Key Events In Developed Markets Next Week - Saturday, Jan. 6

In the US, the main data highlight next week will be the release of the CPI report, which should show a soft print for the month, given falling gasoline prices and more benign housing rent data. Over in the UK, all eyes will be on the November GDP figures, where we're forecasting a modest rebound following the weakness seen in October.

Image Source: Shutterstock

US: CPI Report Expected to Show a Soft Print This Month

The data highlight in the US will be consumer price inflation. The Federal Reserve certainly appears to be more relaxed about the inflation backdrop, with the minutes of the December FOMC meeting acknowledging that upside risks had “diminished,” and this improved situation being cited as the main factor behind officials predicting a lower path for the Fed funds rate in 2024 than previously thought.

The core PCE deflator has been showing more benign month-on-month readings than CPI over the past six months, but we think the CPI report will also show a soft print this month, given falling gasoline prices and more benign housing rent data.

Core CPI is set to break below 4% year-on-year for the first time since May 2021, and this will give the Federal Reserve added confidence that inflation is on the path to sustainably reaching the 2% target by mid-2024.

UK: Monthly GDP Set For Modest Rebound after October’s Weakness

The level of UK activity contracted in October, according to the most recent monthly GDP figures, and a large part of that was down to an unusually large dip in manufacturing activity. The truth is that these figures are becoming increasingly unhelpful for judging the state of the UK economy, and assuming most of the factors behind October’s dip were temporary, we’d expect a bit of a bounce back in the November figures due next week.

Whether or not that happens will largely dictate whether the UK economy enters a “technical” recession, following a very slight fall in overall third-quarter GDP following recent revisions to the data. The reality is that a couple of quarters of -0.1% growth, if it happens, is not much to write home about.

While the jobs market is cooling, so far there aren’t the widespread signs of job losses that are more typically associated with recessionary periods. For now, we think the UK economy will flatline through the first half of this year as positive real wage growth is offset by the ongoing pass-through of higher interest rates.

The Bank of England is still more heavily focused on the inflation numbers – and with both wage growth and services inflation likely to stay sticky in the near-term, the market may be getting ahead of itself in pricing a May rate cut. A lot will depend on the next couple of inflation and jobs reports, but for now, we’re sticking to our call of an August rate cut with 100 bp of easing in the second half of 2024.

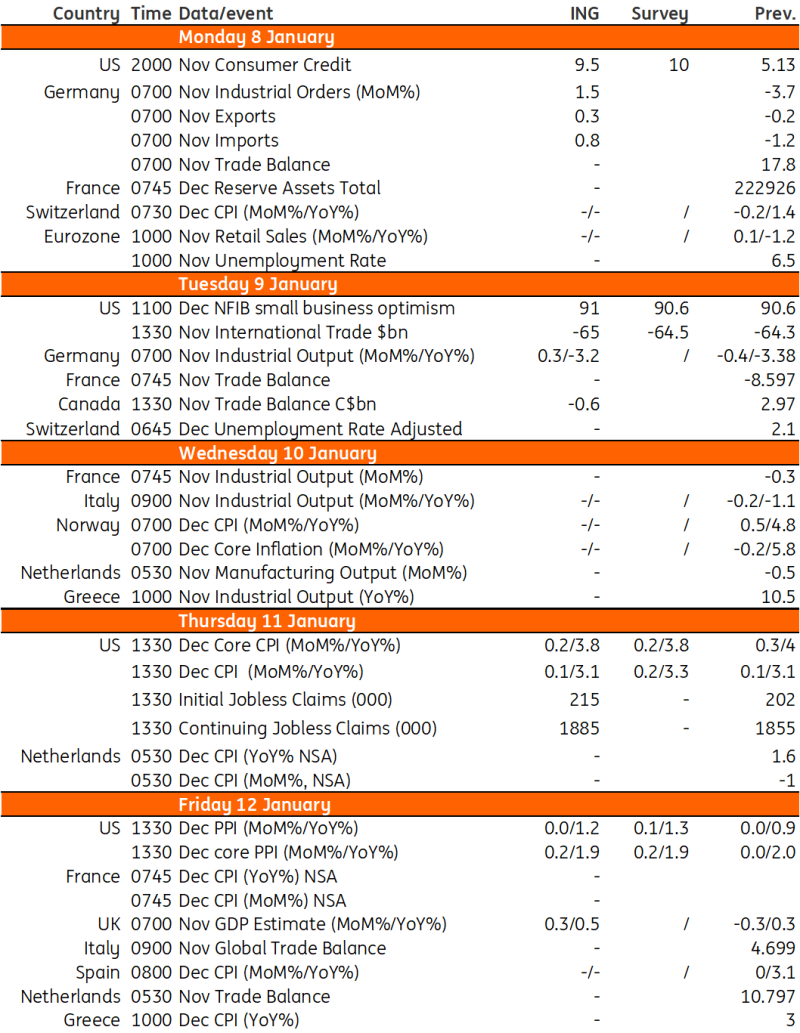

Key Events in Developed Markets Next Week

(Click on image to enlarge)

Image Source: Refinitiv, ING

More By This Author:

Key Events In EMEA Next Week Starting Monday, January 8

U.S. Jobs Report Suggests No Pressing Need For The Fed To Cut Rates

Italian Inflation Only Slightly Down In December

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more