January Inflation

Year-on-year headline and core inflation both down, but both slightly above consensus (with headline at 6.4% vs. 6.2% Bloomberg consensus). (Month-on-month both at consensus, given rounding). Other measures provide ambiguous signals.

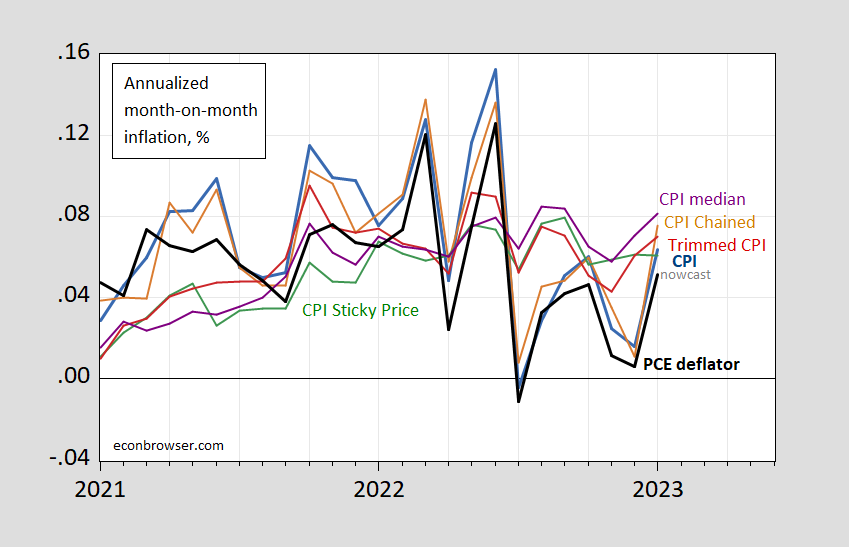

First, we have various measures of overall CPI at m/m changes.

(Click on image to enlarge)

Figure 1: Month-on-month inflation of CPI (blue), chained CPI (brown), 16% trimmed CPI inflation (red), sticky price CPI inflation (green), personal consumption expenditure deflator inflation (black), all in decimal form (i.e., 0.05 means 5%).January PCE deflator is Cleveland Fed nowcast of 2/14. Chained CPI seasonally adjusted log levels X-13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Atlanta Fed, Cleveland Fed, and author’s calculations.

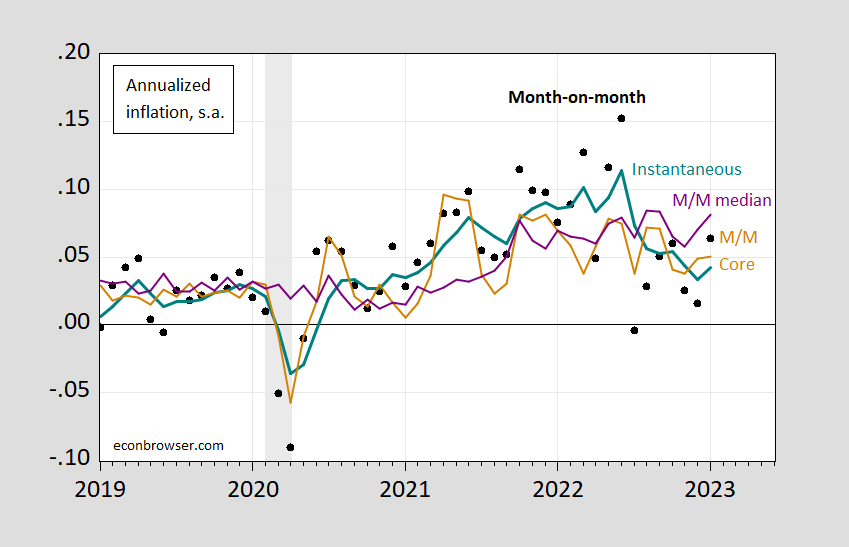

All month-on-month measures save sticky price CPI inflation rise in January. However, we know that month-on-month changes, while providing a more contemporaneous reading on inflation, have a larger noise component. Hence, I plot in Figure 2 m/m versus median, core and instantaneous (per Eeckhout) inflation (t=12, a=4).

(Click on image to enlarge)

Figure 2: Month-on-month CPI (black circle), and instantaneous inflation (τ=12, a=4) (bold teal), month-on-month median inflation (purple), month-on-month core CPI inflation (tan), all at annual rates. NBER peak-to-trough defined recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Instantaneous (τ=12, a=4) inflation is up to 4.4% from 3.4% in December (using CPI revised up through December, incorporating new seasonals), but is still far less than 11.4% in June 2022. (For additional discussion of instantaneous inflation, see this post.)

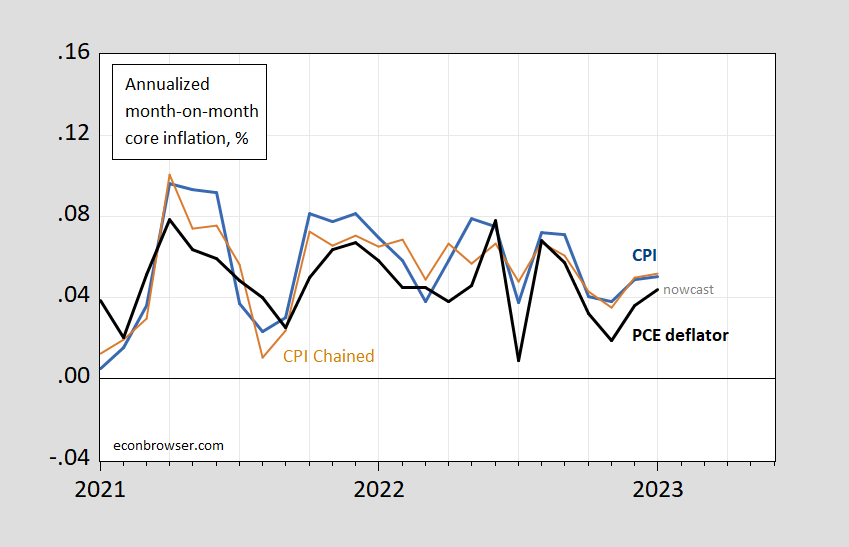

Second, core inflation measures have stabilized at the m/m horizon (and continue to descend at y/y).

(Click on image to enlarge)

Figure 3: Month-on-month CPI core inflation (blue), chained CPI core (brown), personal consumption expenditure core deflator inflation (black), all in decimal form (i.e., 0.05 means 5%).January PCE deflator is Cleveland Fed nowcast of 2/14. Chained CPI seasonally adjusted log level using X-13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Atlanta Fed, Cleveland Fed, and author’s calculations.

Fed funds (CME) futures imply no change to rates at the March 22 meeting, but slightly higher for May and June.

More By This Author:

Forecasters Up Projections Of GDP, Employment

Sentiment And Misery (And Maybe Partisanship)

Cumulative NFP Job Creation In First Four Years, By President