Liquidity Is Trapped In The Banks

In rare fashion, the banks are no longer greatly eager to have your deposits, despite the surge in individual and corporate cash balances looking for a home. Customers’ savings are not what the banking system needs or wants today, since the banks truly do not have profitable outlets for this abundance of cash. Hence, we have the classic Keynesian liquidity trap where no matter how cheap borrowing costs become the demand for investment funds remains weak---- that is, money is essentially trapped within the banking system.

Image Source: Unsplash

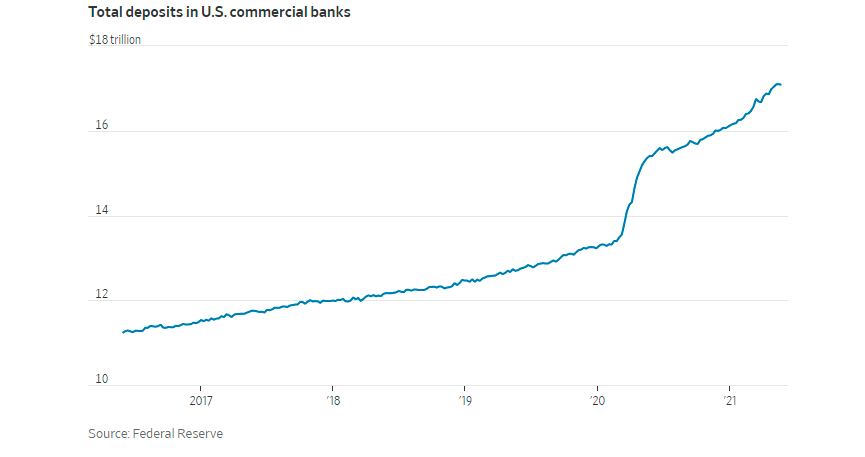

When the coronavirus pandemic hit last year, companies and individuals sought to raise cash in order to weather a storm of unknown duration and intensity. Corporations raised a record amount of debt. Individuals' cash balances surged in response to the combined effects of involuntary cutbacks in consumption and putting aside funds at a time of great job uncertainty. Banks have been holding that cash ever since (Figures 1 and 2). Why are the banks and their clients not taking advantage of this extraordinary amount of cash to generate profitable loans and spur economic growth? Are the banks withholding loans or are their clients not interested in taking advantage of low rates of interest? Frankly, it is a bit of both.

Figure 1: US Bank Deposits

Figure 2: Canadian Bank Deposits

Source: Bank of Canada

To begin with, bank lending has been very slow as evidenced by the declining loan-to-deposit ratio. Prior to Feb 2020, loans represented 75% of deposits in the US; today that ratio is down to 60%, partly in response to the surge in deposits but also, significantly to the lack of lending by the banks. Clients are not so confident that they can turn their borrowing into profitable business activity and the banks recognize that to be the case. Both sides of the credit market are still cautious.

One key measure of bank profitability is the net interest rate margin --- the spread between accepting deposits and putting out loans. That figure in the US has declined from 4% about a decade ago to 2-2.5% today and continues to be under pressure. That has weighed significantly on banks’ profit margins, and we can see why the banks are reluctant to lend to marginal businesses. From the lender’s viewpoint, a robust corporate bond market beckons and that market has stepped up where banks fear to tread. However, small- and medium-sized businesses have no access to the huge pool of corporate borrowings and must contend with reluctant bank managers at the local level.

With banks reluctant to accept more deposits, cash-rich customers often looked to the money market as a temporary haven. But that outlet now faces its own challenges. The money-market funds have been overwhelmed with cash reaching a record high of $4 trillion last month. The Fed is eager to reduce cash balances in the banking system fearing that the overnight rate would go negative. The irony is that the Fed is pushing cash into the banking system by means of its bond-buying program, and the banks are, in turn, pushing that excess back onto the Fed.

The Bank of Canada was first out of the starting gate to phase out its bond-buying program, including federal, provincial, and corporate bonds. Meanwhile, the Federal Reserve continues to pump cash into the system, yet the market participants have nowhere to put the funds, other than turn it around and place it with the Fed. No wonder some pundits liken this to Alice in Wonderland. (Down the Rabbit Hole)

Perhaps the entire situation has been created by the long string of poor choices by the federal reserve bankers. The fact is that eventually things catch up, and at that point it does become clear that wrong choices have been made. Some always refuse to learn from mistakes, but rather choose to repeat them. This is unfortunate.

The essence of this problem of excess liquidity or the liquidity trap is slow economic growth. And that is why monetary stimulus is not able to do anything when real rates of interest are negative as they are today. The only solution to stimulate growth is expansionary fiscal policy which we now have an abundance because of the pandemic.