Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up, the more “they” say it’s nothing just transitory roughness.

Globally synchronized growth is dead, that much is for certain. There wasn’t much decoupling anywhere in between. In between what? This is how it always goes, each and every time.

From 2003 to 2009, it went: globally synchronized growth, decoupling, globally synchronized downturn. From 2010 to 2012, it went: globally synchronized growth, decoupling, globally synchronized downturn. From 2013 to 2016, it went: strong global growth (not synchronized), decoupling, synchronized downturn.

Last year to this year, it has gone: globally synchronized growth, decoupling. What comes next?

They would also like you to believe that what does come next is some way distant, small probability fuzzy concept. These slightly less optimistic risks proliferating across key markets is an annoyance, nothing more. A recession maybe kinda in 2021 or 2041, an old business cycle losing some of its momentum. QE is that important.

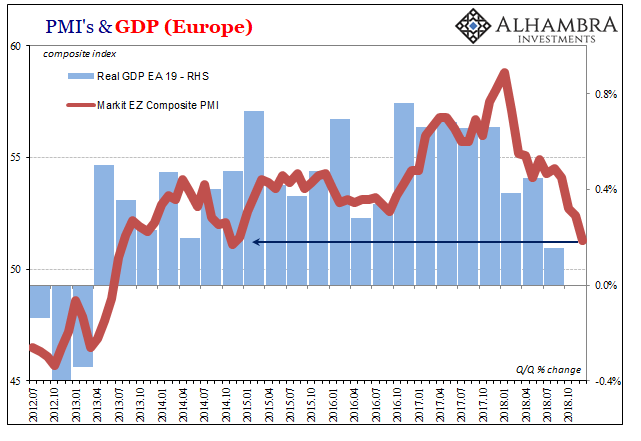

Markit’s Composite PMI for the Eurozone suggests more imminent prospects, the lowest in 49 months, more than four years says so; as does the very clear trajectory.

But that’s just Italy and France, the places we see on the news screwing up the otherwise rocking good times everywhere else. What was Germany’s composite? Slightly better, actually, it was the lowest in 48 months. Though at 52.2 it has largely confirmed the country’s negative Q3 GDP may not have been the temporary imposition of emissions and drought, after all.

If these balanced risks balancing otherwise was strictly a European rebalancing there would still be references to decoupling. There aren’t because it hasn’t ever happened. The US boom isn’t much talked about of late for the same reasons as the ECB’s yesterday spectacle.

The US Composite PMI has now unwound what was left of hysteria – the often purposefully over-hyping of generally unconvincing improvement. It may be this is where the tax cuts went because they sure didn’t end up in US consumer spending. Either way, the composite leaked again lower in December to the worst since before hurricane Harvey.

The US economy isn’t going its own way, it is already faced in the same direction as everyone else if only a few steps behind. That’s all decoupling would turn out to be each time it was meekly offered prior.

Ultimately, this is pretty much the only use for PMI’s; forget the 50 growth versus contraction dividing line. They can tell us when things have changed in a general sense if not usually in that specific fashion. Europe’s composite PMI may very well never stray into the ’40s, yet real GDP could turn out negative anyway. Momentum hasn’t been lost in Europe or the US, it’s just become negative momentum.

The eye-catching descent from last year is enough, which continued full-on in December. The kiss of death, this new Draghi balance.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more

Global synchronized growth is dead so it makes sense when it died global synchronized decline has replaced it. This is why governments should not try to run the economy too much. They do a terrible job of it.