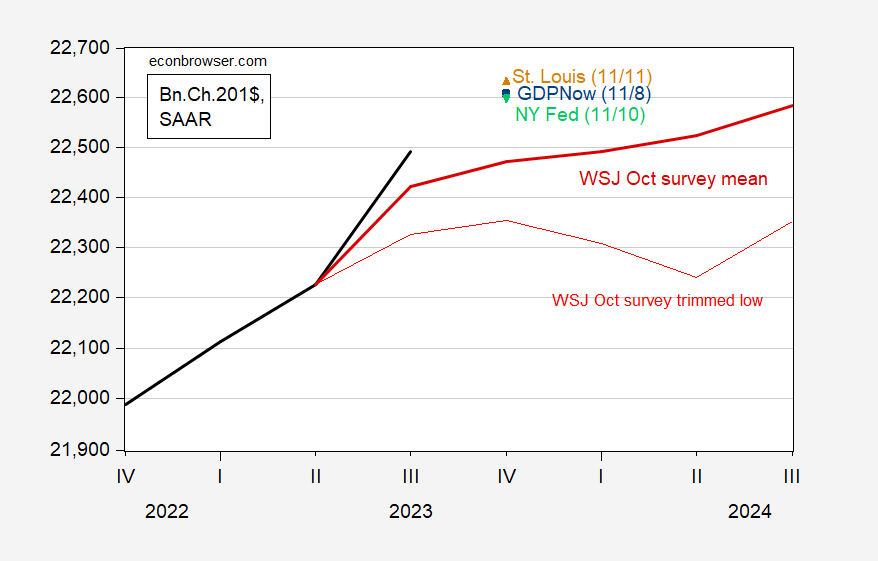

Growth Nowcasts For Q4

Atlanta Fed, NY Fed, and St. Louis Fed are for 2.1%, 2.51%, and 1.9%, SAAR respectively.

Figure 1: GDP as reported (bold black), GDPNow of 11/8 (blue square), NY Fed nowcast as of 11/10 (green inverted triangle), St. Louis Fed news nowcast (brown triangle), WSJ survey mean (bold dark red), 20% trimmed low of WSJ survey fm Jonathan Holt/ScotiaBank (light red), all in billions Ch.2017$, SAAR. Levels calculated on basis on advance GDP release figure. Note on log scale. Source: BEA 2023Q3 advance, Atlanta Fed, NY Fed, St.Louis Fed via FRED, WSJ, and author’s calculations.

The latest weekly reading (for y/y growth) as of data from 11/4 are 2.07% (from the Lewis-Mertens Stock NY Fed Weekly Economic Index), and -0.02% below trend from the Baumeister-Leiva Leon-Sims Weekly Economic Conditions Indicators. That means we’re essentially at trend growth according to the BLLS indicator.

These figures are interesting placed in the context of term spread recession probabilities exceeding 50% around December of this year, and term spread augmented (FCI, debt-service ratio) probabilities breaking that threshold in April 2024. So just because we haven’t seen sharp growth declines yet doesn’t mean we’re out of the woods yet.

More By This Author:

EIA Short Term Energy Outlook Forecast For Oil, And The Impact Of SanctionsAlternative Estimates Of Chinese Q3 GDP Growth

Euro Area Treading Water