Last-Minute

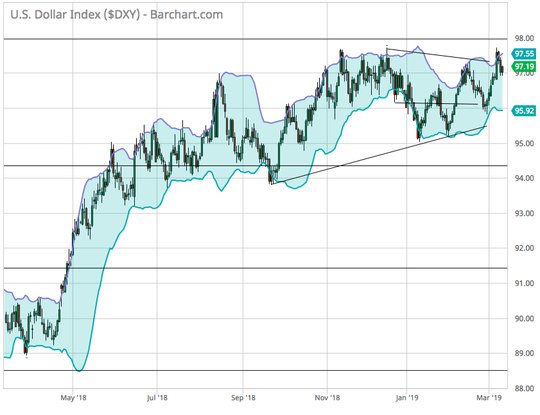

The best performances by athletes, musicians and politicians are always in the last minute. Today is no exception, with UK May securing a concession from the EU giving teeth to the backstop. The problem is this may not win her plan enough votes in Parliament later today. The game theory of the EU is that their concession is just preparation for an extension as a failure in the UK means either a delay or another referendum or a new election and so another set of negotiations. While the rest of the world may look upon this will a smirk and a bit of schadenfreude, the effect of the political uncertainty on global economics isn’t zero. That gets us back to the other last-minute discussions between US and China on trade where no news is good news. This sense of calm won’t last as both the UK and China have a broken clock. The deadlines for good outcomes have long passed with damage control and containment the best result. Lost potential growth and investment could bounce back but that is the stuff of hope rather than reality as all parties from the US to China, UK to Germany have suffered in the one-two punch of tariffs and Brexit. Supply chains take years to build to efficiency and seconds to break, the lack of productivity and threat of inflation that follows could bring a different kind of stagflation to markets. All that brings out the economic data from last night and just ahead – with US CPI looking more important because of it all. The weakness in the Australian economy continues to show in business confidence, housing lending and in RBA speeches. The bounce back in UK data from a horrible December isn’t enough to matter to the bigger political clouds over Brexit. Economics don’t yet trump politics. The USD maybe the best example for measuring this all – even better than the noise of the GBP as markets could be fooled by the broken clock of Parliamentary votes and can-kicking decisions to latter down the road. The USD looks vulnerable to a larger downside test should inflation and politics allow more FOMC patience or less time for US/China deals.

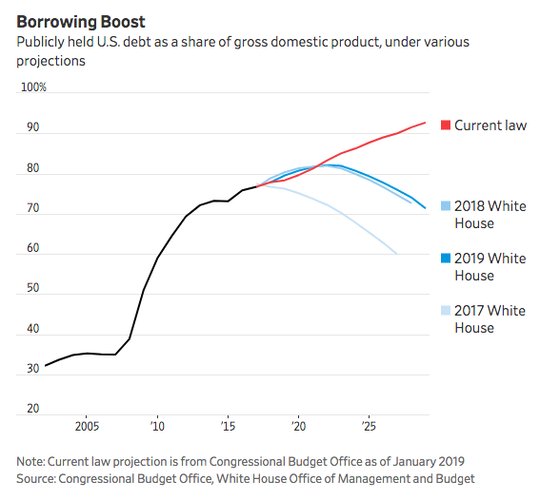

Question for the Day: Does the US budget matter to markets? The White House $4.7trn budget caught headlines yesterday but is seen by many as dead in the water and more a symbol of the broad divide between Trump and Congress. The focus of the market maybe more on the US deficit and US funding costs – given the auctions today and the risk mood in equities leaving bonds looking expensive.

The other part of the budget that catches attention for investors is the weaker revenue projections from the White House. Some of the larger deficit in the US is because of spending, but half is because revenues aren’t what they expected. The Trump team’s revisions from 2017 come to $2 trn. What really matters is the tipping point of confidence for debt where sustainability becomes unbelievable. That rests less on US politics and more on the comparison to alternatives abroad.

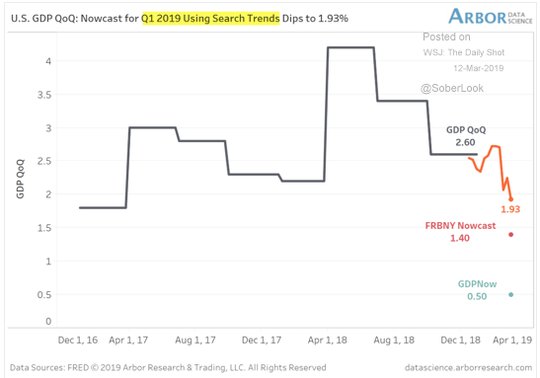

The impact of the deficit spending on growth is another part of the puzzle for investors with the retail sales yesterday not sufficient to spark hopes for 1Q growth being much different or to shift the outlook that 2% is the likely outcome for 2019 GDP.

What Happened?

- Australia February NAB business confidence drops to 2 from 4 – worse than the 3 expected – lowest in 3-years. Current conditions drop to 4 from 7 with declines in profitability and trading notable. Employment was steady at +5. Across industries retail remains the weakest by some margin – and the only sector to record negative conditions in trend terms. The weakness is broad-based across retail sub-industries, but weakest in car retailing and household goods.

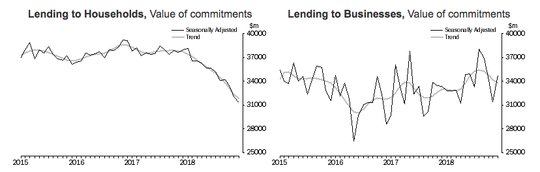

- Australia January home loans drop 2.4% m/m after revised 3.6% m/m drop – worse than the 1% m/m bounce expected– however, December revised higher from -6.1% m/m. The weakness followed new home lending -4.1% and owner-occupied -1.3%. The investment lending for housing fell 4.1% m/m after -4.4% m/m – slightly better than -5% expected. Lending for personal finance rose 1.2% m/m, but remains -16% y/y. Lending for business fell 1.3% but is up 2.5% y/y.

- RBA Debelle: Climate change is a trend not a cycle, economic models need to shift. The RBA deputy governor noted: The challenges we have to address are to take the outcomes from climate modeling and map them into our economic modeling. Similarly, the scenario analysis from climate models needs to be translated into the horizons of our economic models, taking account of price changes and how that affects decision-making. He also mentioned the shift to cleaner energy in China as an example of changing demand and shifting supplies for Australia.

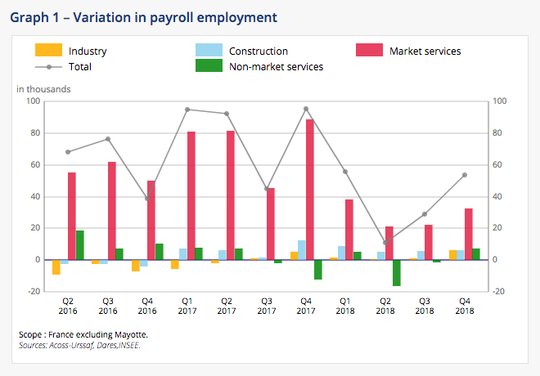

- French 4Q payrolls up 0.2% q/q after +0.1% q/q – as expected. The private payrolls rose 0.3% q/q after revised 0.2% - better than 0.1% q/q expected. 3Q revised higher from 0.1% q/q.

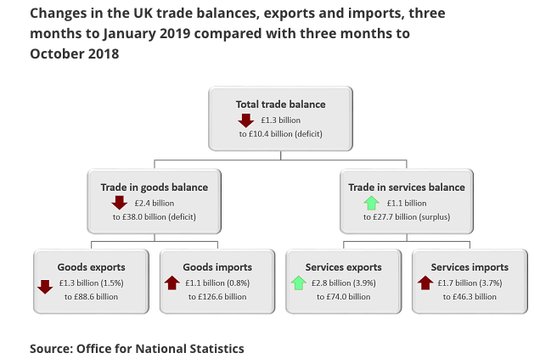

- UK January trade deficit GBP3.825bn after GBP3.448bn – more than GBP3.5bn expected. The trade in goods deficit was again partially offset by a surplus in services. Goods exports fell 1.5% q/q while imports were up 0.8% while service exports rose 3.9% q/q and imports rose 3.7%. Falling exports of cars and fuels, and rising car imports were the main reasons for the widening of the overall deficit. Looking at the last 3M, the trade in goods deficit widened GBP1.6bn in EU and GBP0.8bn in non-EU

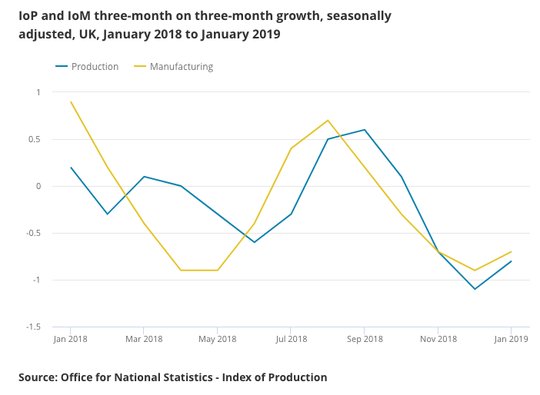

- UK January industrial production up 0.6% m/m after -0.5% m/m – better than +0.1% m/m expected. The manufacturing output rose 0.8% m/m after -0.7% m/m – also better than 0.2% expected – notably the first gain since June 2018. For manufacturing 8 of 13 subsectors rose with pharmaceuticals up 5.7% leading. Mining was up 0.8% m/m, while gas/electricity rose 0.3% m/m. In a separate report, the 4Q construction orders fell 10.5% y/y after -31.4% y/y but January construction output rose 1.8% y/y after -2.4% y/y.

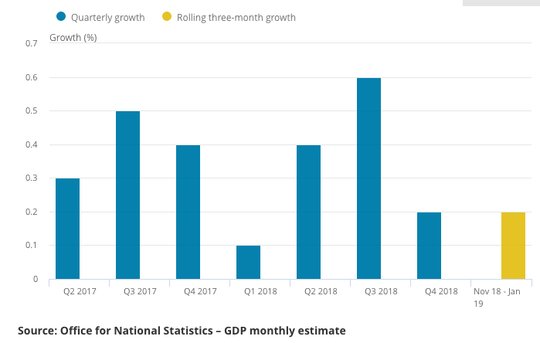

- UK January GDP up 0.5% m/m after -0.4% m/m – better than 0.2% m/m expected and lifts the y/y to 1.4% from 1.0% - better than the 1.2% y/y expected but the q/q remains flat at 0.2%. Services rose 0.5% in the last 3M while production fell and growth in construction recovered from December.

Market Recap:

Equities: The US S&P500 futures are up 0.15% after a 1.47% gain yesterday. The Stoxx Europe 600 is up 0.1% with focus on tech. MSCI Asia Pacific up 1.2% with tech bounce and US/China trade hopes.

- Japan Nikkei up 1.79% to 21,503.69

- Korea Kospi up 0.89% to 2,157.18

- Hong Kong Hang Seng up 1.46% to 28,920.87

- China Shanghai Composite up 1.10% to 3,060.31

- Australia ASX off 0.04% to 6,260.60

- India NSE50 up 1.19% to 11,301.20

- UK FTSE so far flat at 7,133

- German DAX so far up 0.15% to 11,560

- French CAC40 so far up 0.15% to 5,274

- Italian FTSE so far flat at 20,641

Fixed Income: More risk-on, more supply from the US, more spread narrowing between core and periphery in EU. Markets are relatively quiet waiting for more data, more news with Brexit key – German Bund 10-year yields up 2bps to 0.08%, French OATs up 2bps to 0.49%, UK Gilts up 4bps to 1.22% while Italy off 1bps to 2.55%, Greece off 8bps to 3.87%, Spain up 1bps to 1.18% and Portugal off 1bps to 1.31%.

- US Bonds are lower with focus on CPI and supply next– 2Y up 2bps to 2.49%, 5Y up 2bps to 2.46%, 10Y up 2bps to 2.66%, 30Y up 2bps to 3.06%

- Japan JGBs see curve steepening with focus on BOJ next– 2Y off 1bps to -0.15%, 5Y off 1bps to -0.16%, 10Y flat at -0.03%, 30Y up 2bps to 0.60%.

- Australian bonds mixed session with weaker data vs. global risk-on– 3Y up 1bps to 1.61%, 10Y up 1bps to 2.03%.

- China bonds lower with focus on PBOC/US talks– 2Y up 1bps to 2.79%, 5Y up 2bpst o 3.04%, 10Y up 1bps to 3.16%. The PBOC skipped open market operations for the 9th day.

Foreign Exchange: The US dollar index fell 0.15% to 97.10. In emerging markets, the USD is also weaker – EMEA: RUB up 0.15% to 65.785, ZAR up 0.3% to 14.282, TRY off 0.15% to 5.452; ASIA: INR up 0.4% to 69.555, KRW flat at 1130.80.

- EUR: 1.1270 up 0.2%.Range 1.1244-1.1285 with 1.12 holding and 1.13 back in play focus is on US CPI/Politics vs. UK Brexit.

- JPY: 111.35 up 0.15%.Range 111.16-111.47 with risk on mood key and 110-112 holding. EUR/JPY 125.45 up 0.3% - all about equities.

- GBP: 1.3155 up 0.1%.Range 1.3138-1.3288 with EUR/GP .8565 up 0.2% - touched .8475 lows. Focus is on UK Parliament vote on May’s Brexit plan with 1.33 and 1.36 back in play.

- AUD: .7075 up 0.1%.Range .7057-.7082 with NZD up 0.25% to .6845 with focus on weaker Australian data vs. China trade hopes.

- CAD: 1.3400 flat. Range 1.3385-1.3407 with focus on trade, rates and 1.3380 base holding – oil back as a driver?

- CHF: 1.0090 off 0.15%.Range 1.0078-1.0112 with 1.0080 still pivot for either 1.00 or 1.02. EUR/CHF 1.1370 flat with focus on Brexit.

- CNY: 6.7100 off 0.15%.Range 6.7050-6.7260 with focus on a weak export report and US/China talks.

Commodities: Oil up, Gold up, Copper up 0.8% to $2.9425.

- Oil: $57.34 up 1%.Range $56.74-$47.46 with equities and OPEC key focus. WTI $58 resistance in play today with API later. Brent up 1.05% to $67.38 with $68 resistance same.

- Gold: $1296.90 up 0.45%.Range $1291-$1297.90 with focus on $1305 next as USD and policy doubts remain in play. Silver up 1.05% to $15.44 with $15.50 key. Platinum $831.70 up 1.8% and Palladium $1502.40 up 1.4%.

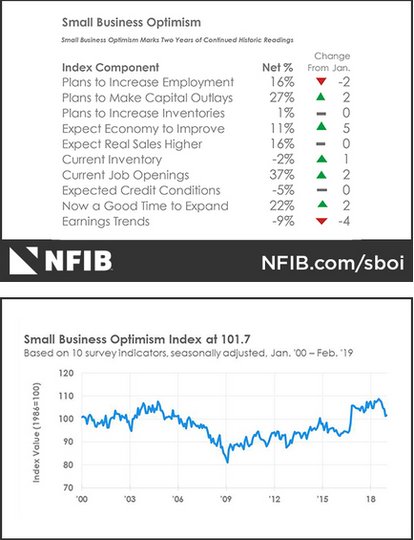

Conclusions: Politics matter? The expectation that confidence will follow markets remains in play but the evidence isn’t so clear yet and this leaves politics in the US and elsewhere as the growing driver for uncertainty. The US February small business NFIB index rose to 101.7 from 101.2 but that misses expectations for a larger 103 bounce. “Small business owners are thankful to have the government shutdown in the rear view mirror but need more certainty about the future,” said NFIB President and CEO Juanita D. Duggan. “Small businesses put their money where their expectations are as we’ve seen when they get tax and regulatory relief. The best thing Washington can do for the small business half of the economy is to continue the policies – tax cuts and deregulation – that leave them with more resources to invest and find qualified workers.”

Economic Calendar:

- 0800 am India Jan industrial production (y/y) 2.4%p 2%e / manufacturing 2.7%p 1.3%e

- 0800 am India Feb Inflation rate (y/y) 2.05%p 2.43%e

- 0830 am US Feb CPI (m/m) 0%p 0.2%e / core 0.2%p 0.2%e (y/y) 2.2%p 2.2%e

- 0845 am Fed Gov Brainard speech

- 0100 pm US 10Y Note Sale

- 0430 pm US weekly API oil inventory 7.29mb p 1.0mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.