Housing Update: Sales Have Bottomed, Prices In Process

No important economic news today. Yesterday existing home sales were released, but their economic impact isn’t all that important, except as it can confirm what has been happening with new houses under construction. And confirmation is what it gave us.

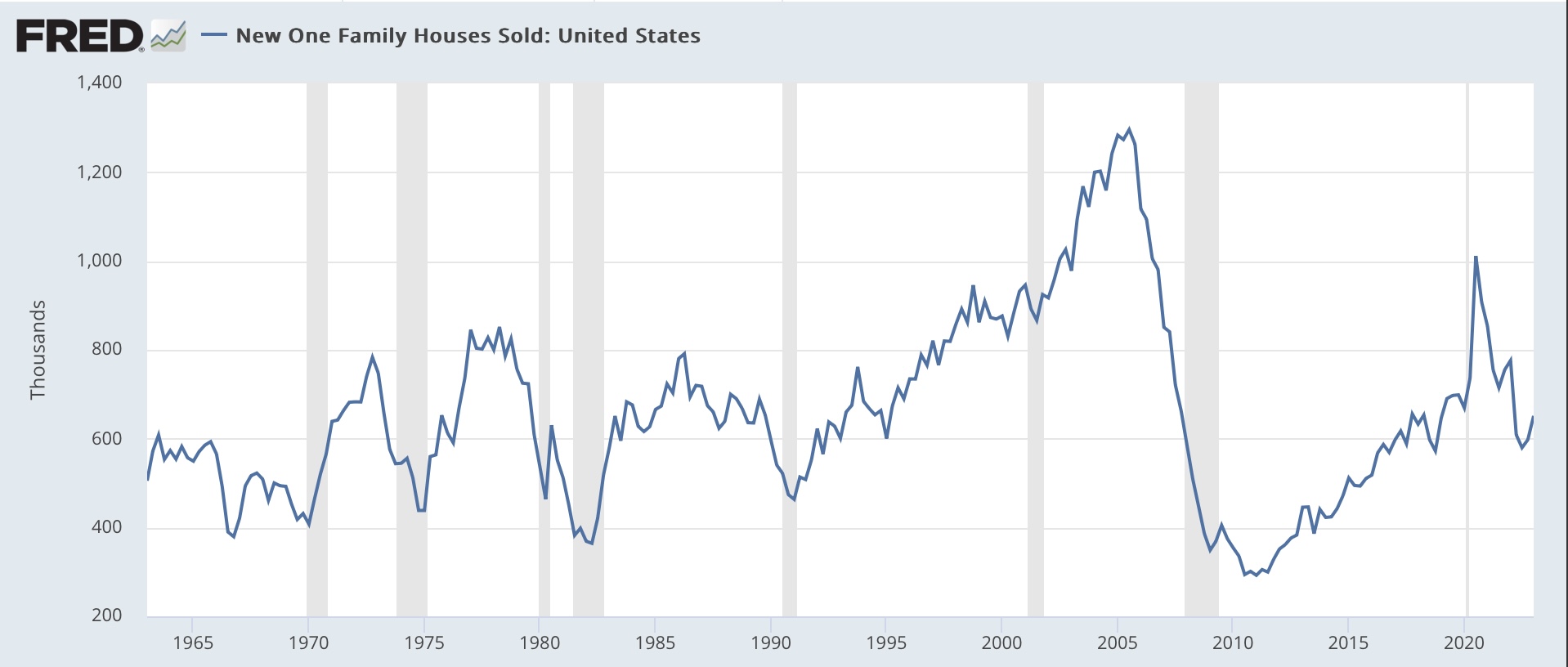

First, *sales* of houses have bottomed, following the peak in mortgage rates over 7% at the end of last October.

New home sales (which will be released for April on Monday) as is often the case, were the first to turn, having bottomed last July:

(Click on image to enlarge)

Existing home sales yesterday remained above their January's bottom by a substantial margin:

(Click on image to enlarge)

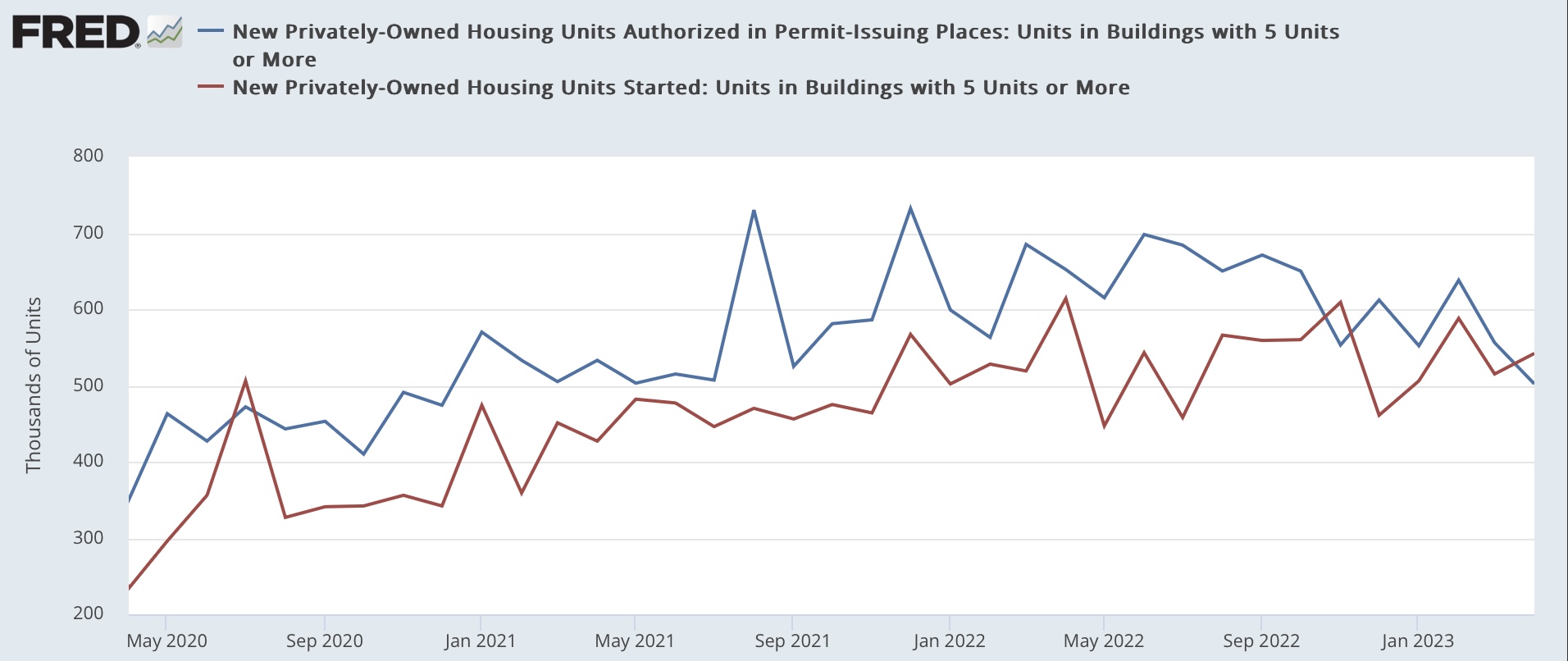

With one exception, housing permits and starts, as reported earlier this week, also bottomed in January:

(Click on image to enlarge)

As shown above, the big bounce came in single family units. While starts in multi-family units have continued to slowly increase, permits for multi-family units made a new low:

(Click on image to enlarge)

This suggests that multi-family units under construction have a ways to go before they turn down. As indicated the other day, total units under construction have turned down, but not by much:

(Click on image to enlarge)

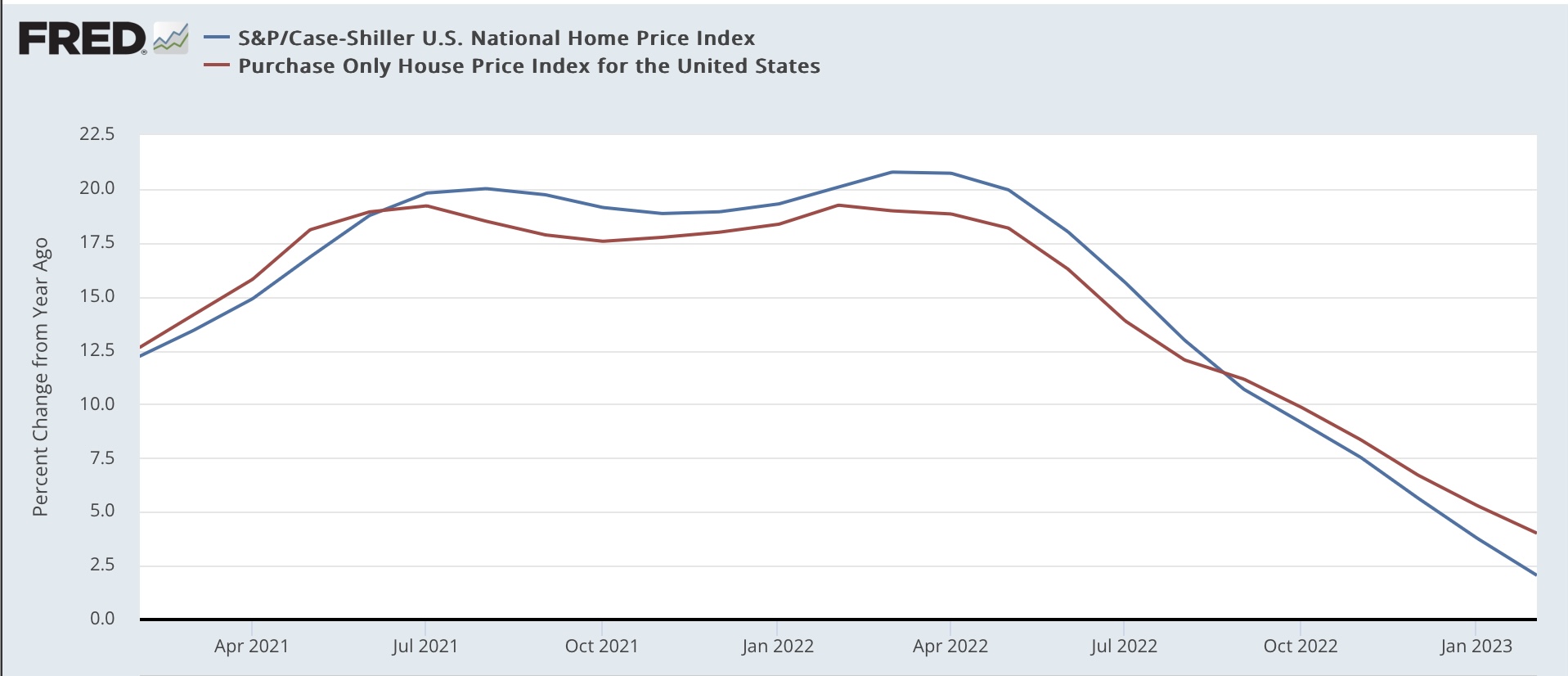

Turning to prices, we mainly have to measure YoY, since little of the data is seasonally adjusted.

Yesterday prices for existing homes were reported to have declined by -1.7%. The past two months have been the first YoY declines since the end of the housing bust over 10 years ago:

YoY median prices for new homes rose to +3.2%, after a single month of YoY decline in January. The below graph is averaged quarterly to cut down on noise:

(Click on image to enlarge)

Here the number is +1.4%.

The FHFA and Case-Shiller repeat sales indexes have only been updated through February, and show sharp YoY deceleration, but still increases of 4.0% and 2.0%, respectively:

(Click on image to enlarge)

These two repeat sales indexes are seasonally adjusted, and show very minor declines of less than 1% and less than 3% respectively:

(Click on image to enlarge)

In absolute terms, prices may have bottomed as well.

The repeat sales indexes will be updated for March on May 30.

More By This Author:

Jobless Claims: Yellow Caution Flag PersistsHousing Permits And Starts Confirm Improvement From Bottom, Multi-Unit Construction Sets New Record High

March Total Business Sales Strongly Suggest That Real Total Sales Have Entered A Downturn

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.