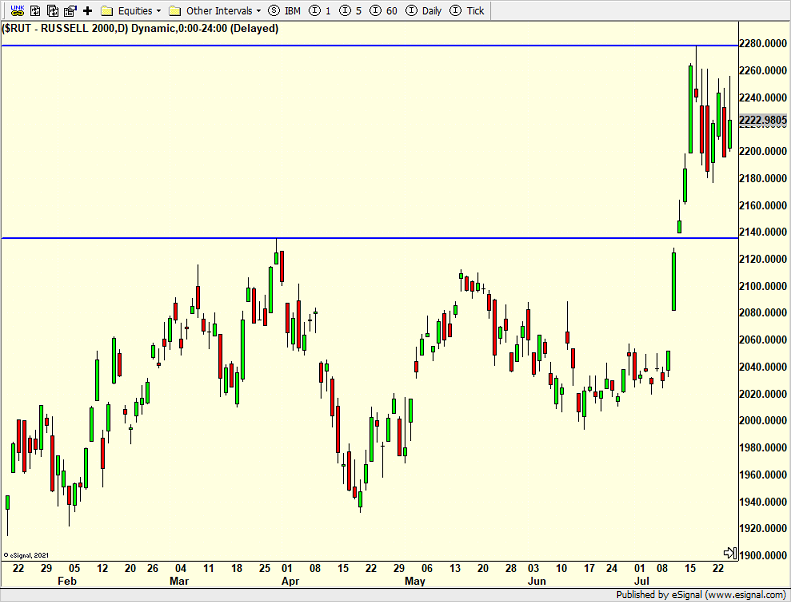

Russell 2000 -3.5%

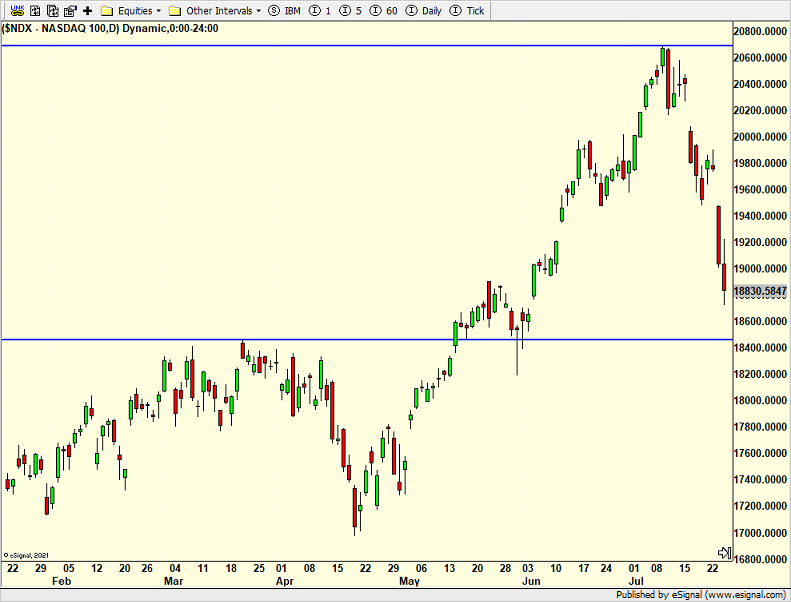

Nasdaq 100 -9%

(Click on image to enlarge)

On the surface you may conclude that the pullback is basically even except for the Nasdaq 100. But you would be wrong. There is something important beneath the surface that the raw numbers do not show. First, all indices did not peak on the same day. The highs have been July 10, 16, 17 and 18. What peaks last is usually what’s leading. In this case it is small caps followed by mid caps.

Additionally, on down days, the Nasdaq 100 has underperformed or lagged while the small caps have lead. On bounce day, the small caps (Russell 2000) have lead or outperformed while the Nasdaq has lagged.

(Click on image to enlarge)

Stocks are due for a bounce and that’s what is shaping up. The odds don’t favor this being the final low, but the key takeaway is that new leadership is emerging or has emerged since that epic day on July 11th.

On Wednesday we bought more RYCIX. We sold ENPIX and some TGNA. On Thursday we bought SSO, RYAZX, and more QQQ. We sold FDEV, some RYZAX, and some FUTY.

More By This Author:

Not Ready To Upgrade 1-3 Month View Just Yet

Biden Out, Harris In – Does It Matter For The Markets?

Bears Making Some Noise – Or At Least Trying

Please see HC's full disclosure here.