How To Make Money In Renewable Energy: NBF's Rupert Merer

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

As the political and financial pressures on fossil fuels mount, investors are starting to explore the renewable energy space with an eye toward reaping its potential. Rupert Merer analyzes that growing energy sector for National Bank Financial and tells The Mining Report why betting on the future of renewables is a prudent strategy for profit growth.

The Mining Report: Where is the renewable energy space headed in terms of profitability?

Rupert Merer: Most renewable power companies have long-term production contracts that provide a relatively low-risk return on invested capital. This is a capital-intensive industry with a lot of invested debt and equity capital. There is excellent visibility on cash flow and revenues—as long as 40 years out in the case of small hydro contracts. The duration of small wind and solar contracts is 15–20 years.

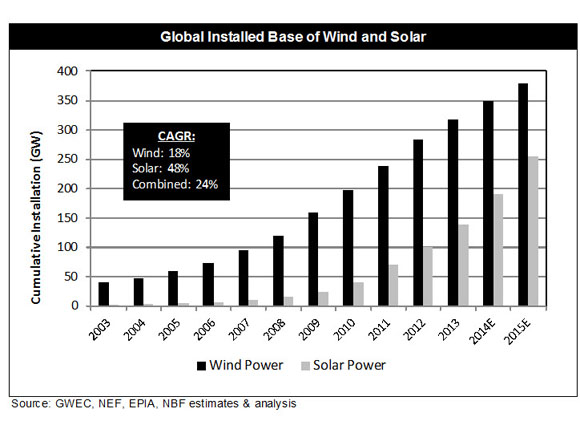

With steady cash flow, the renewables sector can provide dividends of more than 5% for income seekers, typically with good visibility on future dividend growth. As solar and wind power have seen rapidly declining costs over the last few years, they have also seen very high growth. We think that this growth will continue and there should be an increasing number of investment opportunities.

TMR: What are "sustainability investors"?

RM: There are a few funds in Canada, the U.S., and the United Kingdom that invest only in renewable power assets. Some of these fund managers believe that there is an inherent risk with fossil fuel investments. Of course, if governments start to tax carbon at a higher rate or introduce cap and trade, then that could be a limiting factor for using fossil fuels to generate electricity.

Investors in the energy sustainability space typically look for a ratio of more than 50% clean energy in the stocks in their portfolios. Clean energy includes renewables and power plants that use natural gas, provided that the plants are high-efficiency co-generation plants or combined cycle plants.

TMR: How does a renewable energy project secure a long-term contract?

RM: That depends on the jurisdiction. The Canadian power market is regulated at the provincial level. Ontario is the most populated province in the country and it has been the most aggressive at developing renewable power over the last decade. In the past, the government has offered fixed price contracts, or "Feed in Tariffs," for renewable power at a price that would provide an attractive economic incentive for developers. However, generally, in Ontario or in other provinces, firms will bid on, say, delivering 200 megawatts (200 MW) of wind power, under a competitive request for proposal. The contract will typically go to the lowest price bid from a viable entity.

In the U.S., contracts are often arranged between developers and utilities or businesses in the private sector. Projects have typically also included financial partners that have purchased tax credits from the developer.

TMR: Given that wind and solar intermittently generate pulses of energy into the grid, has the grid developed the capability to access renewable energy when it is live, while compensating for it when the generator goes temporarily fallow?

RM: The easiest way to compensate for intermittency is to increase transmission capability.

If the local area has more wind or solar power than it can use, it can send it to a neighboring region. Another way to manage intermittency is to decrease the use of power on the grid when there is a deficit of renewable energy. For example, operators can shut off air conditioning loads when there is a deficit of power. As the amount of renewable power grows, we will need to find better ways to store power.

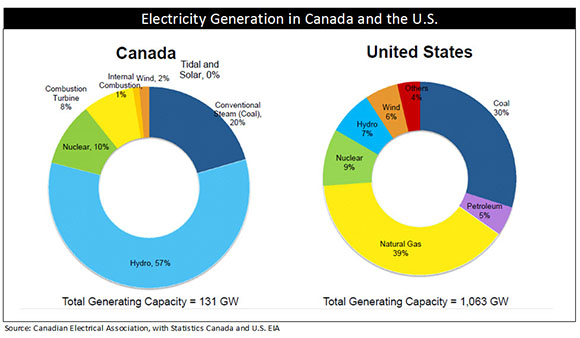

Today, the best way to manage volatility in electricity supply is the regulation of hydropower production. With our hydro capability, Canada is a giant battery for the U.S! British Columbia controls about 13 gigawatts (13 GW) of hydro. It actively trades power back and forth with California. In Quebec, more than 30 GW of hydro leverages a storage capability that can trade power with the Eastern Seaboard. Manitoba trades 10 or 13 GW with the Midwest. This works for Canada today, but it may not be enough in the future.

TMR: Electrical storage is an issue for the renewable energy sector. What are the advancements in battery and other storage technologies?

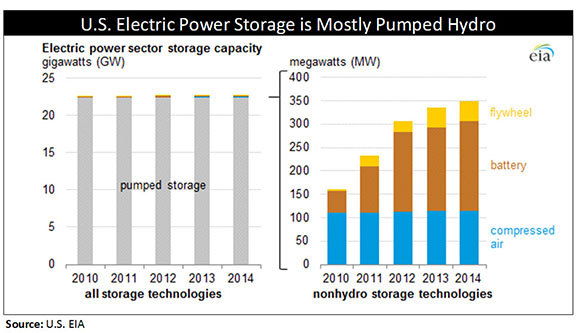

RM: The majority of dedicated electrical storage in North America is in pumped hydro. The use of compressed air storage and reliance on batteries is increasing. But the lithium-ion battery technology has only advanced incrementally during the last few decades. The cost of manufacturing batteries has dropped with higher demand for battery use in electronics and electric vehicles. Today, batteries are still relatively expensive, but there is a push to increase the amount of storage on the grid, which could increase the demand for batteries.

Last year, there were 35 gigawatt hours (35 GWh) of lithium ion batteries produced globally. Now, Tesla Motors Inc. (TSLA:NASDAQ) is slated to produce 35 GWh by 2020 at its Gigafactory. We have seen similar goals for 2020 announced by BYD Company Ltd. (BYDDF:OTCBB), which is the electric car company backed by Warren Buffett. LG Chem Ltd. (051910:KRX) and Foxconn Technology Group are also adding battery capacity. We think that the total production of lithium-ion batteries could increase by a factor of four or five by 2020. Ultimately, we could see dedicated battery storage of electricity on the grid or the use of the batteries in electric cars to manage grid power.

Hydrogen technology and flywheels also continue to develop and should also play a very important role in grid management in the future.

TMR: What is the role of graphite in battery production?

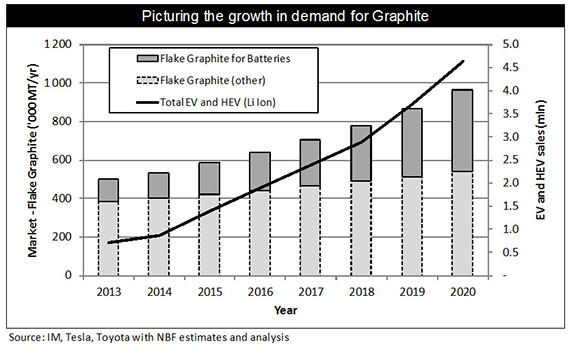

RM: There is 10 times more graphite than lithium in a lithium-ion battery; it's an important part of the makeup of the electrodes. Typically, batteries employ a mixture of synthetic and natural graphite, but the synthetic material is relatively expensive at up to $6,000/ton. On the other hand, natural graphite is mined and processed for between $400 and $500/ton.

Graphite prices have been relatively soft for the last couple of years, but the high growth in battery markets should drive an increase in the demand for graphite.

TMR: What will be the effect of the demand factor on the price of graphite?

RM: One can argue that the price will rise because the demand is going to grow, but there are a fair number of deposits that are out there that are feasible at the current price. If the average price was to move up from roughly $1,100–1,200/ton today to $1,500–1,600/ton, a number of deposits could come on line. As with the history of most commodities, the graphite price will remain relatively stable in the long run. It can be volatile in the short term, but I do not assess that it will take a big increase in the price of graphite to increase the supply.

TMR: Do the existing graphite mines have the capacity to absorb the projected demand or is meeting that demand going to require exploration?

RM: Most graphite—roughly 500,000 metric tons per year—comes out of China. But in the short term, we believe that there will be a contraction of supply coming from China. The Chinese government is clamping down on polluting mines, and there are news reports suggesting that the quality of the Chinese graphite is degrading as the miners strip the good deposits. Battery-grade material needs to be high purity. We see opportunities for graphite mines outside of China, provided that they can access very good quality graphite.

Graphite is not like other commodity businesses. A customer cannot just go onto a commodity board and pick up the desired product. Graphite customers have very specific technical needs for their products, and they look for producers who can meet those requirements.

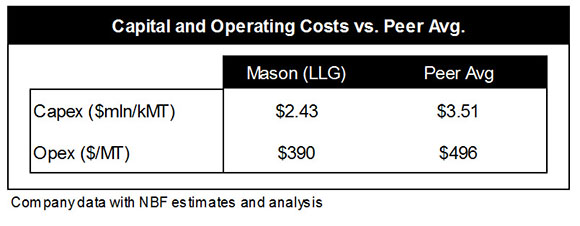

We track Mason Graphite Inc. (LLG:TSX.V; MGPHF:OTCQX), which has the lowest capital and operating costs of any graphite mine that we have seen. Mason Graphite has an experienced management team and has financial backers that could provide some of the equity and debt capital for building out Mason's production facility.

TMR: Is a firm like Mason Graphite going to be competing with Chinese firms or other firms around the world?

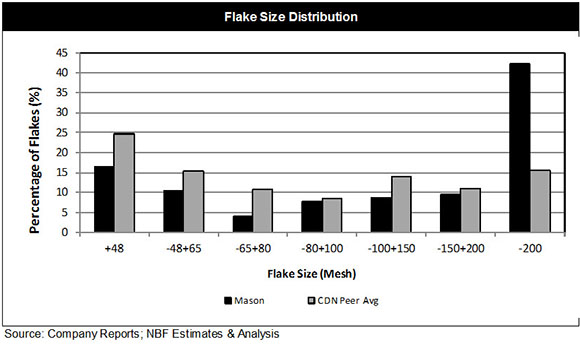

RM: When we model Mason Graphite, we assume that it will sell graphite into the global commodity markets. However, the company will focus on meeting the needs of specific customers. It will build a facility to process graphite within a range of purity attributes and flake size distribution attributes. It will meet very specific customer goals in the very high-purity markets for batteries or electronics.

The number one strength of Mason Graphite is its executive team. Its CEO, Benoit Gascon, has spent the majority of his career building graphite operations, specifically the Timcal deposit in Quebec that was bought by Imerys (NK:PA). Benoit went on to run Imerys' graphite operations. He's a world-class expert.

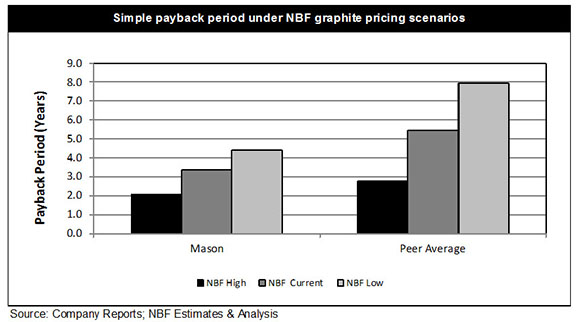

In our view, Mason Graphite's Lac Guéret deposit is the best in the world. It is located in a low-cost area in Quebec, a safe, mining friendly, low-risk jurisdiction. If Mason's deposit has any negatives, it is that, as the Street points out, Mason's average flake size is smaller than a lot of the other deposits that are looking to be developed. We took a hard look at the flake size distribution and at the various prices for graphite depending on flake size, and Mason's deposit is very economical. The Lac Guéret deposit seems to have a short payback period—not only in the current market but, also if graphite prices go down. And, naturally, the economics for every deposit look better as the prices go up.

TMR: Is Mason highly leveraged to debt or does it have enough cash on hand to go forward?

RM: The company does not have enough cash to finish building the mine and processing facility at this point, but it has enough cash to complete its permitting and its feasibility studies to get to the point of construction. Mason will then find the debt financing and revenue stream to build the mine and the processing facility.

TMR: At what point in the development process does it become attractive to invest in Mason?

RM: We have a Buy rating on the stock now and we typically look out 12 months on our investment recommendations. The company will be more attractive when the bankable feasibility study is completed in the next four months. The feasibility study should confirm the low operating cost and low capital cost of the deposit and underpin the economic feasibility of the project. It already has financing from a couple of institutions in Quebec—Sodémex, which is a division of the Caisse de dépôt, a big pension fund, and Resource Quebec, which is part of Investissement Québec, a government-backed fund. We believe that with those two organizations behind it and an attractive bankable feasibility study, Mason Graphite will find the capital partners it needs to push forward.

TMR: Mason Graphite is currently trading around $0.55/share. What is your target price?

RM: Our target is $1.20/share. To get there, we use a 14% discount rate on a discounted cash flow analysis. Once the bankable feasibility study is completed and Mason finds funding, the facility will be derisked, with the discount rate dropping to 9% or less. And of course the target price would move up from that point.

TMR: Returning to wind, do you have any picks in that space?

RM: We cover wind farms in Canada, the U.S. and Europe. Wind companies have very good visibility on future revenue to amortize debt and also to pay a healthy dividend to shareholders. Our top pick of the companies that are highly exposed to wind is Boralex Inc. (BLX:TSX). We believe that Boralex is trading at a 10% discount rate today, versus most of its largest peers at about 8% or less. The company has very good visibility on a compound annual growth rate of greater than 20% for its cash flows available for distribution, between 2014 and the end of 2017.

TMR: Boralex is leveraged across a broad spectrum of renewables—wind, water, solar and thermal, correct?

RM: That's correct, although 75% of its production comes from wind.

TMR: Is the technology for wind farms improving? What are the main goals for wind technology going forward?

RM: Yes, the performance on wind turbines is constantly improving. Wind turbines are larger and cheaper than a decade ago. Whereas the first generation of turbines were 50–100 kilowatts, they are now more than 2 MW. And there are big improvements in turbine blade aerodynamics, which allow for 30% increased production from a single wind turbine. Ongoing technological improvements in turbine design mean that wind farms are efficient in relatively low wind speed environments, and that opens up the number of places where wind power can function competitively. The cost of wind power has dropped across the board. Wind farms are being built that deliver product priced at $0.06/kilowatt hour or less, which is very competitive with power generation from any other source.

TMR: Are industrial users saying, "We're going to build a big turbine and when the wind is not blowing, we'll tap into the grid?"

RM: That is a growing trend, but a wind turbine-powered factory could end up paying more for the grid portion of its electricity. When users start to cut out the utilities, they will incur higher standby charges. I expect that industrial users will want to be completely self-generating in order to cut costs. That brings us back to batteries, of course.

TMR: Is there anybody else in wind that you like?

RM: We have a Buy rating and a $33/share target price for Pattern Energy Group Inc. (NASDAQ: PEGI), which is trading around $30/share. The company pays a healthy dividend of 4.7%. It has recently announced acquisitions. The company has increased its guidance on cash flow available for distribution based upon a 12–15%/year growth factor. Since Pattern Energy went public late in 2013, it has been increasing its dividend by 2% per quarter. That could grow to 3% per quarter. Investors will reward Pattern with a higher share price, and that 4.7% dividend will likely increase. There are some larger yield companies in the U.S., but we think that the valuation on Pattern and its growth profile make it quite attractive.

TMR: Will companies like Pattern and Boralex be acquisition targets, or should investors expect them to grow on their own?

RM: In theory, they are acquisition targets of the larger yield-companies, because they do trade at attractive valuations. Boralex is certainly a very attractive takeover target. Pattern Energy is a little bit larger and harder to acquire, but it, too, could be a takeover target. We would not own these stocks for that reason, though, but we would look at them for their attractive dividends, and the growth potential on the dividends.

TMR: Thanks for your time, Rupert.

Rupert Merer is a sustainability and clean tech research analyst and managing director at National Bank Financial (NBF). He joined NBF in 2006 after working in private industry, bringing more than 20 years of experience in this sector to his research analysis. Prior to joining NBF, Merer worked for a Canadian gas utility, where he was manager of energy technology. Merer also worked in the hydrogen technology industry in technical, financial, marketing and corporate functions. He began his career as a combustion engineer, working on gas turbine technologies. Merer was ranked No. 1 Alternative Energy analyst by Brendan Wood International in 2013 and for five of the last seven years. Merer has a BSc in engineering physics, an MBA from Queen's University and an MASc in mechanical engineering from the University of Toronto. He is a registered Professional Engineer (ON) and holds a Chartered Financial Analyst (CFA) designation.

Rupert Merer is a sustainability and clean tech research analyst and managing director at National Bank Financial (NBF). He joined NBF in 2006 after working in private industry, bringing more than 20 years of experience in this sector to his research analysis. Prior to joining NBF, Merer worked for a Canadian gas utility, where he was manager of energy technology. Merer also worked in the hydrogen technology industry in technical, financial, marketing and corporate functions. He began his career as a combustion engineer, working on gas turbine technologies. Merer was ranked No. 1 Alternative Energy analyst by Brendan Wood International in 2013 and for five of the last seven years. Merer has a BSc in engineering physics, an MBA from Queen's University and an MASc in mechanical engineering from the University of Toronto. He is a registered Professional Engineer (ON) and holds a Chartered Financial Analyst (CFA) designation.

Disclosure:

1) Peter Byrne conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and ...

more

Still guessing the market?

http://www.devtechnologies.net/