Is The S&P 500 The Right Portfolio For You?

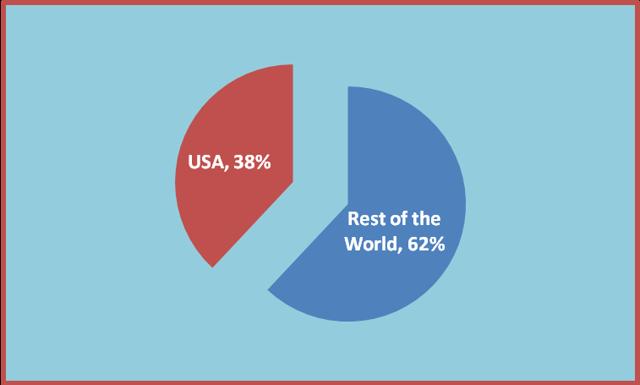

The USA is the world’s biggest free-market economy. Over many years, the value of all stocks traded on US stock markets (as judged by market cap) have traditionally fluctuated between 33% and 43% of all publicly-traded issues worldwide. Not only that, in terms of the quality of the regulatory environment, the US is among the nations where we can most trust the reported revenues and various filings. (Earnings, which are regrettably the most reported upon numbers released to the public, can however be manipulated in any number of ways, no matter where the company is domiciled!) Taking the mid-point of that range US markets look like this…

In bear markets, history shows that very few investors elect to stick with their index funds. But in bull markets, there is a preponderance of advice given that individual investors and active managers cannot keep pace with simply buying the lowest-cost passive index fund that mimics one index. Many investors have short memories and forget the carnage of previous bear markets (like March 2000 - March 2003 and October 2007 – March 2009.)

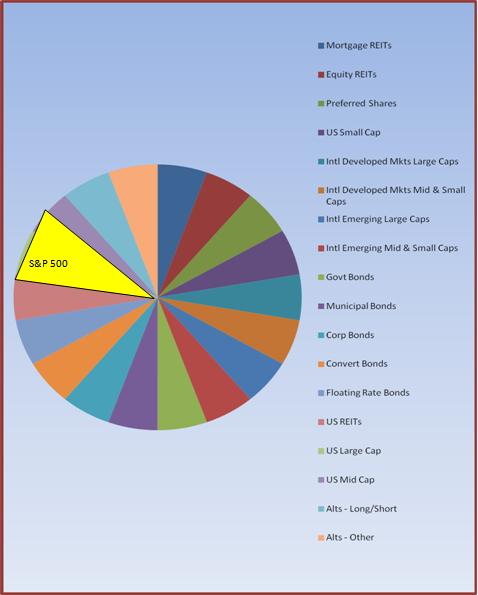

As a result, many of us are quick to jump on the index bandwagon. The index most often employed is, I believe, the most appropriate one if investors are inclined to hand responsibility to one index: the most popular index is the SPX, the S&P 500 Index. It should be. The S&P 500 Index consists of all the large cap stocks, some mid cap stocks and a few REITs; in the aggregate, it is a fine cross-representation of America’s biggest and best (or, since we are talking market capitalization rather than corporate assets, revenues, etc., it is comprised more accurately of the “most popular”) companies.

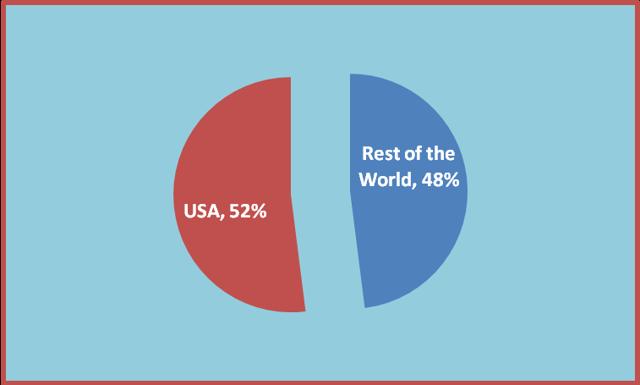

So popular have US equities become, in fact, and so disrespected are equities in the rest of the world right now that, according to the latest numbers from S&P (specifically, us. spindices.com) US markets now comprise 52% of total global markets!

Some may read this chart and say, “Go USA! We’re #1!” I look at it and wonder, given that this is a position beyond what it has typically been, if there might be a reversion to the mean. That doesn’t mean US stocks will have to fall. It might be just as likely that foreign stocks will rise. In either case, it is the biggest reason why we are diversifying our holdings at this point to include more foreign-based multinationals.

I certainly haven’t given up on US securities. Indeed, the biggest single position in my family accounts and many client accounts (as well as in our sample portfolio for Investor’s Edge ® subscribers) is the Gotham Index Plus Fund (GINDX). I wrote about it here in the process of discovering the way to publish a “secret” article on Seeking Alpha. If you ever want to write an article that no one will read, just select the “Mutual Fund” category during your submission! I usually get a couple thousand page views and a half-dozen comments on even my most obscure articles but by writing about a mutual fund I ensured that no one would read it and only one person would comment on it.

It seems the current popular opinion makes discussions of mutual funds moot: “Mutual funds bad. ETFs good! Active management bad. Passive good! Lowest expense ratio (even if total return is not as good) totally excellent. Higher expense (even if after-expenses total return is better) bad, bad, very bad!”

The interesting thing is that GINDX is an index fund, albeit one with a twist. Its foundation is a straight S&P 500 index fund. It is also a 130/30 fund, or in this case, 190/90, co-managed by value investors Joel Greenblatt, author of The Little Book That Beats the Market, and his partner and Co-Chief investment Officer, Robert Goldstein. [A caveat: this fund has a $250,000 minimum investment, but many online brokerage firms have negotiated a much lower entry price, like $5000.]

I own a number of US stocks, ETFs, mutual funds and CEFs and always will. But for me the mix is changing in two ways. Here’s why I believe a straight S&P 500 fund is simply not the way to create an all-seasons, best performing portfolio: all markets revert to the mean (RTM). (For those inclined to pillory me for trying to protect client and reader portfolios from a possible decline, please remember that RTM is classic Jack Bogle! If you have 20 or 30 years until you need to tap your portfolio then RTM, even if it leaves your mouth dry and your heart beating loudly as it traces its bottom, will ultimately trace higher above the mean as well.)

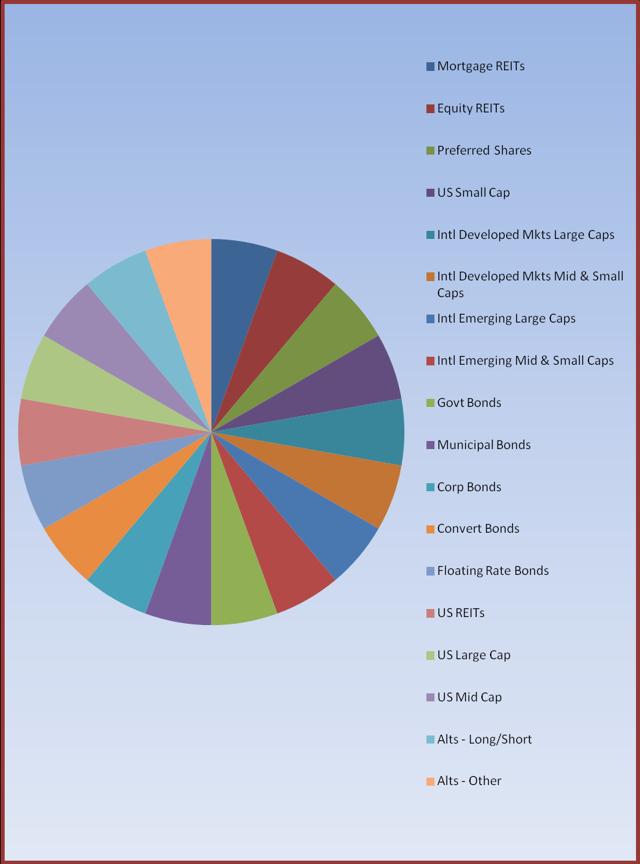

However, I don’t personally want to own only one asset class – US stocks – even if they are divided into the subsets of US large cap, some US midcap and a few US REITs. Here are the asset classes I consider investing in:

And here, highlighted in yellow, are the asset classes the S&P 500, the most popular investment choice of the greatest number of American investors, invests in:

This may look complicated at first glance, but it isn’t. Just because we have that full smorgasbord from which to choose doesn’t mean we have to use every one of them! Sometimes I’m quite satisfied to be in only one or two of them. There are certainly times in the investing cycle when it would be a good thing to put all your eggs in the basket defined by all US large caps, a number of US mid caps and a few REITs. Heck, for most of the past 8 years that would have been as good a choice as any and better than most!

But I am a value investor. So today I have selected the primary asset classes of US and international developed market securities (be they stocks, funds or ETFs), US REITs, specific income holdings and alternatives – 5 broad classes that provide growth, income and risk management.

8 years ago companies that were selling for 11 times earnings are now selling at 33 times earnings; companies selling at a book ratio of 1.1 are now at 2.5. And as for investor sentiment, too many people are whistling past the graveyard hoping nothing jumps out and grabs them. These people will stick with their narrow band of asset classes defined by the S&P 500.

For the rest of us, might I suggest you at least consider doing what we are doing for clients and suggesting for subscribers. Right now -- and this will change if trailing stops execute or I decide to change the allocation parameters – we are about 35% long US all-cap, mid-cap and value funds as well as US health care stocks like Cerner Corp (CERN), Enzo Biochem (ENZ), and Tekla Health Sciences (HQL).

We have also purchased natural gas firms like Range Resources (RRC), Southwestern Energy (SWN), and Chesapeake Energy (CHK) which I suggested for purchase recently, and tech companies like Cisco (CSCO) and HP Inc (HPQ). We also have about 8% of the sample portfolio in US REITs like Physicians Realty (DOC) and Ladder Corp (LADR).

We own about 10%, and will own more, in the international equities arena. Some examples are Roche Holdings (RHHBY), Mexico Fund (MXE) and ETF Europe Hedged Equity (DBEU). At this stage of the market cycle, we also own another 13% or so in income holdings like ETF First Trust Preferred and Income (FPE) and T Rowe Price Floating Rate Fund (PRFRX) and another 14% in smart beta funds like AQR Long/Short (QLEIX) and Vivaldi Merger/Arbitrage (VARAX).

It really isn’t that complicated to truly diversify to protect against market risk. I happen to love doing the reading, research and analysis of common stocks, so I have quite a mix. But you could do much the same, with hopefully similar results, using just 6 or 7 funds or 6 or 7 ETFs.

As Sgt. Phil Esterhaus used to say, “Let’s be careful out there!”

Good investing,

Disclaimer:

(1) Do your due diligence! What's right for me may not be right for you.

(2) Past performance is no guarantee of future results. Rather an obvious statement, but too many investors look solely at periodic past performance rather than implementing a rational plan that is right for them.

plementing a rational plan that is right for them.

You are welcome to contact me at joe@stanfordwealth.com with any questions.

Disclaimer:

(1) Do your due diligence! What's right for me may not be right for you.

(2) Past ...

more