In December, Truck Sales Tanked While Car Sales And Private Jobs (Per ADP) Increased

I will write about the biggest economic release of the day, the ISM services report for December, later. In the meantime, here are two other important data releases for December, one from a private source (ADP), and the other from the BEA’s GDP updates.

As an initial matter, I don’t think we can be confident of the month to month accuracy of the official jobs report for several more months - and that is not counting any further disruption from another possible government shutdown in February.

To cut to the chase, ADP reported at 41,000 gain in private jobs in December. As shown in the graph linked to below, according to this series since July only 27,000 jobs have been added to the economy in total, or an average of 5,400 each month(!):

(Click on image to enlarge)

.webp)

While this is not recessionary, it is about as close as you could come to the precipice. We’ll see what the official report says on Friday.

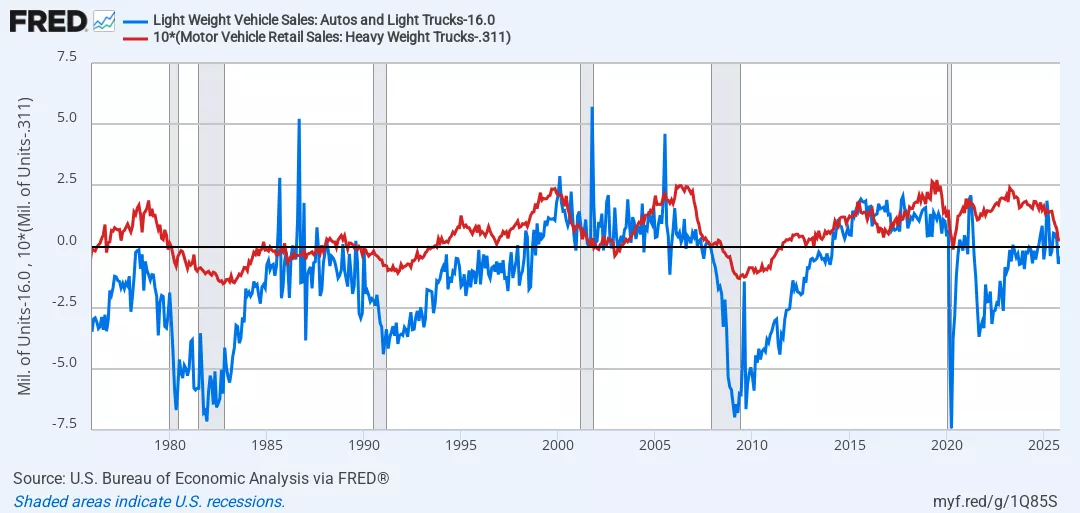

An important if underutilized short leading indicators for recessions is vehicle sales. After houses, these are the biggest durable purchases made by the vast majority of consumers. As I have noted in the past, typically truck sales decline first (and rebound second), followed by car and pickup truck sales (which rebound first). Additionally, truck sales are much less noisy and so, after housing, give the first clear warning that a recession is likely ahead.

And December truck sales, which declined another -9% from November to .311 million annualized units, and are down -43.6% from their post pandemic peak, are clearly recessionary (note: since FRED for some reason implements a one month delay in updating its graphs, I have subtracted the December values for car and truck sales so that that level shows at the 0 line. Additionally, I have multiplied the truck sales number by 10 for scale):

(Click on image to enlarge)

In fact, there has never been a case where such a decline has not been shortly followed by a recession, if the economy was not already in one.

Car and light truck sales, by contrast, increased 0.4 million in December to 16.0 million annualized units. This is down -11.6% from their post pandemic peak in 2021, and -10.6% down from their secondary peak last March when there was a rush to buy before tariffs kicked in.

Further, while the 3 month average trajectory since March has been declining, at their current levels car and light truck sales are at higher levels than at any time from 2022 through late 2024. So while truck sales are very recessionary, car sales are not recessionary at all.

I’ll try to draw some broader implications for the economy once we have the ISM services report in hand as well.