Globalization Is Dead, But The Idea Is Not

Dorothea Lange Youngest little girl of motherless family 1939

We can, every single one of us, agree that we’re either in or just past a -financial- crisis. But that seems to be all we can agree on. Because some call it the GFC, others a recession, and still others a depression. And some insist on seeing it as ‘in the past’, and solved, while others see it as a continuing issue.

I personally have the idea that if you think central banks -and perhaps governments- have the ability and the tools to prevent or cure financial crises, you’re in the more optimistic camp. And if you don’t, you’re a pessimist. A third option might be to think that no matter what central bankers do, things will solve themselves, but I don’t see much of that being floated. Not anymore.

What I do see are countless numbers of bankers and economists and pundits and reporters holding up high the concept of globalization (a.k.a. free trade, Open Society) as the savior of mankind and its economy.

And I’m thinking that no matter how great you think the entire centralization issue is, be it global or on a more moderate scale, it’s a lost case. Because centralization dies the moment it can no longer show obvious benefits for people and societies ‘being centralized’. Unless you’re talking a dictatorship.

This is because when you centralize, when you make people, communities, societies, countries, subject to -the authority of- larger entities, they will want something in return for what they give up. They will only accept that some ‘higher power’ located further away from where they live takes decisions on their behalf, if they benefit from these decisions.

And that in turn is only possible when there is growth, i.e. when the entire system is expanding. Obviously, it’s possible also to achieve this only in selected parts of the system, as long as if you’re willing to squeeze other parts. That’s what we see in Europe today, where Germany and Holland live the high life while Greece and Italy get poorer by the day. But that can’t and won’t last. Of necessity. It’s an inbuilt feature.

Schäuble and Dijsselbloem squeezed Greece so hard they could only convince it to stay inside the EU by threatening to strangle it to -near- death. Problem is, they then actually did that. Bad mistake, and the end of the EU down the road. Because the EU has nothing left of the advantages of the centralized power; it no longer has any benefits on offer for the periphery.

Instead, the ‘Union’ needs to squeeze the periphery to hold the center together. Otherwise, the center cannot hold. And that is something those of us with even just a remote sense of history recognize all too well. It reminds us of the latter days of the Roman Empire. And Rome is merely the most obvious example. What we see play out is a regurgitation of something the world has seen countless times before. The Maximum Power Principle in all its shining luster. And the endgame is the Barbarians will come rushing in…

Still, while I have my own interests in Greece, which seems to be turning into my third home country, it would be a mistake to focus on its case alone. Greece is just a symptom. Greece is merely an early sign that globalization as a model is going going gone.

Obviously, centralists/globalists, especially in Europe, try to tell us the country is an exception, and Greeks were terribly irresponsible and all that, but that will no longer fly. Not when, just to name a very real possibility, either some of Italy’s banks go belly up or the upcoming Italian constitutional referendum goes against the EU-friendly government. And while the Beautiful Brexit, at the very opposite point of the old continent, is a big flashing loud siren red buoy that makes that exact point, it’s merely the first such buoy.

But Europe is not the world. Greece and Britain and Italy may be sure signs that the EU is falling apart, but they’re not the entire globe. At the same time, the Union is a pivotal part of that globe, certainly when it comes to trade. And it’s based very much on the idea(l) of centralization of power, economics, finance, even culture. Unfortunately (?!), the entire notion depends on continuing economic growth, and growth has left the building.

Centralization/Globalization is the only ideology/religion that we have left, but it has one inbuilt weakness that dooms it as a system if not as an ideology. That is, it cannot exist without forever expanding, it needs perpetual growth or it must die. But if/when you want to, whether you’re an economist or a policy maker, develop policies for the future, you have to at least consider the possibility, and discuss it too, that there is no way back to ‘healthy’ growth. Or else we can just hire a parrot to take your place.

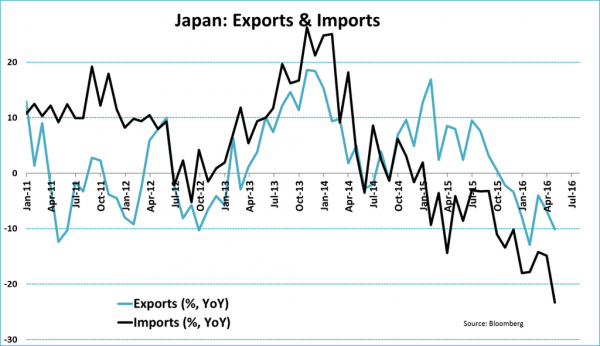

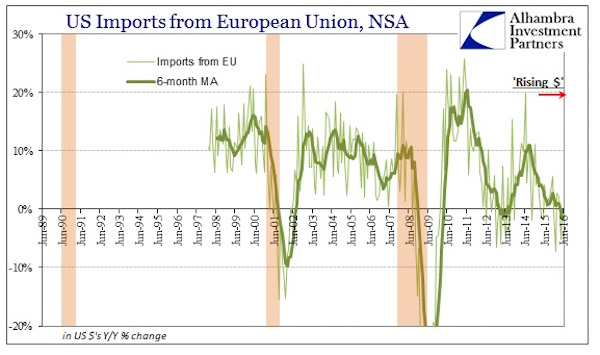

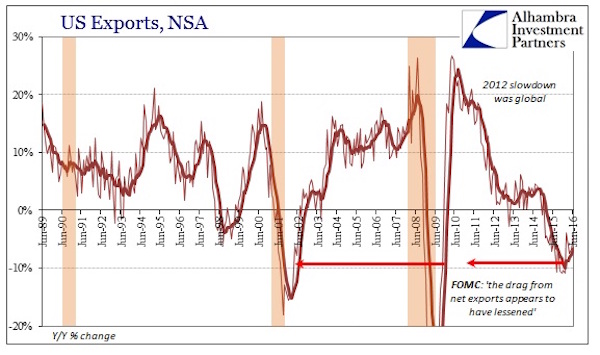

So here’s a few graphs that show us where global trade, the central and pivotal point of globalization, is going. Note that globalization can only continue to exist while trade, profits, benefits, keep growing. Once they no longer do, it will go into reverse (again, bar a dictator):

Here’s Japan’s exports and imports. Note the past 20 months:

Japan’s imports have been down, in the double digits, for close to 3 years?!

Next: China’s exports and imports. Not the exact same thing, but an obvious pattern.

If only imports OR exports were going down for specific countries, that’d be one thing. But for both China and Japan, in the graphs above, both are plunging. Let’s turn to the US:

Pattern: US imports from China have been falling over the past year (or even more over 5 years, take your pick), and not a little bit.

And imports from the EU show the same pattern in an almost eerily similar way.

Question then is: what about US exports, do they follow the same fold that Japan and China do? Yup! They do.

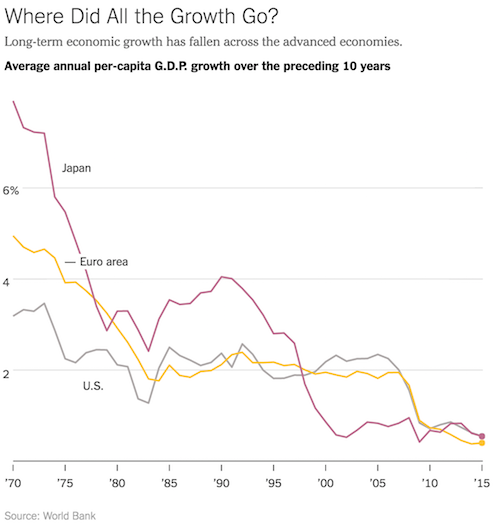

And that’s not all either. This one’s from the NY Times a few days ago:

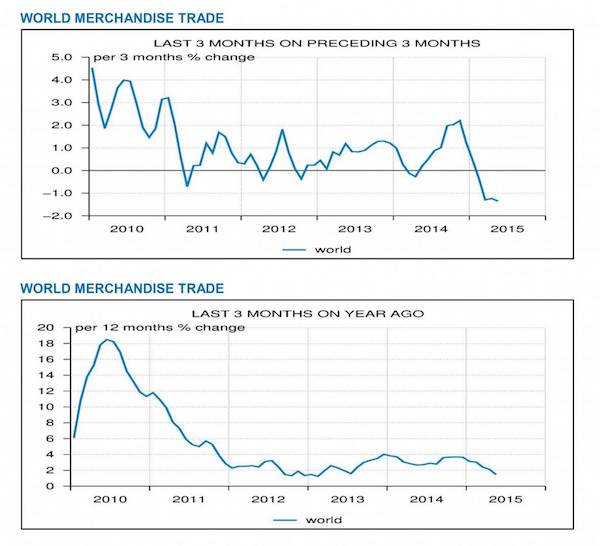

And this one from last year, forgot where I got it from:

Now, you may want to argue that all this is temporary, that some kind of cycle is just around the corner and will revive the economy, and globalization. By now I’d be curious to see how anyone would want to make that case, but given the religious character of the centralization idea, there’s no doubt many would want to give it a go.

Most of the trends in the graphs above have been declining for 5 years or so. While at the same time the central banks in these countries have been accelerating their stimulus policies in ways no-one could even imagine they would -or could- just 10 years ago.

All of the untold trillions in stimulus haven’t been able to lift the real economy one bit. They instead caused a rise in asset prices, stocks, housing, that is actually hurting that real economy. While NIRP and ZIRP are murdering 95% of the people’s hope to retire when they thought they could, or ever, for that matter.

No, it’s a done deal. Globalization is pining for the fjords. But because it’s become such a religion, and because its high priests have so much invested in it, it’ll be hard to kill it off even just as an -abstract- idea. I’d say wherever you live and whenever your next election is, don’t vote for anyone who promotes any centralization ideas. Or growth. Because those ideas are all in some state of decomposing, and hence whoever promotes them is a zombie.

Fascinating article, Raul. I would just say that growth that is slow, ie., the new normal, is pretty much all we have left. The Fed cannot allow greater growth, because it cannot raise interest rates and destroy the value of sovereign bonds. As for the Eurozone, the TLTRO program, if expanded, could help the real economy. I am not a fan of the #Eurozone, but #Draghi may be a little smarter than the rest of the worlds' central bankers. Only time will tell.