Gold Maintained Its Haven Status During The Evergrande Sell-Off

It’s the biggest company you’ve never heard of—until last week, that is. Evergrande Group, the “too big to fail” Chinese property developer, rattled markets last Monday when it missed interest payments to at least two of its lenders. This gave more than a few investors flashbacks to Lehman Brothers’ demise in 2008, which helped trigger the global financial crisis.

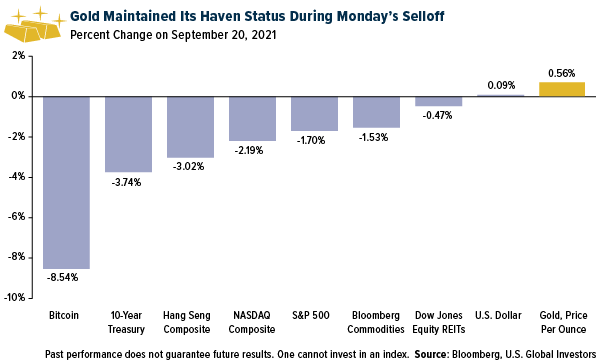

The selloff spread to U.S. markets, and I was pleased to see that gold maintained its haven status. The yellow metal ended the day slightly up more than half a percent, passing an important “stress test” of its investment case in the age of Bitcoin.

The world’s biggest cryptocurrency, believed by many to be “digital gold,” plunged 8.5% on Monday as investors dumped riskier assets. Indeed, Bitcoin is more than four times as volatile as gold. Those of you who attended HIVE Blockchain Technologies’ earnings webcast on Friday know that gold bullion has a 10-day standard deviation of only ±3, while Bitcoin’s is ±14. Ether’s is even higher at ±19 over 10 trading days.

Bitcoin dipped further last week after the Chinese government banned all crypto transactions and crypto mining, prompting many to speculate that the People’s Bank of China (PBOC) is preparing to issue its own CBDC, or central bank digital currency.

I believe this crackdown is yet more proof that people need to own some Bitcoin, which is currently on sale as we await news on whether the Xi Jinping Administration will step in to prevent another pandemic, this one of the financial kind.

Speaking of HIVE… The company reported record annual revenue of $66.7 million for the period ended March 31, 2021, and record earnings of $43.5 million. A big thank you to shareholders for their patience and for keeping the faith!

Gold and Bitcoin Looking More Attractive as Contagion Fears Mount

For the record, I find it hard to believe that President Xi will do nothing. Evergrande may not be a household name in the U.S., but it’s China’s second largest real estate company, with nearly 800 projects in 234 cities. It also offers financial products, invests in electric vehicles and is even building a theme park on an artificial island off the province of Hainan.

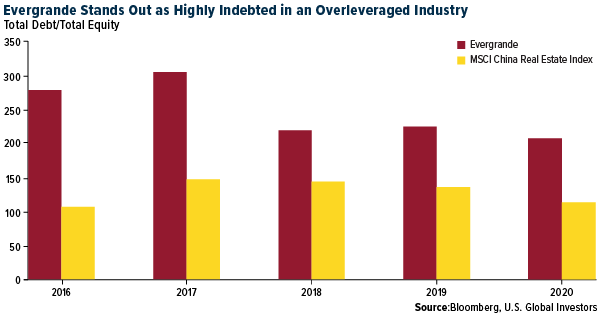

This growth didn’t happen organically, though, and today Evergrande is believed to be the world’s most indebted developer, saddled with more than $300 billion in total liabilities. In November 2020, the Financial Times wrote that the Fortune 500 company “has enough land to house the entire population of Portugal and more debt than New Zealand.” At the end of last year, it had roughly twice as much debt as equity, putting it in a class well above other Chinese real estate firms.

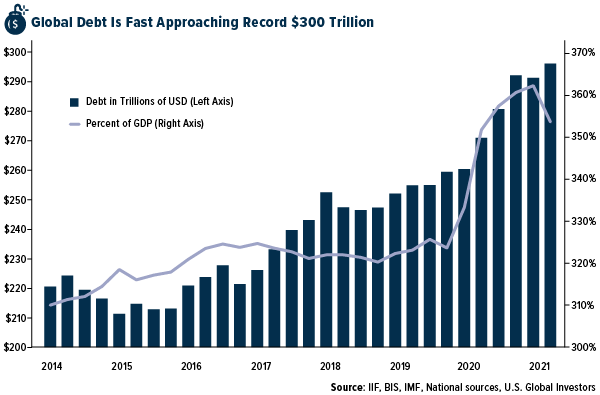

As “eye-popping” as Evergrande’s debt load is, it’s a “small drop in the ocean of debt that the world is swimming in,” CLSA’s Damian Kestel wrote last week in a note to clients. Total global debt in the second quarter stood at just under $300 trillion, a new record, according to the Institute of International Finance’s (IFF) most recent Global Debt Monitor.

“The bigger they come, the harder they fall,” as the saying goes. If Evergrande were allowed to fail without any governmental intervention, it could spark a credit crisis that would make 2007-2008 look tame by comparison.

Against this backdrop, gold and Bitcoin look very attractive to me as stores of value, and both happen to be on sale right now. I’ve always recommended a 10% weighting in gold, with 5% in bullion and 5% in gold mining stocks and ETFs. I also believe it’s prudent to have between 1% and 2% in Bitcoin.

No, They’re Not Mutually Exclusive

As someone who’s involved in both gold and Bitcoin investing, I clearly don’t subscribe to the idea that one is better than the other in all cases. I agree with Bloomberg’s James Seyffart and Eric Balchunas, who said in a note last week that gold and Bitcoin “can complement each other in a portfolio.”

Although the two assets share obvious similarities and differences—one is thousands of years old while the other is a brand spanking new; one is easily portable while the other isn’t—I think there are three important distinctions that investors need to be aware of: volatility, taxation, and correlation to the market.

Volatility I’ve already talked about.

Looking at taxation, Bitcoin is taxed the same as a stock, with a long-term capital gains rate of between 0% and 20%, depending on income level. Gold, on the other hand, is taxed as a collectible, meaning it carries a higher fixed rate of 28%, regardless of income. Point: Bitcoin.

And then there’s a correlation. Gold has no correlation to the S&P 500, making it suitable for someone who wants to hedge against market risk. As a risk-on asset, Bitcoin has a slight correlation to the S&P. Point: Gold.

When you add all of this up, I believe it shows that gold has a small advantage over Bitcoin as a diversifier and store of value—at least for now. This could change as the Bitcoin network matures and its price swings stabilize.

Bitcoin Man

I am thrilled and honored to be featured on October’s front cover of Real Assets Adviser, which is sent out to and read by thousands of registered investment advisors (RIAs).

The fun photo was taken by U.S. Global Investors’ very own IT technician Rick Thompson, who moonlights as a photographer. You can see more of his amazing work on his Instagram page.

I want to thank Real Assets editor Mike Consol, who reached out with the idea to feature me. Our conversation covers a number of topics, including gold and Bitcoin (of course), my early career, the current state of the airlines' industry, and the San Antonio Spurs. The entire interview is posted here.

Airlines Webcast

Besides leading the HIVE earnings report last week, I also took part in a webcast on the airlines' industry, co-hosted by ETF Trends Managing Editor Lara Crigger.

As you might imagine, much of the discussion centered on when and to what extent the airlines industry will fully recover.

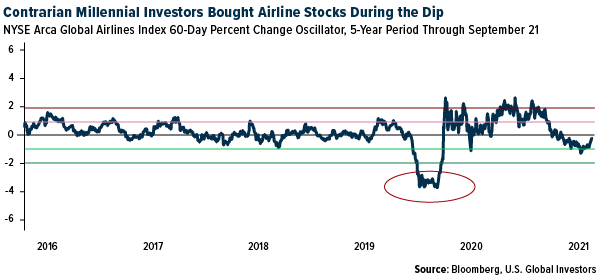

Below is a slide that seems to have resonated with attendees. It shows the 60-day standard deviation oscillator for the NYSE Arca Global Airlines Index, and if you notice, airline stocks were greatly oversold at the start of the pandemic. I bring this up because that’s when contrarian millennial Robinhood investors got in, at the same time that Warren Buffett and others panic sold.

Disclosure: The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 ...

more