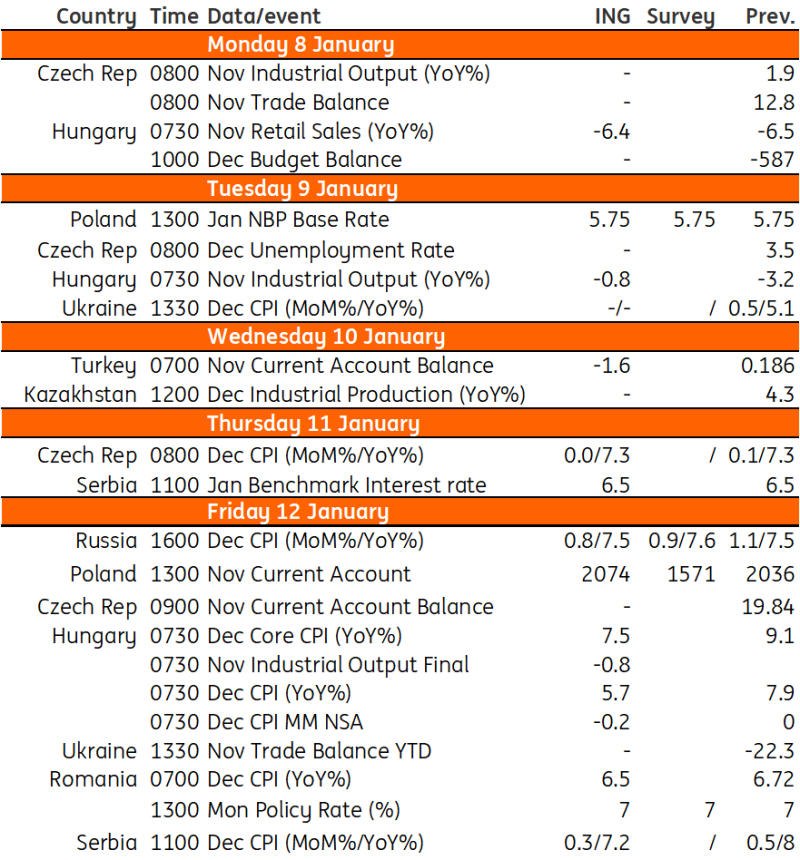

Key Events In EMEA Next Week Starting Monday, January 8

Image Source: Pixabay

Next week's focus will be on Poland's first MPC decision of this year, where we expect rates to remain unchanged as the council awaits more information on inflation developments. Elsewhere, we estimate that prices will remain unchanged in the Czech Republic, translating into a stable inflation figure of 7.3% YoY.

Poland: Rates to remain unchanged

Current account (Nov): €2074mn

We expect yet another hefty surplus on the current account balance in November on the back of sizeable surpluses on goods and services trade balances still being supported by lower prices of energy imports. According to our estimates, exports fell by 1.6% year-on-year, while imports shrank by 9.6% YoY compared with +1.6% YoY and -8.4% YoY respectively in October. In such a scenario, the 12-month rolling current account surplus should improve to 1.5% of GDP from 1.1% after October.

NBP rate (Jan): 5.75% (unchanged)

The first MPC policy sitting this year will be a non-event, as rate setters are widely expected not to make any policy decisions in January. The National Bank of Poland (NBP) rates will remain unchanged (with the main policy rate still at 5.75%) as the Council awaits more information about inflation developments. On the one hand, the short-term inflation outlook looks more favourable than projected in the November NBP staff scenario as authorities have extended measures “freezing” electricity and gas prices for households until mid-2024. On the other, the 2024 draft budget prepared by the new ruling coalition envisages an even higher fiscal gap and borrowing needs than the already record-high imbalance proposed by the former Morawiecki government in September. We expect the MPC to stick to wait-and-see approach until at least March, when the new macroeconomic projections will be prepared.

Czech Republic: Last big inflation number

We estimate that prices remained unchanged in December, which translates into a stable inflation figure of 7.3% YoY, the same as in November. We see core inflation falling further from 3.9% to 3.7% YoY. The main upward drivers here are food prices. Otherwise, other items are stable or falling. Fuel prices in particular fell massively in December, where the drop in oil prices has been most pronounced. The risk here is housing prices, including energy prices, which showed a surprise increase in November. In January, the comparative base from last year and the much smaller month-on-month growth compared to last January should come into play. For now, we estimate 2.8% YoY, but we will see more after the December number.

Key events in EMEA next week

Refinitiv, ING

More By This Author:

U.S. Jobs Report Suggests No Pressing Need For The Fed To Cut RatesItalian Inflation Only Slightly Down In December

Eurozone Inflation Increased Less Than Expected In December

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more