Inflation Breakevens: Common And Uncommon Shocks

Assuming unadjusted nominal-real yields are a good indicator of inflation expectations (see yesterday’s post for why maybe not), it’s interesting to see how market-based inflation expectations have moved over the recent past (pre-today’s ECB decision):

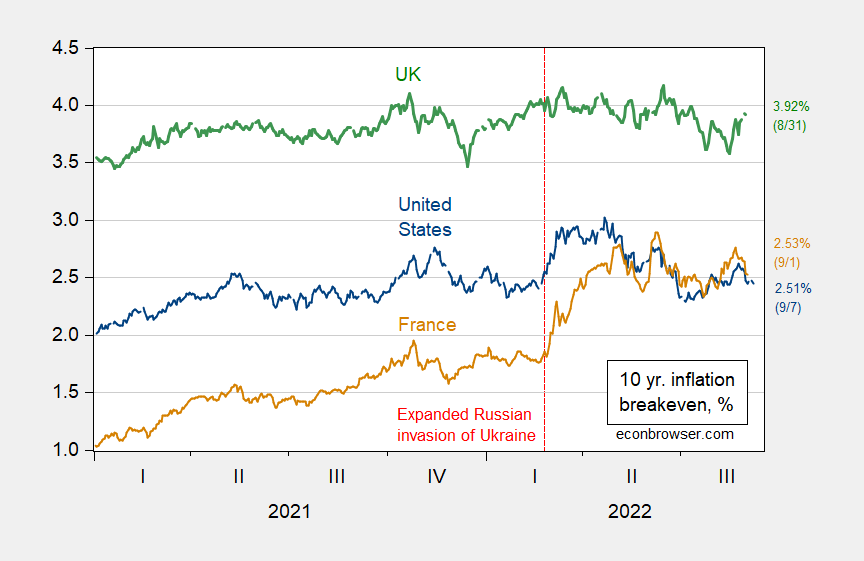

Figure 1: Ten-year inflation breakeven for US (blue), for UK (green), for France (tan), all in %. US based on constant maturity Treasury-TIPS spread, UK for Treasury-Gilt spread, France for spread between Treasury (mat. 5/36) and indexed (mat 3/36). Source: Treasury via FRED, BoE, and Tresor, and author’s calculations.

Notice that the French and US breakevens rose simultaneously with the expansion of the Russian invasion of Ukraine (thanks, Putin). The UK breakeven remained fairly constant. although it shared a mini-spike in mid-June with the other two series. That’s not to say the breakeven for the UK has stayed constant. Go back to mid-2016, and you see a jump there (so, there’s the uncommon shock).

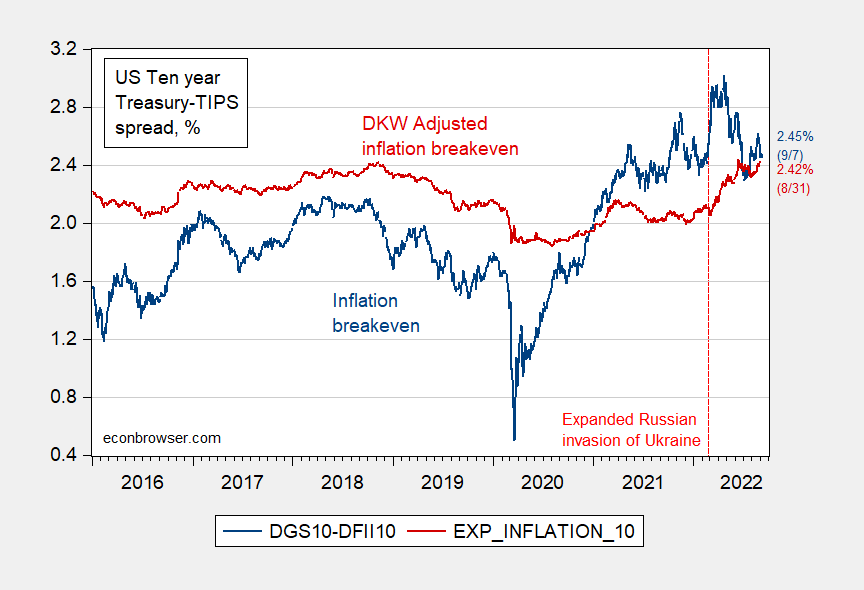

As I noted at the outset, these are unadjusted (for inflation risk, liquidity premia), which can be important. Adjusting for the premia, US expected inflation has risen steadily since February 24.

Figure 2: Five-year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), both in %. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 9/7, and author’s calculations.

No reason for the inflation risk premia and liquidity premia (and in France, default risk over the Eurozone crisis period) to behave as they do in the US. Hördahl and Tristani (IJCB, 2018) compare US and French inflation breakevens adjusting for spreads, through 2014. I’m sure the real time adjusted series exist somewhere for France and the UK, so any tips welcome.

More By This Author:

Market Based Expectations Of Five Year Ahead InflationEuro Area GDP Nowcasts, Pre-NordStream Indefinite Shutdown

The Hit To The Russian Economy, Internally Assessed