Grey Rhinos

The crisis of 2008 was for many a “black swan” as US subprime leverage surprised in its crisis spreading across the world infecting all economies. Some will argue they knew it was coming, but no one understood the full global impact. The “grey rhino” problem for the present markets is more appropriate as it hits at the large, visible threats to global growth that are ignored – namely trade wars, US government shutdowns, Brexit, tightening monetary policy and China growth. The mood swing for markets continues apace. The blame for today’s rising fear over greed comes from China President Xi who warned against “black swans” and “grey rhinos” amid the economic downturn. Xinhua reported that Xi instructed officials to "prevent and defuse major risks" across a range of fields — politics, ideology, society, science, and technology — to "ensure a healthy economy and social stability.” The point of fear drives on Xi sounding worried about the economy and the chaos that could follow from a larger economic downturn. Many see this as China’s Minsky moment. Others blame ongoing trade war talk as the US plans a formal extradition for Huawei executive. Against this backdrop, the other news for today has been better – starting with Korea GDP beating with government spending driving, continuing with UK unemployment dropping to 44-year lows, extending to German ZEW where morale brightens despite the list of global worries. The equation for Europe and growth in 2019 matters as many see the Italian issues resolved or kicked down the road, the political mess of France and Germany less problematic, the auto and other environmental rules accepted, all leaving upside surprise risk to a rather gloomy region. The role of the IMF WEO update yesterday matters in counterbalancing this story. For today, the risk-reward game maybe best measured by the EUR/USD where the drop below 1380 and the 55-day moving average opens the risk for 1.1300 trend support tests and breaks.

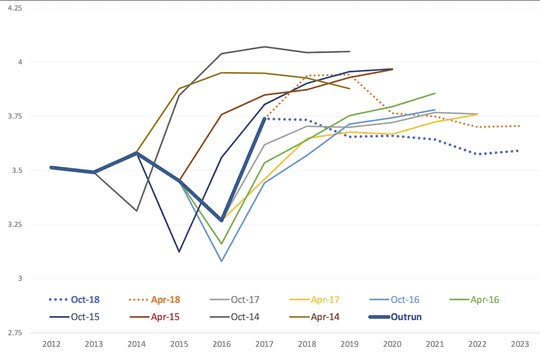

Question for the Day: Is the IMF outlook for global growth too optimistic? The history of the WEO and its role in setting the tone for central bankers and politicians in the G20 and Davos is important to consider particularly at the start of a new year. The IMF has a long history of overestimating global growth. The forecast error from 2009-2018 was 17.9% of the total 2018 global GDP or about $10trn. This optimism bleeds into policy reactions and has a cost.

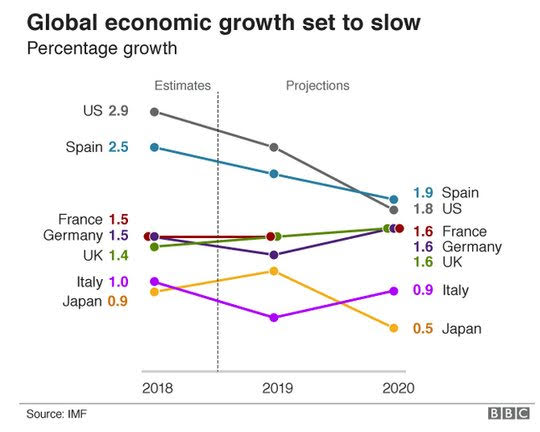

The IMF just cut its WEO forecasts for 2019 by 0.2% to 3.5% and its 2020 growth forecast by 0.1% to 3.6% from the October outlook. The IMF noted: “The downward revisions are modest; however, we believe the risks to more significant downward corrections are rising. While financial markets in advanced economies appeared to be decoupled from trade tensions for much of 2018, the two have become intertwined more recently, tightening financial conditions and escalating the risks to global growth.”

The key part of the IMF report is in the listing of downside risks – Trade, financial conditions, China growth, Brexit and US government shutdown. This is their description: “An escalation of trade tensions and a worsening of financial conditions are key sources of risk to the outlook. Higher trade uncertainty will further dampen investment and disrupt global supply chains. A more serious tightening of financial conditions is particularly costly given the high levels of private and public sector debt in countries. China’s growth slowdown could be faster than expected especially if trade tensions continue, and this can trigger abrupt sell-offs in financial and commodity markets as was the case in 2015–16. In Europe, the Brexit cliffhanger continues, and the costly spillovers between sovereign and financial risk in Italy remain a threat. In the United States, a protracted US federal government shutdown poses downside risks.”

What Happened?

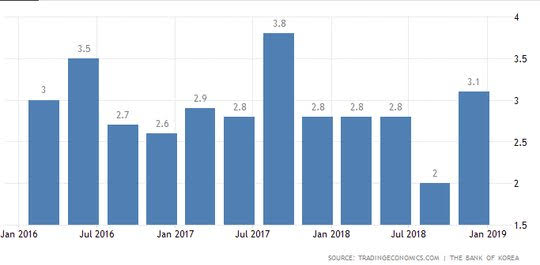

- Korea 4Q GDP 3.1% y/y after 2% y/y – better than 2.8% expected. The full year GDP rose 2.7% - slowest in 6-years and down from 3.1% in 2017. The 4Q expansion was up 1% q/q from 0.6% q/q in 3Q - also better than 0.6% q/q expected and best in 3 quarters – supported by final consumption up 1.5% from 0.7%, government spending up 3.1% from 1.5% and private spending up 1% from 0.5%. Fixed capital formation rose 1.8% after a -4.6% contraction. Trade was a drag with exports -2.2% from +3.9% while imports rose 0.6% after -0.7%.

- Spain November trade deficit E2.57bn from E3.8bn – better than E3.0bn expected– but up from E1.99bn in Nov 2017. Imports rose 3.2% while exports fell 0.3%.

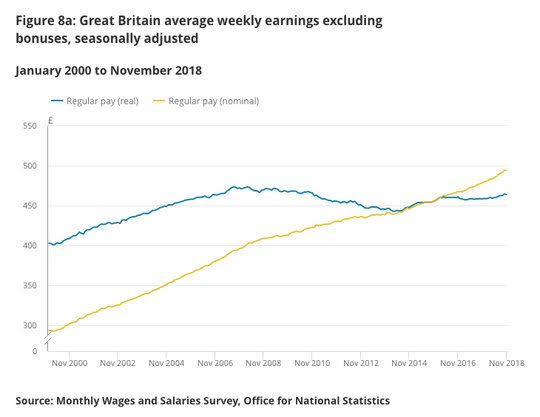

- UK December claimant count 20,800 after revised 24,800 – near expectations of 20,000. The November 3M unemployment rate drops to 4% from 4.1% - better than 4.1% expected and best since Feb 1975 – while the average earnings rose to 3.4% from 3.3% - also better than the 3.3% expected. The earnings ex-bonus were unchanged at 3.3% y/y. The November 3M employment rose 141,000 after 79,000 in the previous 3M period.

- UK December PSNB GBP 2.11bn after GBP6.25bn – more than the GBP1.2bn expected– still the lowest borrowing for December in 18-years. The current FY borrowing (ytd) is GBP35.9bn off GBP13.1bn from 2017 and the best in 16-years. The debt ex-public sector banks was 84% of GDP, down 0.5% from Dec 2017.

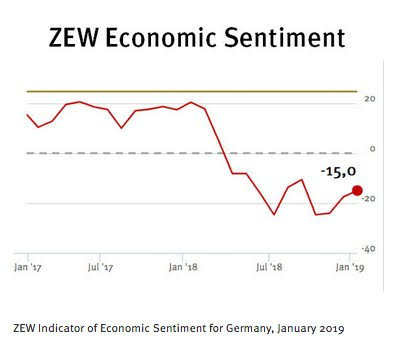

- German January ZEW economic sentiment improves to -15 from -17.5 – better than the -18.4 expected. The current conditions fell to 27.6 from 45.3 – weaker than 43 expected and the lowest since Jan 2015. “It is remarkable that the ZEW Economic Sentiment for Germany has not deteriorated further given the large number of global economic risks. The financial market experts have already considerably lowered their expectations for economic growth in the past few months. New, potentially negative factors such as the rejection of the Brexit deal by the British House of Commons and the relatively weak growth in China in the last quarter of 2018 have thus already been anticipated,” ZEW President Wambach noted. For the Eurozone, the economic sentiment improved to -20.9 after -21.0 worse than -20.1 expected, however, the current conditions in the Eurozone drop 6.8 points to 5.3.

Market Recap: Davos comments from economists and bank leaders driving markets on top of Xi and May political fears.

Equities: The S&P500 futures are off 0.65% after a 1.32% gain Friday. The Stoxx Europe 600 is off 0.25% with bank earnings from UBS, China growth fears key. The MSCI Asia Pacific fell 0.5% with China growth fears returning.

- Japan Nikkei off 0.47% to 20,622.91

- Korea Kospi off 0.32% to 2,117.77

- Hong Kong Hang Seng off 0.70% to 27,005.45

- China Shanghai Composite off 1.18% to 2,579.70

- Australia ASX off 0.49% to 5,924.30

- India NSE50 off 0.36% to 10,922.75

- UK FTSE so far off 0.55% to 6,931

- German DAX so far off 0.35% to 11,099

- French CAC40 so far off 0.5% to 4,844

- Italian FTSE so far off 0.75% to 19,492

Fixed Income: Back to safe-havens. Equities and IMF counter any data surprises. German 10-year Bund yields off 1bps to 0.25%, French OATs off 1bps to 0.65%, UK Gils flat at 1.33% while periphery better on ECB hold hopes - Italy off 1bps to 2.75%, Spain off 3bps to 1.34%, Portugal off 4bps to 1.58%, Greece off 1bps to 4.14%.

- US Bonds are bid across the curve focus is on growth, equities– 2Y off 2bps to 2.59%, 5Y off 2bps to 2.60%, 10Y off 3bps to 2.75%, 30Y off 4bps to 3.06%.

- Japan JGBs bid with curve flatter focus on China stories– 2Y flat at -0.17%, 5Y flat at -0.15%, 10Y off 1bps to 0%, 30Y off 1bps to 0.69%

- Australian bonds bid on IMF and weaker outlooks– 3Y off 1bps to 1.81%, 10Y off 1bps to 2.30%.

- China bonds hit despite Xi and equities– blamed on weaker CNY and less inflows – 2Y up 6bps to 2.65%, 5Y up 2bps to 2.95%, 10Y up 2bps to 3.13%.

Foreign Exchange: The US dollar index .96.36 flat. The USD is bid in EM – EMEA: RUB off 0.15% to 66.462, ZAR off 0.6% to 13.907, TRY off 0.6% to 5.353; ASIA: INR off 0.3% to 71.40, KRW flat at 1131.40,

- EUR: 1.1360 off 0.05%. Range 1.1346-1.1373 with 1.13-1.15 still prison but momentum risks 1.12 again.

- JPY: 109.40 off 0.25%. Range 109.32-109.69 with EUR/JPY off 0.3% to 124.30. The focus is on China and BOJ with 108-110 consolidation.

- GBP: 1.2905 up 0.1%. Range 1.2855-1.2928 with EUR/GBP .8805 off 0.15% - as Plan B sounds like Plan A, markets price in more delay. Jobs help with 1.2850 key base for 1.3020 tests.

- AUD: .7125 off 0.45%. Range .7121-.7160 with focus on commodities and China again – data ahead jobs and NZ CPI key. NZD off 0.3% to .6710.

- CAD: 1.3330 up 0.3%. Range 1.3292-1.3343 with focus on commodities, China and 1.34 risk

- CHF: .9965 off 0.1%. Range .9963-.9982 with EUR/CHF off 0.2% to 1.1315 – risk mood driving safe-haven and Davos expensive coffee

- CNY: 6.8075 up 0.2%. Range 6.79-6.8120 with the 6.80 break confirmed opening 6.83 and 6.88 risks – all about China growth, grey rhinos.

Commodities: Oil down, Gold flat, Copper flat at $2.6930.

- Oil: $53.05 off 1.8%.Range $52.90-$54.51 with focus on IMF and China stories as USD and equities drive - $52-$54 WTI trading. Brent off 1.95% to $61.52 with $62 capping and $60 key base.

- Gold: $1282.90 flat.Range $1276-$1284.30 with equities down helping gold up - $1276 base now with $1288 and $1295 next. Silver off 0.6% to $15.30 with focus on USD. Platninum off 0.9% to $794.80 and Palladium off 2.5% to $1301.80.

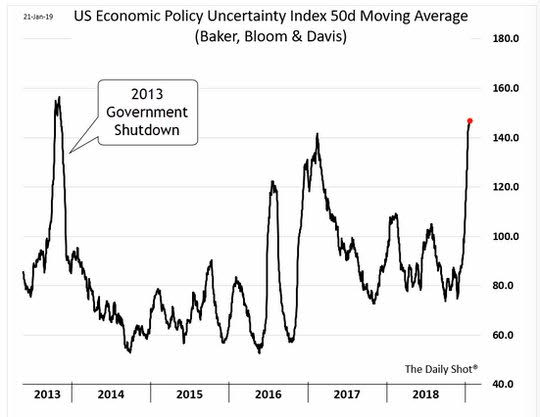

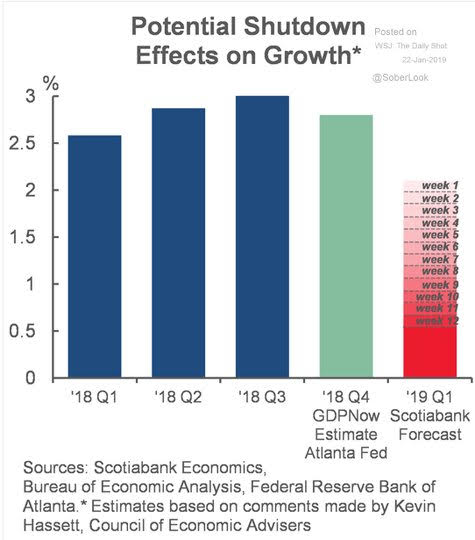

Conclusions: How bad is the US government shutdown on the economy? There are a number of unintended consequences of the present political stalemate resulting in the 32nd day of the partial government shutdown. Business and consumer morale is beginning to move down faster, business openings, IPOs, ETFs and other parts of regulation are stalled. Policy uncertainty is rising.

The reaction function of the market vs. the FOMC vs. politicians is in play and its clearly hurting growth. Just how weak 4Q growth is matters, as the baseline of 1Q and the measure for 2019 risk, with the economic data ahead becoming that much more important to understanding policy reactions and mistakes. On hold for the ECB and Fed isn’t the same as easy and that maybe the crux of the problem going forward.

Economic Calendar:

- 0830 am Canada Nov wholesale sales (m/m) 1%p 0.4%e / manufacturing sales -0.1%p -1.1%e

- 1000 am US Dec existing home sales (m/m) 1.9%p -1.3%e / 5.32mn p 5.25mn e

- 1130 am US sells 3M and 6M bills

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.