Homebuilders Don’t See A Path To Higher Transactions

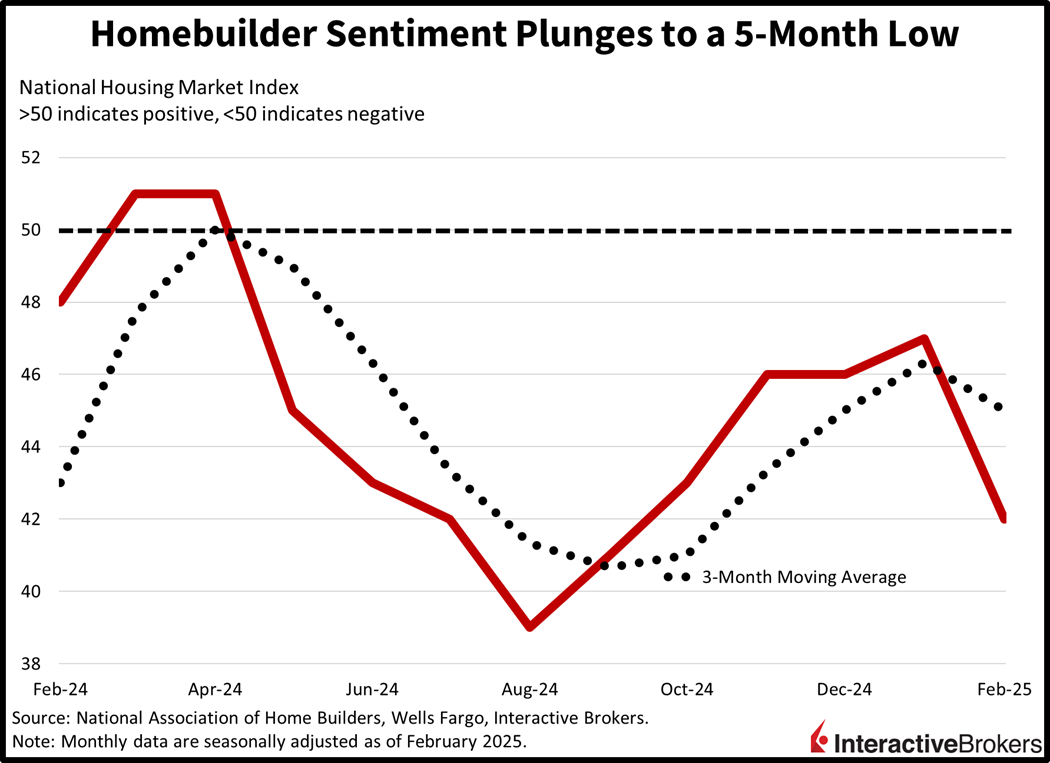

Optimism amongst market participants regarding the nearing of a potential ceasefire between Kyiv and Moscow sent stocks towards all-time highs in early morning trading. But a 10 am intraday homebuilder sentiment report derailed the momentum as industry players reported the lowest level of confidence in 5 months. Indeed, a shortage of home buyers, pricey costs for materials, heavy mortgage rates and tariff uncertainty are pressuring transaction volumes, much to the dismay of builders. The softening real estate sector, furthermore, isn’t serving to quell yields, which are rising and at their loftiest heights of the session. Equities are near their flatlines, meanwhile, as traders hope for a catalyst that can lift benchmarks out of their two and a half month trading range.

Homebuilders Put Away Shovels

Homebuilder sentiment plunged to its lowest level since September as the headwinds of tariff uncertainty, rising costs and elevated rates weighed on affordability. The dampened outlook has essentially erased all of the progress in the months following the presidential election due to industry players seeing little that the White House can do to improve transaction volumes. The headline figure dropped a whopping 5 points to 42 this month, missing projections for an unchanged 47. All three major components of the gauge reflected pessimism, with the outlook for single-family sales in the present and the six-month future dropping from 50 and 59 to 46 on both fronts. The traffic of prospective buyers also slipped from 32 to 29 while all regions contributed to the decline, sporting weaker results month over month (m/m).

New York Manufacturers Report Declining Optimism

Manufacturing conditions are improving modestly in New York state this month, supported by rising orders, shipments and prices. The Empire Manufacturing Survey came in at 5.7 in February, better than the -1 projected and the -12.6 from January. Capping the overall gain, however, were contracting employment and shorter work weeks alongside worsening optimism. Sentiment was hurt by weaker expectations for capital expenditures as well as a dampened outlook for supply availability.

Commodities and Dollar Rally

Markets are mixed with Treasurys losing, commodities and the greenback gaining and equities nearly flat. Major stock index performance is uneven with modest selling in the Dow Jones Industrial and Nasdaq 100 baskets met with limited buying enthusiasm in the Russell 2000 and S&P 500 benchmarks. Sectoral breath is nonetheless positive and led by utilities, industrials and materials, which are sporting gains of 0.8%, 0.7% and 0.7%. Only 3 of the 11 major segments are lower, characterized by consumer discretionary, communication services and health care dropping 0.5%, 0.4% and 0.3%. Treasurys are getting trimmed, however, with the 2- and 10-year maturities changing hands at 4.29% and 4.53%, 3 and 5 basis points (bps) heavier on the session. Pricier borrowing costs are helping the greenback, though, with its gauge up 22 bps as the US currency appreciates against most of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollar. Trade and geopolitical uncertainty are pushing up materials charges and silver, lumber, gold, crude oil and copper are gaining 1.6%, 1.3%, 1.2%, 0.6% and 0.1% as a result. WTI crude is trading at $71.80 per barrel as OPEC + is seen delaying production increases despite President Trump calling for more supply.

Investors Wait for New Construction Report

Today’s real estate data depicts an industry that was far too exuberant in its expectations of lighter mortgage rates and softer inflationary pressures. Perhaps part of the cheerfulness stems from President Trump’s long tenure in the construction and property management sectors alongside his bias toward low financing costs. Meanwhile, solving significant societal problems like that of home affordability requires meaningful policies and sacrifices, measures that aren’t easy to enact. Finally, tomorrow’s data releases on building permits and housing starts will offer us a perspective on whether waning sentiment is being countered with buoyant activity. I don’t expect that to be the case since 7-handle mortgages are far too extended for most of the population to close transactions but the results could underscore an old-school Winston Churchill quote that alludes to watching what they do, rather than listening to what they say.

More By This Author:

What’s Eating At The Consumer?

Feeling Hot Hot Hot

Trader Sentiment Soured When The Sentiment Numbers Arrived

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more