Is The Weak Stock Market Predicting A New Recession?

“The Dow has grown increasingly volatile in the past year, swinging more than 1,000 points on five days in 2018 -- something that's happened only eight times in the history of the exchange. The Dow closed down 8.7% for all of December, the worst record for the month since 1931, when Herbert Hoover was president. In one seven-day stretch, it fell by 350 points or more six times.” (Jeremy Diamond and Lydia DePillis, Trump downplays stock market swings amid growing economic anxiety, CNN, Jan 3, 2019)

President Donald Trump has downplayed last month's stock market rout -- a dive that led to the worst December since the Great Depression -- as a "little glitch."

The US Fed has been hiking interest rates, mortgage rates have been increasing, house construction is slowing, and the American economic recovery is over nine years old.

The stock market has been in a down phase for more than a year now, and volatility has increased over the past three months. Even though unemployment is at its lowest level in 50 years it is quite understandable that many are worried that the market collapse is predicting a new recession.

Those who support the predictive value of the stock market for the economy argue that since the stock market is forward-looking, current equity prices reflect expected future earnings and profits. Since corporate profits are directly linked to the business cycle, fluctuations in stock prices are thought to lead the direction of the economy.

When the economy is expected to slip into a recession, for example, the stock market will anticipate this by bidding down the prices of stocks. A second and related strand of this argument is that when the stock market is declining, investors are suddenly less wealthy and will spend less. In turn, this will slow the economy down and possibly throw it into a recession.

Nonetheless, on a historical basis it is not unusual for investors to get spooked about the economic outlook, and even though the market declines, nothing too bad may materialize.

As Paul Samuelson observed in a famous Newsweek article in the 1960s “the stock market has predicted nine of the past five recessions.” Indeed, it is entirely possible that the recent collapse in equity prices is nothing more than a normal market correction in the wake of an extremely strong financial recovery.

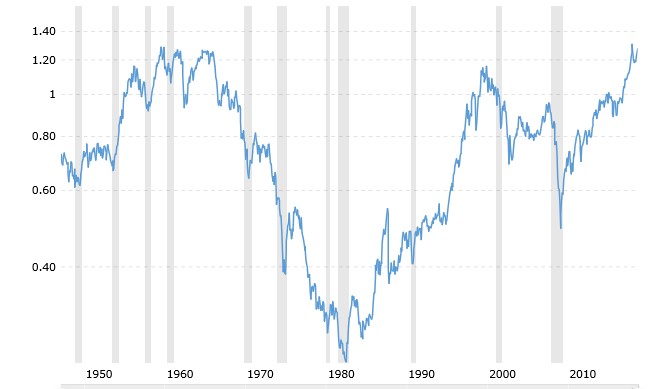

The following chart traces the ratio of the Dow Jones Industrial Average to U.S. GDP since 1948. The chart strongly underscores that equity prices have increased faster than the US economy since 2008.

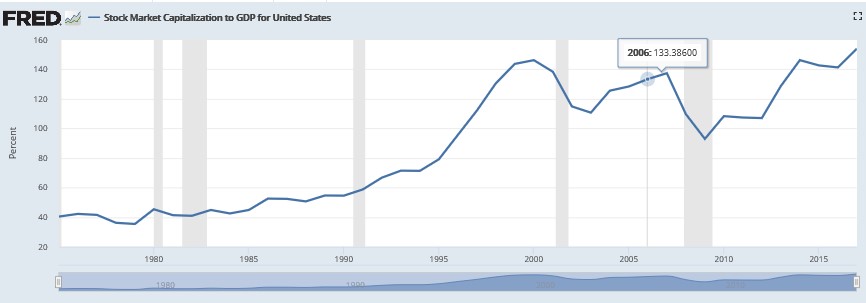

The stock market capitalization to GDP ratio concept is another measure often used to determine whether the overall market is undervalued or overvalued compared to a historical average.

The numerator is the total value of all publicly traded stocks, while the denominator is nominal GDP. This indicator gained notoriety when Warren Buffett commented that it was "probably the best single measure of where valuations stand at any given moment."

In 2000, according to statistics from The World Bank, the market cap to GDP ratio for the US was 153%, a sign of an overvalued market. And of course, US equity markets then fell sharply after the dot.com bubble burst.

It is obviously alarming that the ratio may be even higher today than in 2000.

Ratio Of The Dow Jones Average To US GDP

Stock Market Capitalization To US GDP

(Click on image to enlarge)

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!