“It Was The ‘Meh’ Of Times. It Was The Worst Of Times…”

Conference Board is on the former, while the U. Michigan sides with the latter.

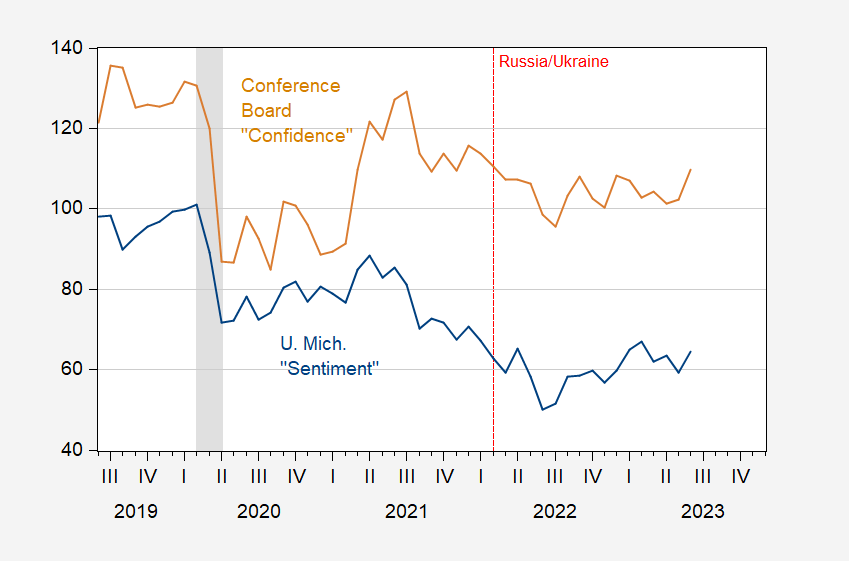

Figure 1: University of Michigan Sentiment Index (blue), and Conference Board Confidence Index (tan). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, Conference Board via investing.com, and NBER.

According to the Michigan index, sentiment is even lower than during the depths of the pandemic. The Conference Board index indicates confidence at levels seen at the beginning of 2021, and definitely above pandemic levels (110 in June, vs sample average of 94). Why the difference? A hint is provided by looking at the long time series of both indices.

Figure 2: University of Michigan Sentiment Index (blue), and Conference Board Confidence Index (tan). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, Conference Board via investing.com, and NBER.

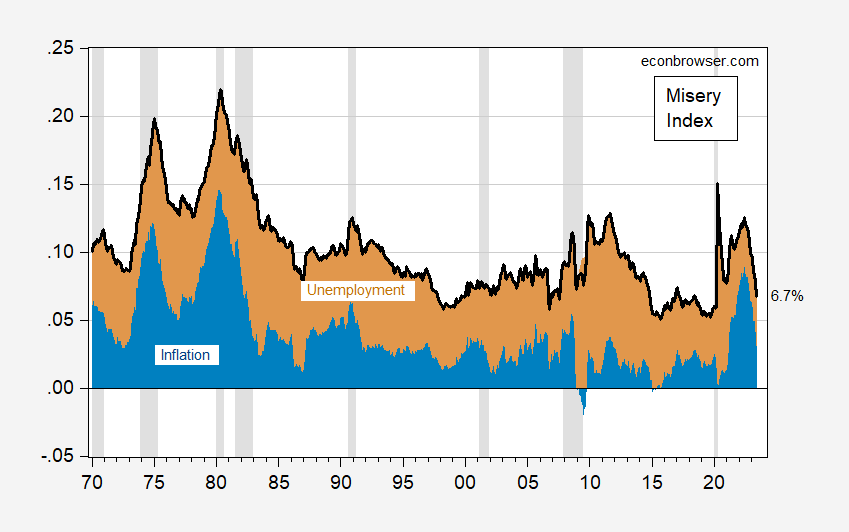

Folk wisdom as conveyed by Investopedia notes the higher linkage of the Conference Board index with employment and the Michigan index with pocketbook issues (cost of living). This means that the two will not covary with the Misery Index the same way (see investigation of the correlation between Misery Index and Michigan sentiment in this post). Consider the components of the Misery Index in the unweighted version, shown below:

Figure 3: Misery Index (bold black line), share due to y/y CPI inflation (blue bar), due to unemployment (tan bar). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

For the Michigan sentiment index, the regression results one obtains for 1970-2023M06 is:

UMCSENT = -0.415u – 0.479π

Standardized (“beta”) coefficients. Adj-R2 = 0.41, SER = 10.07, DW = 0.16, Nobs = 576, sample 1970M01-2023M06. Bold denotes significance at 10% msl, using HAC robust standard errors.

For the Conference Board confidence index, the regression results are:

CONFIDENCE = -0.725u – 0.095π

Standardized (“beta”) coefficients. Adj-R2 = 0.54, SER = 16.04, DW = 0.19, Nobs = 642, sample 1970M01-2023M06. Bold denotes significance at 10% msl, using HAC robust standard errors.

One can’t compare “beta” coefficients across regressions, but one can within regressions. The estimates confirm that for the Michigan index, unemployment and inflation enter about equally. For the Conference Board measure, unemployment is the key issue.

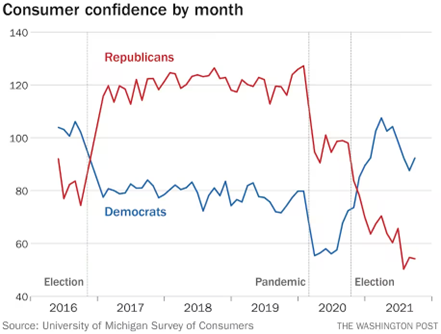

Notice that I have treated the data as if there is an average sentiment value. I do wonder (w/o knowing the distribution of responses) if there is actually one average value; this graph from Bump (WaPo, December 2021) illustrates this point.

Source: Bump,”The inescapable partisanship of how people view the economy,” Washington Post, December 15, 2021.

It would be interesting to see how the disaggregated sentiment indices comoved with the Misery Index (in other words, who was detached from reality), but I don’t have the data readily accessible. Mian (REStat, 2023) shows that these partisan-biased expectations affect economic decisions, like consumption. He also documents that these effects have been increasing over time.

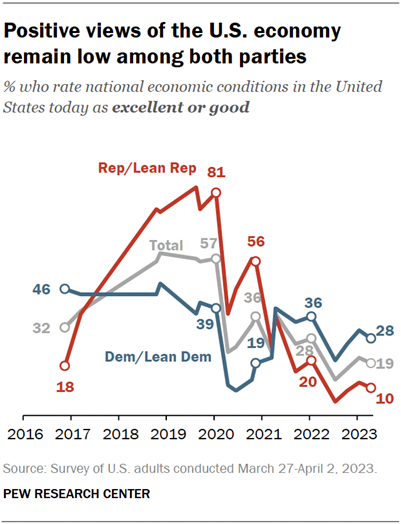

Interestingly, looking at overall economic optimism over the last seven years, it appears that Republicans/Lean Republican respondents have exhibit wilder swings than Democrats/Lean Democrat.

Source: Pew Research Center, April 7, 2023.

Republican/Lean Republican views on the economy range over 71 ppts, while those of Democrat/Lean Democratic range over 36 ppts, peaking in 2019. So while there is a partisan divide, at first glance it appears to me Republican/Lean Republican swing more wildly. If indeed behavior is driven by in part sentiment, then the average index might not appropriate for gauging the effect on the economy.

More By This Author:

PPI Inflation Down In JuneInflation And Core Inflation At Various Horizons

More On NFP Employment Overestimation