Gold Looking Sporty, Silver Loving Forty

Image Source: Unsplash

First, we absolutely must start with a look at silver. By its “continuous contract” (the front month for which is now December), the gray metal attained $40/oz. recently for the first time since Sept. 21, 2011; (essentially 14 years ago).

(Click on image to enlarge)

This has been long overdue, and yet silver still remains rather cheap. In settling out the week and the month of August at $40.75, the gold/silver ratio at 86.3x nonetheless remains excessively above the century-to-date average of 69.3x. As fabulous as it is to see silver at that lovely $40/oz. level, were the metal priced today at that ratio’s average, it'd instead be +25% higher at $50/oz. (at 50.76 for those of you scoring at home).

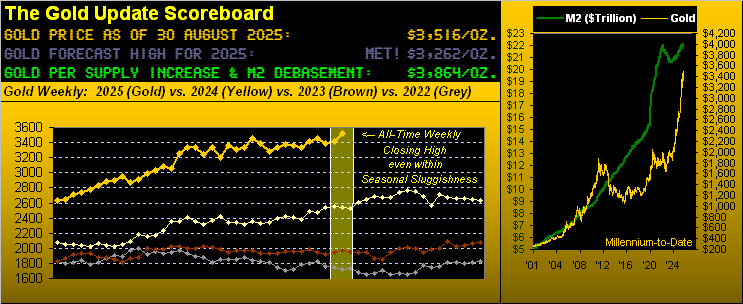

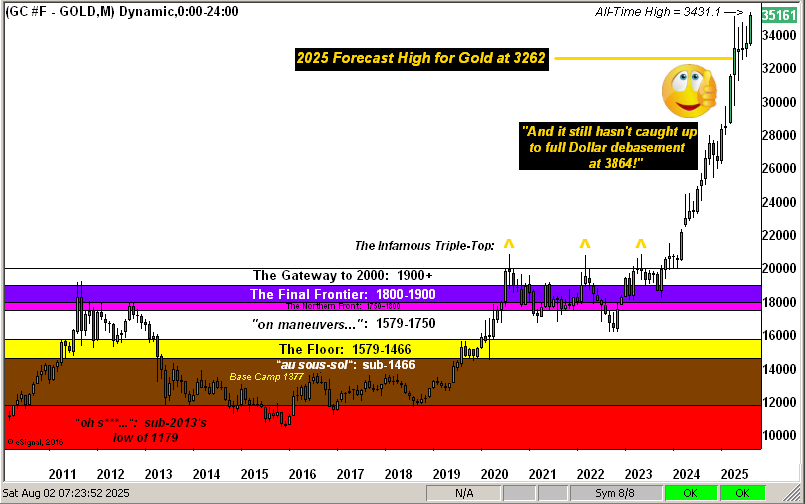

As for good, old gold, the price settled the week looking sporty at the 3516 level, which too by its “continuous contract” (also now December) is another all-time closing high on both a daily and weekly basis. However, the all-time Intraday high remains at the 3431 level from three weeks prior on Aug. 8. But “sluggish seasonality” aside, we’ll take it.

Here are gold’s weekly bars from a year ago-to-date. The rightmost, blue-dotted, parabolic long trend appears to be nicely in place with the price itself sitting on the dashed regression trendline:

And while September is the worst month of the year for S&P 500 (as I said a week ago that “through the 24 Septembers century-to-date, that month’s cumulative S&P change is -32.3%”), it's been a decent month for gold on balance, with its past 24 Septembers netting an all-in gain of +7.2%.

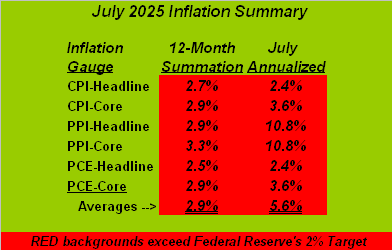

Thus, by current conventional wisdom, Gold stands to benefit from this next Sept. 17 Federal Open Market Committee vote to cut the FundsRate by -0.25%. But should they so do? Let’s go to our completed StateSide inflation summary table for July, bearing in mind that red backgrounds are in excess of the Fed’s inflation target of 2%:

And so every measure now is backed in red. Of course, that can be resolved with a rate hike -- or otherwise exacerbated with a rate cut. Plus for August, both wholesale and retail inflation data will be reported the week prior to the FOMC’s Policy Statement. Either way, if next week brings poor data for August’s payrolls, that would be cut-friendly.

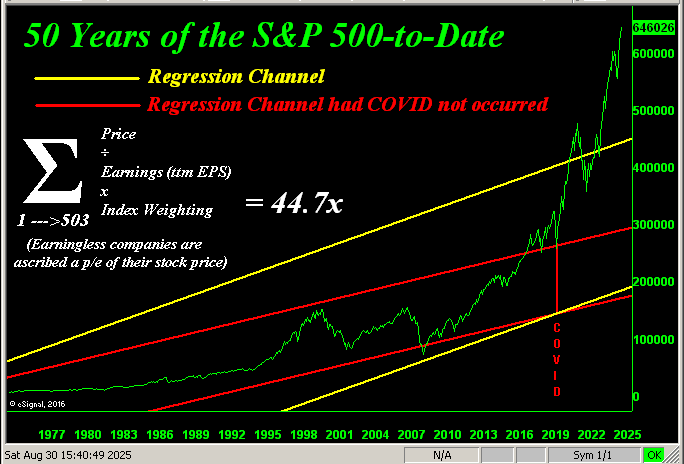

You may ask, "if jobs go down and inflation goes up, then what?” I would say that such an outcome could be indicative of stagflation. So much so, that the Fed may have to simply sit on its hands in being “...atentive to the risks to both sides of its dual mandate...” Not great. Add in the ongoing, ridiculous overvaluation of the S&P 500, and September may not be a very happy month (unless one holds gold).

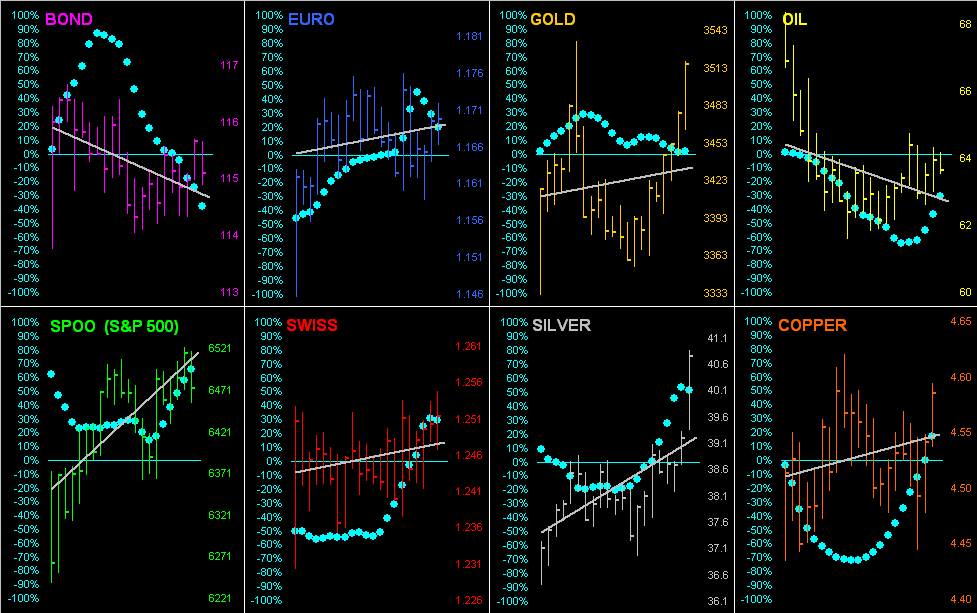

Indeed, as we next turn to our year-to-date standings of the 'BEGOS Markets,' the metals continue to own the podium, with silver (as we’ve anticipated) rightly topping the stack in regaining $40/oz. with its rallying comeback:

We can also see the severely-stretched S&P 500 up +9.8% to this point, but actually underperforming the full percentage changes of the prior two years. And now with September in the balance, it wouldn't be surprising by year-end to find the S&P in the red.

Yet in looking at the BEGOS bunch across the past 21 trading days (one month), let's turn our attention to their respective daily bars, gray trendlines, and the blue dots which depict each trend’s day-to-day consistency.

And specific to the bond, Friday was its worst net daily change since Aug. 15, that day having been a week prior to non-committal FedChair Powell in Jackson Hole. So, are the “Bond Ghouls” (hat-tip to the late Louis Rukeyser) thinking the Fed may not cut come Sept. 17? That would not make for a happy head of The Executive Branch in Washington:

(Click on image to enlarge)

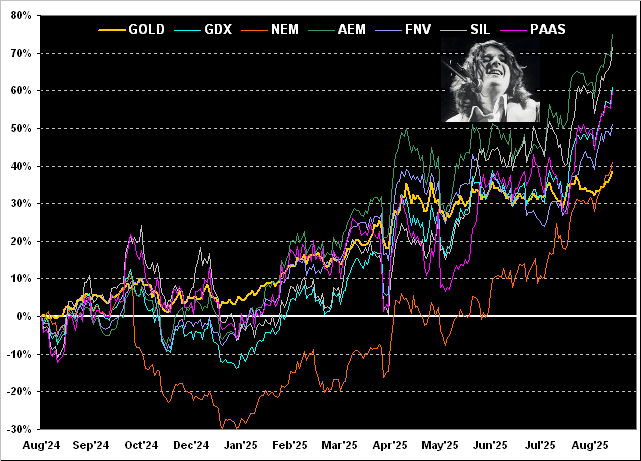

However, on a happier note, let’s look at gold's percentage track from one year ago-to-date along with our usual top-tier precious metals equities. And from “worst-to-first” — the leverage of the equities over gold really now standing out — they rank as the following: Gold itself +38%, Newmont (NEM) +41%, Franco-Nevada (FNV) +51%, Pan American Silver (PAAS) +60%, the VanEck Vectors Gold Miners exchange-traded fund (GDX) +61%, the Global X Silver Miners exchange-traded fund (SIL) +72%, and Agnico Eagle Mines (AEM) +75%.

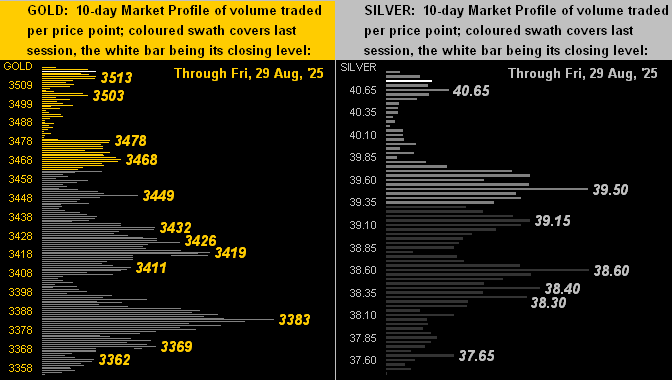

Next, let’s zoom in on the 10-day market profiles for gold on the left and our star player silver on the right, with the respective white bars representing Friday's closing prices. To borrow from a 1913 newspaper advertisement for Ohio’s Piqua Auto Supply House, “One look is worth a thousand words“. Thus in this case, nothing else needs to be said:

Let's now look at gold’s structure per the monthly bars since 2010. But unlike the S&P 500 — which for month-after-month has been valued beyond perfection despite un-supportive earnings — gold remains priced (per our opening scoreboard) at a discount to dollar debasement.

(Click on image to enlarge)

For this week, we’ve saved the Economic Barometer toward the end as it segues well with what we’re perceiving as the perfect September storm. As aforementioned, across the past 24 years the S&P 500’s cumulative percentage changes for September come to -32.3%; moreover from the “7/11 Dept.”, seven of the past 11 Septembers have finished in the red. And what if the Fed does not budge on Sept. 17?

Again, August job creation (or the lack thereof) works in the Fed’s cutting favor. And the Chicago Purchasing Managers’ Index for the month just came in as quite sour, down from July’s 47.1 — and missing by a mile the consensus for 46.0 — at 41.5. Yet on the other hand, (hat-tip Bloomy), Chicago FedPrez (and FOMC voting member) Austan “The Gools” Goolsbee is less concerned about the employment picture than the inflation outlook.

Also, both Personal Income and Spending increased their paces for July. Furthermore, of the past week’s 12 incoming Econ Baro metrics, just four were worse period-over-period. Therefore, does apparent economic strength warrant cutting the rate? The perfect September storm, indeed:

Thus into September we go with this friendly graphic reminder:

More By This Author:

Copper Above Its Neutral ZoneGold Gains A Little; Dollar Drools Spittle; Powell Non-Committal

Gold Sensing Seasonal Sluggishness