Thursday, October 6, 2022 5:59 PM EST

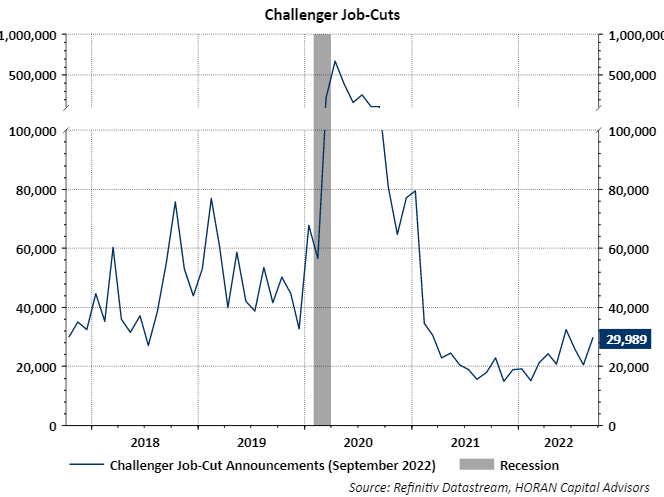

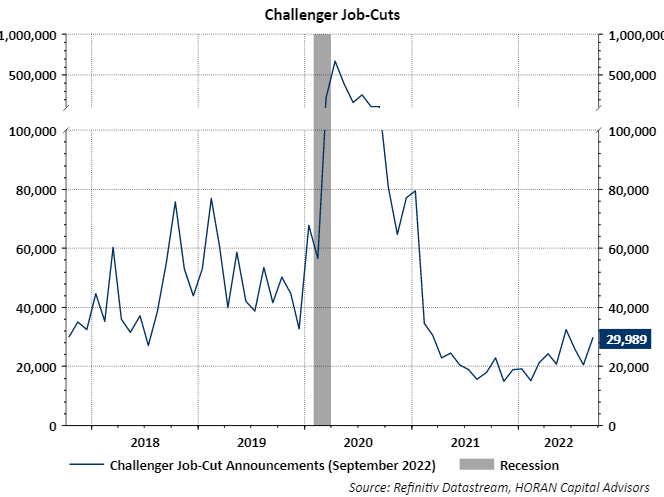

Employment data released today gives some indication the job market is weakening. The Challenger Layoff report for September shows job cuts increased 46% month over month and 68% year over year. Although the report notes the nine-month total for job cuts is lower than the same nine-month period in 2021, the third quarter job-cut total of 76,284 is 45% higher than the third quarter of 2021 when employers planned to cut 52,560 jobs. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc., said, “Some cracks are beginning to appear in the labor market. Hiring is slowing and downsizing events are beginning to occur,”

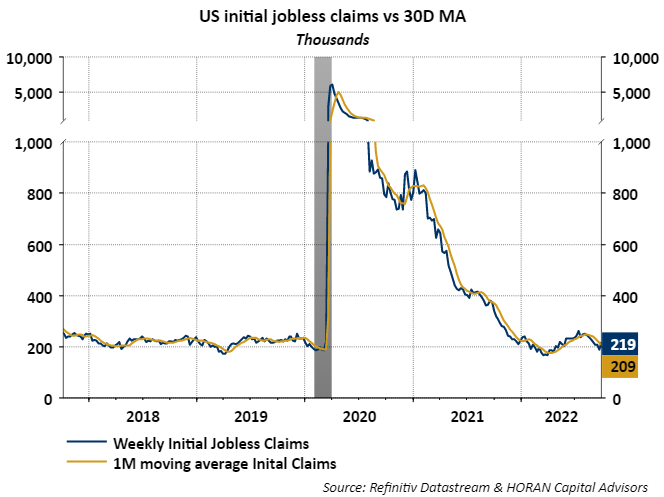

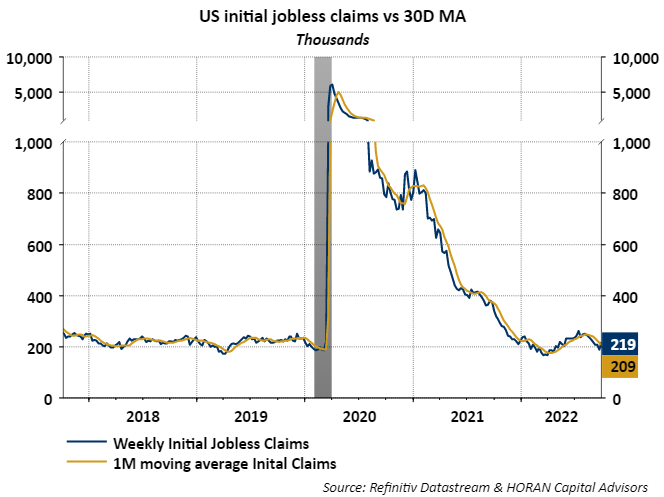

Weekly initial jobless claims exceeded expectations of 203,000 and rose to 219,000 compared to a lower revised 190,000 in the prior week. With today's report the number of jobless claims again rose above the one-month average of 209,000.

Today's employment data, along with the Job Openings and Labor Turnover survey I wrote about yesterday, provide some indication the job market may be softening. This is the type of data that would give the Fed justification for slowing the pace of rate increases. As I noted in yesterday's post, the magnitude of the rate increases this cycle are far greater than prior Fed tightening cycles. It seems the Fed should see if the tightening to date is resulting in bringing inflation down via a weakening consumer.

More By This Author:

Equity Market Testing June Low

An Economic And Market Environment Difficult To Evaluate

Market Turns Lower On Fed Comments

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a solicitation to the purchase or the sale of any security or investment of any kind.

The Content of This Article Is for Informational Purposes Only. The Blog of Horan Capital Advisors and Horan Capital Advisors (HCA) Disclaim Responsibility for Updating Information on This Article. In Addition, the Blog of Horan Capital Advisors and HCA disclaim Any Responsibility for Third-party Content, Including Information Accessed Through Hyperlinks. All Individuals Are Advised to Conduct Their Own Independent Research Before Making Any Investment Decision. Past Performance Is Not Indicative of Future Results.

HORAN Capital Advisors, LLC is an SEC registered investment advisor. The information herein has been obtained from sources believed to be reliable but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to provide and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

less

How did you like this article? Let us know so we can better customize your reading experience.