Indices Poised For New Highs But They Better Not Fail First

The strong breadth thrust I wrote about continues to power the stock market higher in what is a very strong seasonal period. In other words, there is a good market tailwind from the calendar. The thrust was the catalyst. However, with only a 6% pullback, the thrust was not a bell-ringing, go all in and not worry signal. Rather, it was a good spot in an ongoing bull market to add money, add some risk, prune and plant.

If you look at the various trades we have done over the past week, they are numerous. We added back what we sold in early November as well as did some major rebalances for a perceived run to new highs into 2026.

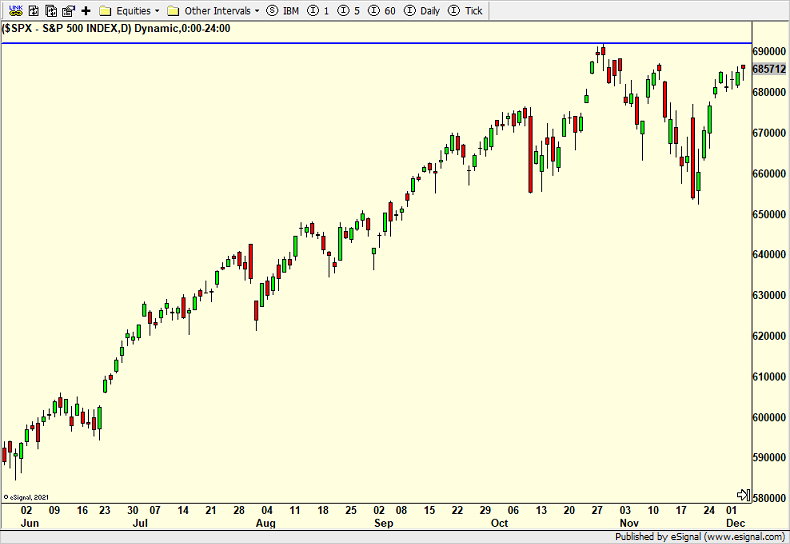

The S&P 500 is a two-day rally from new highs. I would not want to see it stall and roll over before getting back to the old highs, especially this month.

(Click on image to enlarge)

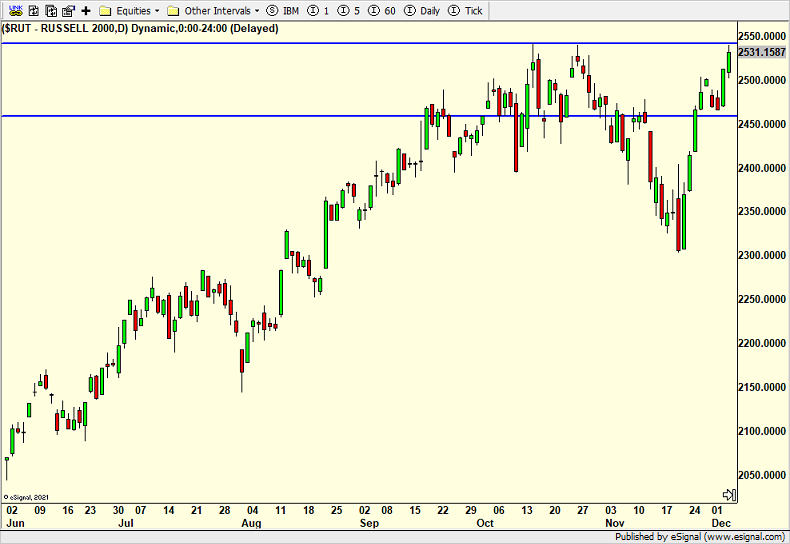

The good news is that the small caps have been leading which they are supposed to into January. Below is a chart that shows this. When price is going up, smalls cap are leading. When price is going down, large caps are leading. Since mid-November the RUT or Russell 2000 has lead the rally which is a positive thing.

(Click on image to enlarge)

And speaking of the Russell 2000, here it is below, right at the old highs which I love to see ahead of the other indices. I expect the small caps to make new highs next week and the other indices to follow suit. And before the question is asked, I would be concerned if the S&P 500, S&P 400 or NASDAQ 100 did not make a new high while the others did. Again, I don’t think that will be the case.

(Click on image to enlarge)

More By This Author:

Bulls Turn Tide – All-Time Highs – BitcoinThanksgiving Rally Delivers – December Supposed To Be Up

Bulls Fight Back But Landscape Unchanged

Disclosure: Please see HC's full disclosure here.