How Much Faster Has American Inflation Been Compared To Euro Area Inflation?

Since the pandemic struck, 0.4 percentage points (headline), 0.7 percentage points (core).

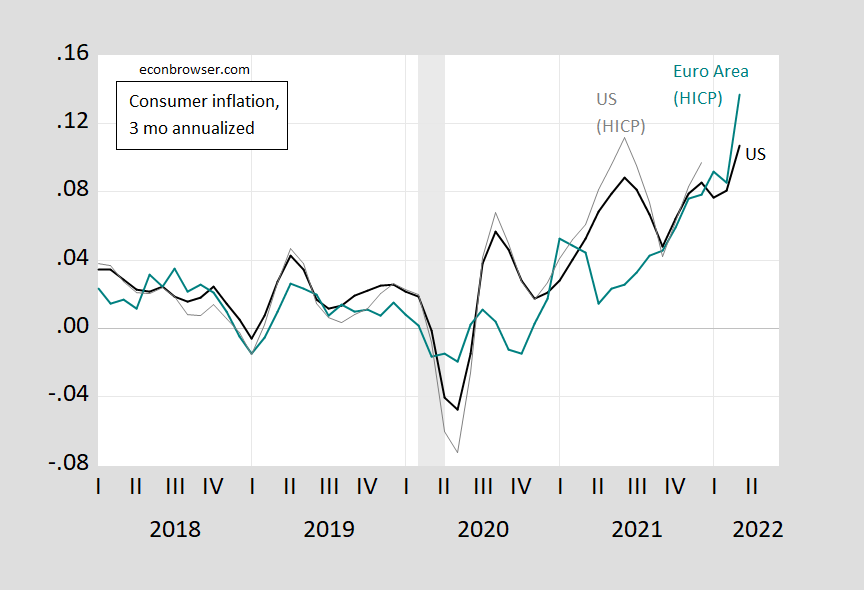

Here’s 3-month headline inflation annualized.

Figure 1: Three month annualized inflation rates for US CPI (black), US HICP (gray), Euro Area HICP (teal). Euro Areaand US HICP seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations.

Euro-area inflation has recently moved ahead (3-month changes) relative to the US. One could ascribe this to the sharp movements in energy prices, particularly for natural gas, experienced by Europe as compared to the US.

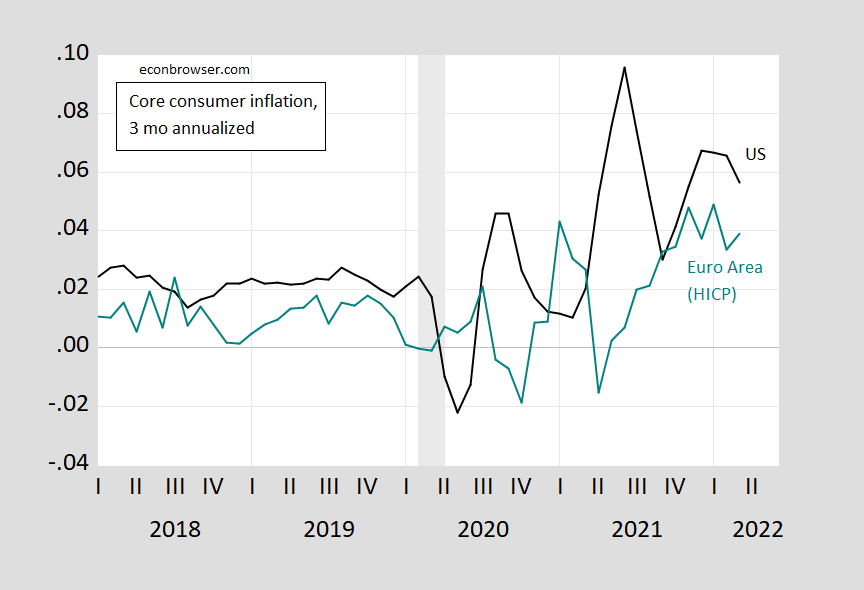

For evaluating the proposition that domestic factors — in particular demand-pull vs. aggregate supply — were more important in the US, one could look at the core measures. These figures are shown in Figure 2.

Figure 2: Three month annualized inflation rates for US Core CPI (black), Euro Area Core HICP (teal). Euro Area seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations.

Headline and core inflation in the US are higher than the corresponding Euro Area series. Are the differences statistically significant? Recalling that the US measures differ from the Euro Area measures (see this on HICP), it makes sense to compare the differentials between the US and Euro Area series before, and after the onset of the pandemic (and the implementation of differing fiscal and monetary measures).

Specifically, I examine the time difference in the difference between US and Euro Area inflation, going from pre- to post-covid periods. This is an application of the differences-in-differences approach.

Define the annualized month/month inflation difference US vs. country i:

![]()

Take this variable and run the following regression over the 2018-2022M03 period:

![]()

Where covidt is a dummy variable taking a value of 1 from 2020M02 onward.

The α coefficient is the pre-covid inflation differential between the US and country i; the β coefficient is the change in the inflation differential post-covid.

Using HAC robust standard errors, I find that the estimated β coefficient is 0.0042 for US-Euro Area (HAC robust standard error 0.011), for headline inflation. For core inflation,the estimated β coefficient is 0.0071 for US-Euro Area (HAC robust standard error 0.011). In neither case does the t-statistic for the null of zero on the β coefficient approach statistical significance at conventional levels.

The ECB discusses some of the reasons (mechanically) for the differences in inflation behavior.

So, while it’s true US headline (core) inflation accelerated 0.4 percentage points (0.7 percentage points) more than that of the Euro Area, the difference is not statistically significant in either case.

Disclosure: None.