Feeling Hot Hot Hot

(Today’s Theme Music: Buster Poindexter, of course.And the original version)

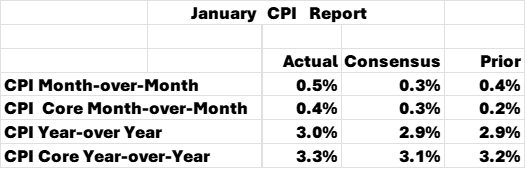

There are many days when we discuss “highly anticipated numbers”, only for them to match economists’ consensus and for markets to then go about their usual business. Today’s CPI report was not one of them. Every key metric came in above expectations.

Source: Bureau of Labor Statistics

It is very difficult to take today’s numbers in stride. The bond market didn’t, with Treasury yields rising 8-12 basis points across the curve, though equity traders attempted to utilize their favorite playbook nonetheless shortly after the open. One feature of the current equity market seems to be this mantra:

Every dip is a buying opportunity. The bigger the dip, the bigger the opportunity.

Heck, did you really think that a hot inflation number would prevent Meta Platforms (META) from continuing its 17-day winning streak.We can’t be sure how it will end the day, but META is now +0.7% higher after joining the broader market’s -1% lower opening. The megacap tech stocks are the focus of today’s dip buying, since the Nasdaq 100 (NDX) has been outperforming the S&P 500 (SPX) for most of the day. By midday, NDX had clawed back to unchanged, even as NYSE decliners outpace advancers by more than 3:1 and more than half the S&P 500 components are currently trading lower.Why let a dour bond market interfere with our love of tech stocks? And if there is enough love being shown for tech stocks, they can pull the broad indices along with them.

Meanwhile, expectations for a rate cut have been slashed. Yesterday, Fed Funds futures were pricing in a cut by September and a 43% chance for another cut by year-end. They have now pushed back that cut expectation until December.Just a month ago, in the wake of a stronger than expected jobs report, we noted how stock traders seemed far more concerned with the diminishing hopes for rate cuts than signals for a more robust economy. Ahead of that December jobs report, released on January 10th, traders were pricing in a full cut for June and a 72% chance for a second cut by the end of 2025.After that report, the first cut was pushed back to September and hopes for a second cut fell to 15%. Frankly, that isn’t all that different from where we line up now.

We also see 2-Year yields reflecting the relative stasis in rates. They were 4.38% on January 10th and 4.37% after a jump of 8.5bp as I write this. And 10-Year yields are lower today versus then, at 4.63% after a 10bp jump, as opposed to 4.76% then. Also, to put stocks into perspective, SPX closed at 5827.04 and NDX closed at 20,847.58 after that report; they are both about 4% higher today.So, it is any wonder why stock traders remain convinced that dip buying is the way to go?If something keeps working, people will keep doing it.

Oh, by the way, we can fit a bullish narrative for stocks to today’s inflation report. Stocks can indeed be a hedge against modest inflation, since earnings per share are measured in nominal terms. Inflation raises those nominal results, particularly for companies with relatively inelastic demand for their products.The largest tech stocks fit that bill, at least while the enthusiasm for all things related to AI continues.And thus, the dips get bought, even with a hot hot hot inflation report.

More By This Author:

Trader Sentiment Soured When The Sentiment Numbers ArrivedTariffs – Or Not? – And Volatility

Underappreciating Fiscal Policy

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more