Key Events In Developed Markets And EMEA For The Week Of October 9

Image Source: Unsplash

We expect to see increases in both PPI and CPI in the US next week, while in the UK, GDP data is unlikely to sway the Bank of England's November decision. All eyes will be on key data releases in the Czech Republic, which we're expecting will support our forecast of a November rate cut. In Hungary, core inflation is expected to continue its trend-like decline

US: Expected rise in both PPI and CPI

It has been a volatile couple of weeks for US markets as the higher-for-longer interest rate narrative from the Federal Reserve gained increased traction. Yields have spiked higher, helping to push the dollar stronger, while equity markets have come under more pressure. A holiday-shortened week may bring a little calm, but it won’t last long given the release of PPI and CPI data on Wednesday and Thursday.

Energy prices rose through the month as oil prices spiked higher, while higher food commodity prices are also likely to contribute to a fairly chunky 0.4% month-on-month increase in headline prices. Core rates should be more moderate, with slowing rents potentially having more of a cooling influence. Nonetheless, we still see the risk of a 0.3% MoM core CPI number, which will keep the more hawkish FOMC vocal on the prospect of another rate rise in either November or December.

UK: GDP unlikely to sway BoE on November decision

There are a couple of reasons why next week’s UK GDP data for August is unlikely to make much of a difference to the Bank of England’s November meeting. The first is that it has been unhelpfully volatile recently, and it seems that’s not totally (or even partially) related to the extra bank holiday in May. An unusual surge in manufacturing in June was partially reversed in July, while we’ve seen the mounting impact of strikes on the numbers too. But that’s not the full story, and we saw a broad-based decline in service-sector activity in the first part of the third quarter.

We expect a very slight rebound in GDP next week, but our confidence in these numbers is low. Our best guess is that when you add in August and September, we’ll get see overall quarterly GDP fall by 0.2%. But even aside from the volatility, the Bank of England is just not that focused on activity anyway, and by its own admission is looking at services inflation, private-sector wage growth, and the vacancy-to-unemployment ratio as a guide for policy. All three of those indicators will be released on 17-18 October. Barring any big upside surprises there, we think the Bank will be content with keeping rates on hold again in November.

Czech Republic: Another decline in headline and core inflation

We expect consumer prices to fall 0.4% MoM in September for the first time since April, which translates to 7.2% YoY. The drag down should be food and energy prices and the seasonal downward movement in recreation prices. On the upside, fuel, education and clothing prices are pushing up. In our view, the downside risk is energy prices given that many energy companies are announcing significant price cuts for consumers for September and October. However, it is not always clear what proportion of consumers will be affected by the change, which may be reflected in the CPI. The Czech National Bank expects 7.2% YoY for September, in line with our estimate. Core inflation should remain below the central bank's forecast and approach 5%. Thus, the September numbers should support our forecast for the first rate cut in November.

Hungary: Core inflation expected to continue its trend-like decline

In Hungary, we will see some data on the external and internal balance in a frontloaded but rather light calendar. On Monday, we expect the trade balance to remain in surplus but with a slight deterioration due to rising energy prices. The September budget balance will bring us another monthly deficit. However, given that the government has just raised this year's deficit target from 3.9% to 5.2% of GDP, continued fiscal weakness shouldn't surprise anyone.

Tuesday will be the highlight of the week with the latest inflation print. This time, we see another big reduction in the general price pressure. The headline figure for September will fall by 4 percentage points on the back of an energy-related base effect, while the monthly repricing will be quite strong mainly due to fuel prices. Core inflation will also continue its trend-like decline.

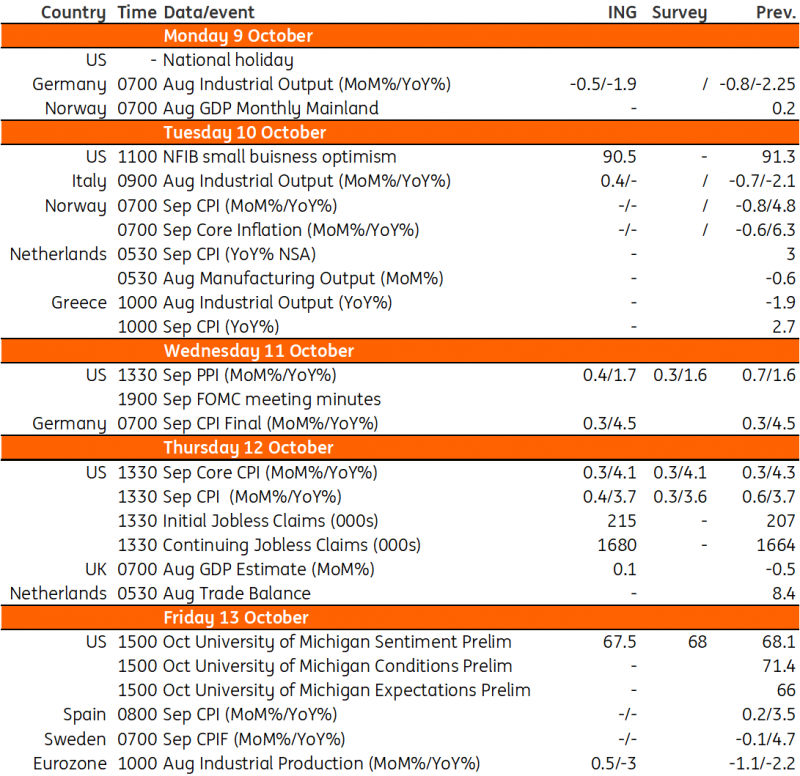

Key events in developed markets next week

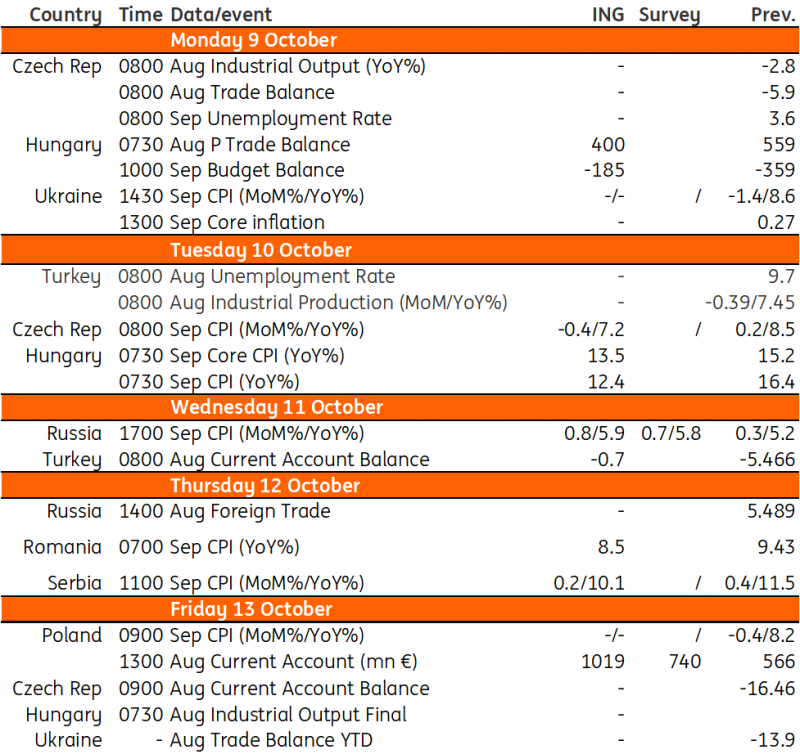

Key events in EMEA next week

Refinitiv, ING

More By This Author:

Why Oil Prices Will Stay High And Add To Stagflation RiskBlowout US Jobs Report Puts 5% 10Y Yields In Sight

Asia Week Ahead: Regional Inflation Readings And An MAS Decision

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more