Highly Unusual Developments In The U.S. Money Supply

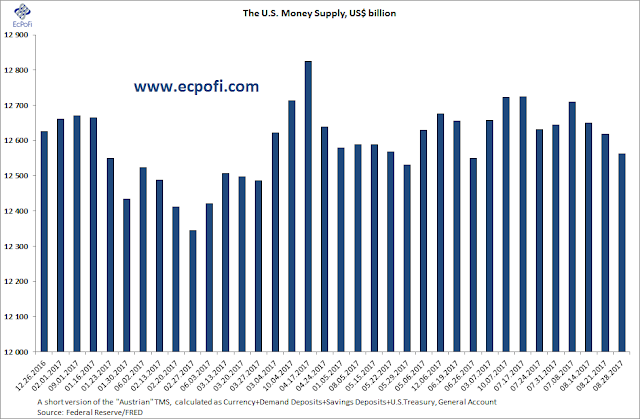

The numbers for the final week of August have just been released and they show a highly unusual development for being this late in the year: the money supply is actually lower today than at the beginning of the year.

If this continues it will not be long until the year on year growth rate turns negative. More specifically, if the current trend continues the growth rate could plummet below zero - a development which has not taken place for more than 22 years - sometime in October, if not earlier. Even if it does not, the growth rate will nonetheless fall substantially compared to October last year when it hit more than 12%.

Though there are leads and lags between changes in the money supply growth rate and stock market returns, October may look like a particularly dangerous month this year as the money supply growth rate has slowed more or less continuously and at great pace all year. Sooner or later money will become scarcer (and interest rates higher) and favoured over stocks forcing a stock market sell-off and a potential panic.

Also, deflationary pressures will sooner or late kick in which may lead the Federal Reserve to abandoned all talk of further potential interest hikes. In fact, it may have no other choice (given the misplaced "theories it operates under) than to implement the next round of QE (though it will be too late to avoid a stock market panic).

In other words, this is not the time to be long the U.S. stock market and other stock markets that correlate with it.

Disclosure: I am short U.S. midcap stocks.

Disclosure: None.