Gold Price In The USA To Reach $2,000 Per Oz Once Again?

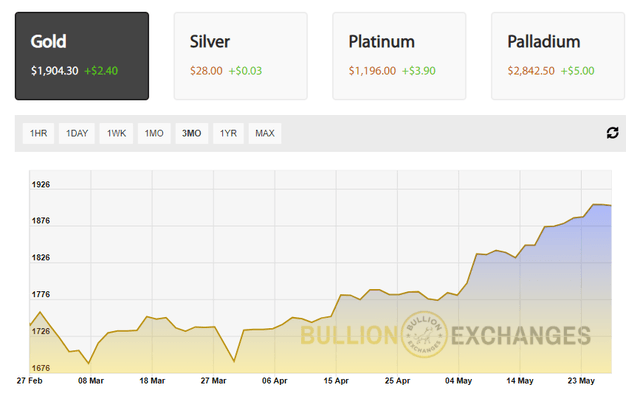

On Tuesday this week, the gold price overtook $1,900 for the first time since January. At this time last year, the gold price was around $1,737 per oz and it pushed to an all-time high of $2,048 in August.

Amid all the talk of Bitcoin and cryptocurrency crashes, gold’s rise has been relatively steady. Some analysts from Metals Focus in the UK believe it has enough support to test the $2,000 this year. But why exactly is the current price of gold rising now? Where is the gold price in the USA going?

Where Is the Support for the Current Gold Price Coming From?

The International Monetary Fund reported that several major central banks bought large amounts of gold in April. Thailand comes in as the biggest investor last month, increasing its reserves by 43.5 metric tons (tonnes). Other countries include Uzbekistan by 8.4 tonnes, Kazakhstan by 4.4 tonnes, India by 6.8 tonnes, and Cambodia by 5 tonnes.

Just like with Bitcoin, when a major player moves into the market, their decisions in the market play a major impact on the price. So, this support for gold by central banks is a major benefit to the world gold market. These several central banks reinvesting in gold are partially the reason behind the current price of gold reaching $1,900. The World Gold Council expects these banks will be the net gold buyers of 2021.

“Large, sporadic purchases and sales in recent months have made it difficult to determine a direction of travel for central bank demand in the short term. But our expectation remains for continued overall net buying for the year, as we believe positive sentiment towards gold is largely unchanged among the central banking community," - From the World Gold Council's Q1 report.

Basically, purchases from central banks have been sporadic and significant, making tracking gold demand difficult. Commerzbank thinks that if this support continues, the gold price in the USA will continue to positively impact the gold price. When mixed with the demand from investors returning to gold, the bank says that it is only a matter of time before the gold price in the USA returns to $2,000.

Additionally, traditional hedges have been rising through the month for their easy liquidation and more stable trading environment. Recent Chinese legislation against Bitcoin and the rise of cryptocurrency taxes are turning off crypto investors. Consequently, many traders are now returning to gold, according to JP Morgan.

Inflation: A Boon to the Gold Price in the USA

Inflation is a rising threat, and many believe that they need to balance their assets with hedges like gold and cryptocurrency.

Wade Guenther, a managing partner at Wilshire Phoenix indicated that his firm is seeing the demand for gold rising exponentially. Wilshire Phoenix launched an adaptive gold-backed ETF in February, Wilshire wShares Enhanced Gold Trust (WGLD). The adaptive portion of the fund means that market volatility causes it to adjust its gold and cash holdings.

Source: Yahoo Finance

Based on the recent volatility, the ETF shifted from 84% gold into 100% gold. This is because the gold market has been steadily growing. If this continues, the fund will remain on this 0:1 ratio for cash to gold, but the fund rebalances monthly.

However, this is only one facet of the conversation. Guenther believes that inflation will create more market volatility because investors and analysts do not yet clearly see how inflation will affect equity market valuations. Both rising manufacturing costs and wages will all affect companies’ budgets throughout 2021. He says. "Everyone's expectations on the magnitude of recovery are starting to alter a little bit, and inflation is a big part of that."

Guenther also added that investors will begin to see how inflation affects valuations during the second-quarter earnings season. Since the start of the year, volatility in equities was low even as prices rose to new records. Now, he believes volatility may be returning, which is why gold is seeing renewed demand. If this volatility continues, then the gold price in the USA will continue to grow.

Silver to Overtake Gold’s Growth?

Metal Focus, a research firm in the UK believes that silver will outperform gold this year. Their reasoning is that the gold market has been going through a 2-month rally based on investors’ desire to build a hedge. This renewed focus on gold pushed the gold-to-silver ratio much closer to 1:70.

The firm mentioned that silver prices may have stalled a bit recently while copper prices fell from their record highs. But, they remain optimistic that silver can benefit from demand in both the industrial and investment sectors. Their perspective is that despite new COVID variants, the continued fiscal stimulus and fiscal policies will bolster industrial commodities. Basically, these governmental accommodations increase the likelihood of inflation while real interest rates remain low. This suggests room for support in the realm of gold and silver.

Right now, investment demand continues to grow. Physical bullion demand reached record levels in the first quarter, rising 43% in comparison to last year. Metals Focus continued on to say that the current price of silver will continue to grow from the green energy front, especially because it is a smaller market. As a result, the gold to silver ratio could fall back into the low 60s during the second half of 2021, according to the firm.

Disclaimer: This article is not meant to serve as professional economic advice. Any action you take upon the information from this article and website is strictly at your own risk.