Gold: The Only Way The Debt Is Going To Be Paid Is To Devalue The U.S. Dollar

The Consumer Price Index (CPI) just came out at 5.4%, a little higher than expected. It rose 0.9% in June according to the Labor Department data released Tuesday. Excluding the volatile food and energy components, the core CPI rose 0.9% and increased 4.5% from June 2020. Not including food and energy seems to be critical factors in making inflation appear to be less than it is, if you counted such goods. Food prices are rising fast. Soybeans reached 1667 on May 12. Corn reached 735. Wheat reached 773 from a low of about 488 last year. The Fed appears to think that this is transitory so they don’t include it in the CPI. If you include such numbers, then the inflation rate is more than 10%. There are different forms of inflation; price/wage inflation, price inflation, and velocity inflation. Most people don’t take into consideration monetary or currency inflation, which we are currently experiencing. The dollar is worth less and less as the government prints more and more money. The key is whether the Fed is right and this inflation is transitory or if we are entering a new realm where the US dollar’s value is far less than it is now.

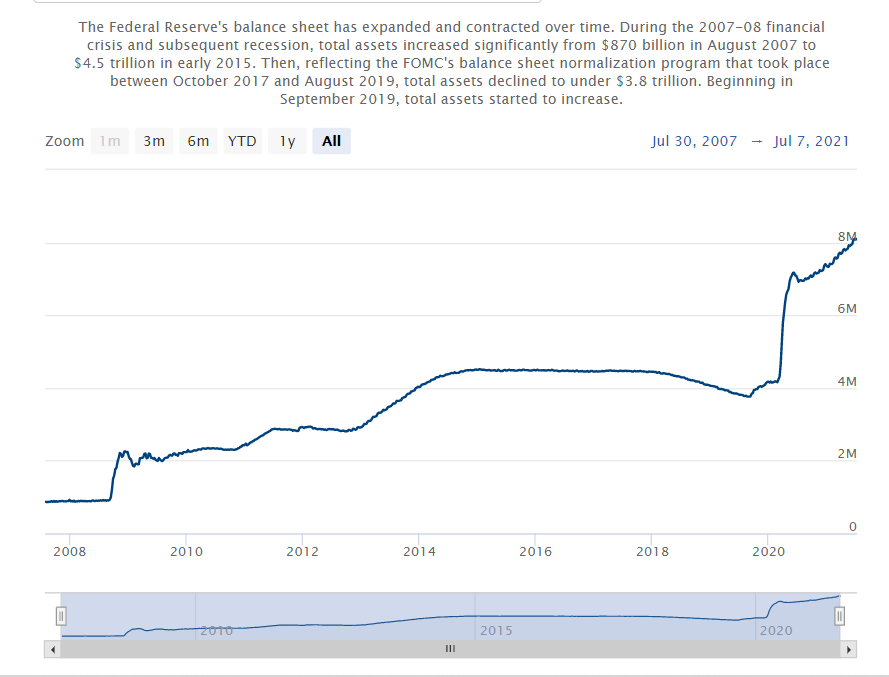

Courtesy: Federal Reserve Bank

We have to realize that the real estate market has created an incredible amount of wealth for middle-class Americans and homeowners since the pandemic struck. Not only is the Fed balance sheet exploding to over $8 trillion, but we also have a tremendous amount of stimulus, and both are driving prices higher in many markets. Such factors will determine whether we have shifted into a new realm of currency valuation or if inflation is temporary. We have price inflation and we have currency or monetary inflation. When we have price inflation, we have to take into account the decline value of the currency due to monetary inflation. Printing money decreases the value of the dollar. The potential for hyperinflation, such as happened in Venezuela, Weimar Germany, and in various African countries, increases. If the bond vigilantes are looking at the US dollar as a target of devaluation and we continue to provide stimulus to the market at a time of negative interest rates or close to negative rates, we could see a major shift in the value of the dollar reflected in the marketplace. We could see a collapse in the value of the dollar to zero. All fiat currencies could fall to zero. The only way the debt is going to be paid is to devalue the dollar, which is what Mexico did when it devalued its currency, basically transferring the debt to Main Street and the exchange went from 16 pesos to the dollar to thousands of pesos to the dollar. The debt to GDP ratio is way out of line. We are seeing such ratios above 100%. If interest rates rise, such debt levels are unsustainable. An adjustment is coming.

We are surprised that gold and silver are still at their current levels as many investors look for an alternative asset to the US dollar that will maintain its intrinsic value. That is why digital assets are increasingly popular. Crisis is an opportunity. Digital currencies and precious metals offer incredible opportunities. Gold mining shares are tremendously undervalued. The profit potential is enormous in precious metals and gold mining shares. They are tremendously undervalued.

Strategy

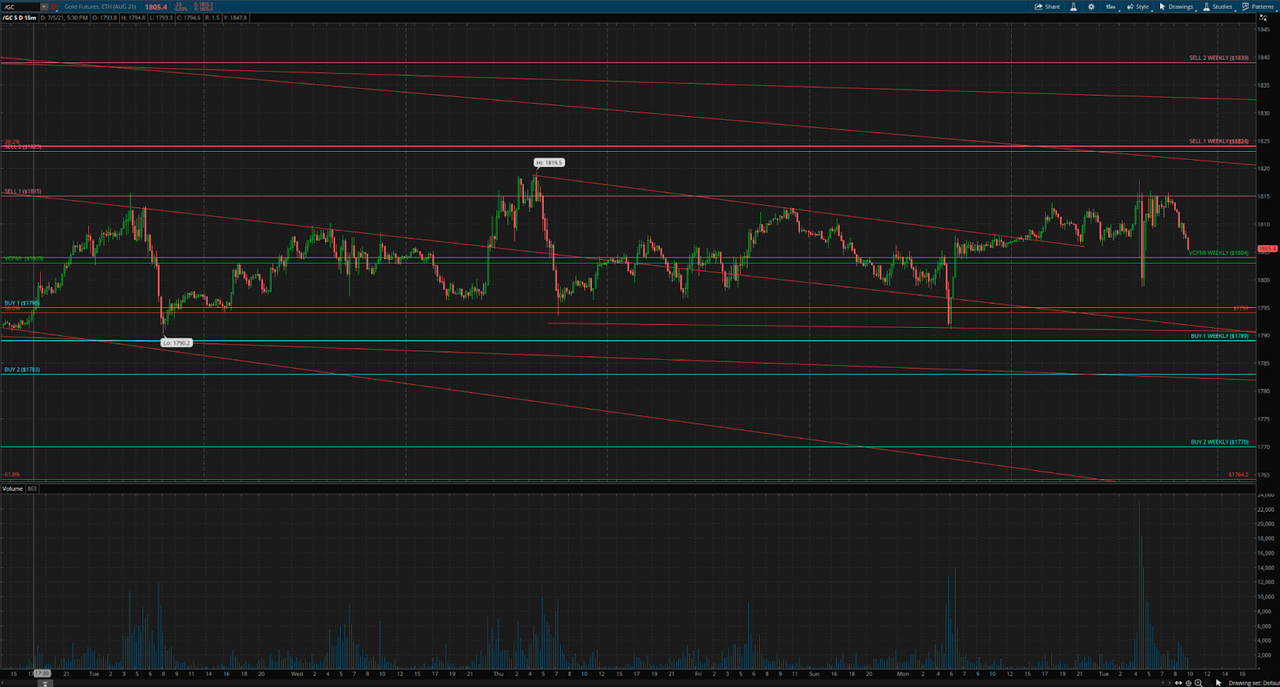

(Click on image to enlarge)

Courtesy: TDAmeritrade

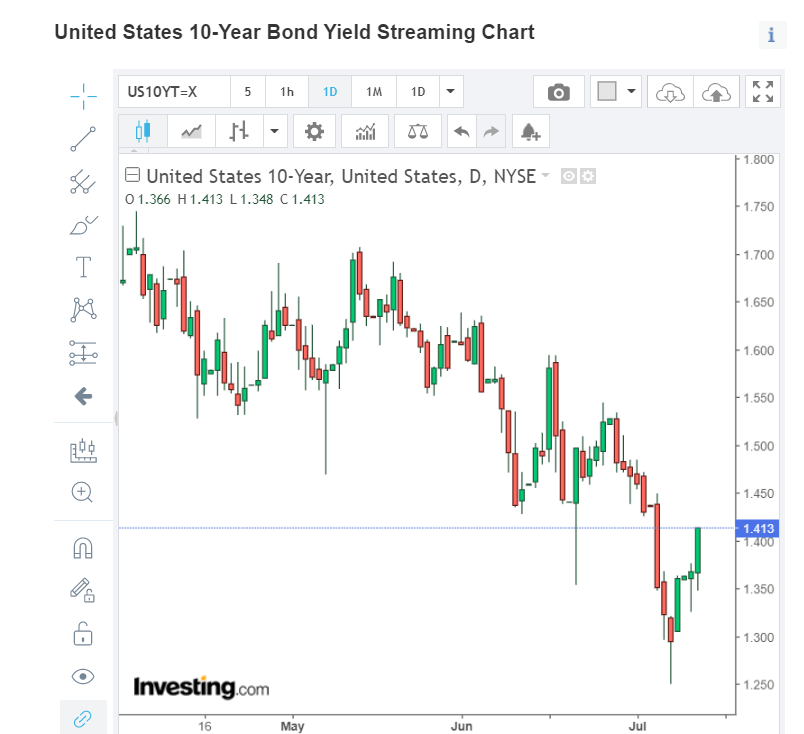

Gold is trading at $1814.40. It has been active, from $1815 to $1802 and then back up again. It is highly volatile today. Such volatility seems to be increasing in precious metals. We can still see an anomaly in the metals markets since prices are still extremely oversold compared to the fundamentals. The 10-Year Note has not reacted to the CPI news and is actually down a point at around 1.40. One of the leading key indicators that we watch in relation to inflation is the 10-Year Note. We do not see any pressure at all in relation to inflation. The note has gone from 1.70 to 1.34, which is a huge percentage change in the yield.

Given the volatility in precious metals, we recommend ETFs to hold positions overnight. Direxion Daily Gold Miners Index Bull 2x Shares ETF (NYSEARCA:NUGT) is volatile, but is a good alternative to holding futures. We recommend adding to your long-term core position in gold and derivatives, such as NUGT. We use our proprietary Variable Changing Price Momentum Indicator (VC PMI) to buy the extremes below the mean and either day trade or buy and hold for the long term. We expect gold and silver to go up significantly; the question is not if, but when. In silver, we are building a position in SILJ. Silver offers the most undervalued asset across the board. SILJ is an ETF that we are buying aggressively every time the market pulls back. One day, gold will be up one or two hundred dollars and silver will also shoot up. By then, it will be too late. For gold, we see $1822 as a target, which is the VC PMI Sell 2 level. At $1823 or $1824, it is the second daily VC PMI target and also the weekly Sell 1 level of $1824. Gold trading above $1824 activates the targets of $1824 and $1839.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive ...

more