GameStop - Game Over

Market observers and participants have been temporarily distracted in the past week by the battle between Reddit’s plucky retail investors and lazy short-selling hedge funds over the fate of Game Stop (GME). It won’t be the last time the world stops to watch such an event in the same way that people, who would otherwise never watch a race, are glued to the screen when F1 drivers crash into the barrier or each other. Pundits have tried to turn this into more than it is, but until people turn up with actual pitchforks in front of Mr. Griffin’s $60M penthouse pad in Chicago, I am inclined to side with George Pearkes’ take on the matter; move on, nothing (much) to see . People with time on their hands, and a stimulus cheque(?), have decided to take a punt. On the face of it, they have been successful, but most will have bought and sold too late to avoid the gut-wrenching losses that are all but inevitable in the context of the kind of volatility, which GameStop has exhibited recently.

Meanwhile in the boring and dusty world of global macro trading, investors’ eyes are still focused on the long bond in the U.S., where it is, or isn’t, going, and what this means for other asset classes, the economy, not to mention the Fed’s reaction function? Friday’s NFP report was, as ever, a case in point. A hot report would, I suspect, have driven the 10-year yield above 1.2%, and while yields fell in response to Gazelle2299the actual number—a consensus undershooting 49K—commentators were quick to point out that the worse the economic data, the more aggressive the fiscal stimulus. This latter dynamic, obviously, ought to drive yields higher.

Put differently, investors are still trying to put numbers on the idea of “reflation”, what it means for the long bond—factoring in a front-end that’s pinned to the floor—and other asset classes. The consensus seems to be that long-term yields won’t be allowed to increase too far too fast, and that the Fed won't lift short-term interest rates anytime soon.

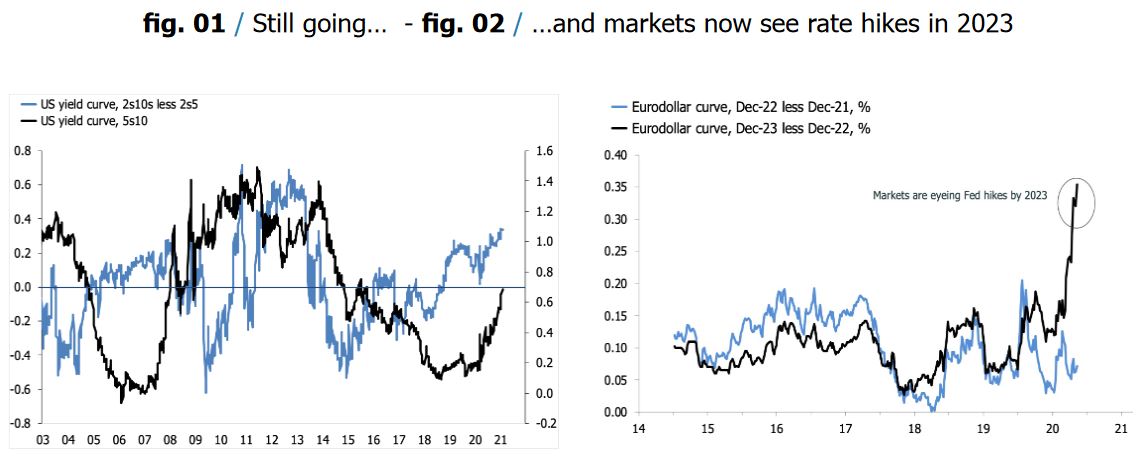

Both assumptions probably are correct, but look closer and markets are already grinding away at them. The first chart on the next page shows that the yield curve—adjusted for strong forward guidance holding down the front-end—is still steepening. The 2s5s is now as wide as it was in 2016, with the difference between the 2s5s and 2s10s pushing 2014 levels. The second chart shows that markets are pricing in lift-off in the Fed funds rate by 2023.

There are two ways that these trends can reverse. In the first instance, the Fed decides that enough is enough, and tries to lean on the long-end, either via outright purchases, or more strenuous communication. The second is that fundamentals bring it to a halt. A steepening curve, in an environment where short-term rates are locked, has an inbuilt correction mechanism via the increasingly attractive roll and carry. Private investors will eventually buy that carry, and it’s possible that the Fed is happy to let markets evolve accordingly.

As far as macroeconomic fundamentals are concerned, Simon Ward’s recent missive suggests that the reflation story is getting stale. He presents evidence to the fact that global manufacturing is now losing momentum, and points to stretched stock-to-bond returns. If Simon is right, the 10y is a buy. I am partial to this conclusion, though we shouldn’t lose sight of the main indicator, inflation, and what markets and policymakers would do if it came around, even temporarily. As it turns out, we might be about to find out.

The third chart shows that my normalised survey index of manufacturing selling prices in the Eurozone, China and ISM prices paid in the US is rocketing, indicating that PPI inflation will shoot higher in the next three-to-six months. This trend is consistent with the sharp increase in both hard and soft commodities since the middle of last year.

this trend also is increasingly clear, mainly in the context of supply-side bottlenecks. Stories about steel rationing in the U.S., semiconductor shortages holding back auto production and disruptions in South American copper mines are but a few of the signs. Markit’s PMI surveys now show clear evidence of stretched delivery times, soaring work backlogs, and rising input prices, mainly in manufacturing. Most of this increase is being absorbed by tightening profit margins, but that won’t last. If sustained, output price inflation, and eventually core consumer price inflation, will rise too.

The picture is less dramatic if I include services price inflation, where inflation expectations remain depressed, as my fourth chart shows. This which makes sense. After all, services activity is currently being held down by the virus, and while vaccination is now underway, it’s still too soon to put a date on when we are all clear. that point is coming, however, and we probably shouldn’t discount the possibility that the upturn in goods inflation is a precursor for what will happen to services once the economy opens. We should let the numbers do the talking in the end, but it is easy to see how the shift in inflation will pose a challenge for policymakers, having mostly been focused in the past year on how to shovel as much stimulus into markets and the economy as possible.

The final charts attempt to quantify the upturn in inflation, proxied here by the increase in surveyed inflation, either realised or expected. The first two suggest that the upturn in 10-year yields have further to run, based as it were on macroeconomic fundamentals. The last two charts show that the pick-up my composite price index is consistent with further gains in old energy equities, in both relative and absolute terms.

It’s possible that Simon Ward is right, and that the reflation narrative is going to hit the skids in the first half of the year as growth scares and disinflation rear their heads. It’s also possible that the reflation narrative is about to be confirmed by the economic data, making life slightly more difficult for policymakers. If that’s the case, it won’t be game over for the trend in financial markets, but game on.

Want to read as a PDF? Click here.

Disclosure: None

Nah, don't think so.

Good read, thank you for sharing.